Wall Street’s confidence cracked but didn’t crumble. From AI exhaustion to China’s rare-earth reset, this might be the week the market quietly changed direction.

MARKET PULSE

The Setup Resolves: Erosion, Not Collapse

The market flirted with a breakdown but refused to fall.

By the close, what looked like fear turned into a quiet show of resilience and your next winning trade may be hiding in today’s laggards.

The Nasdaq slipped 0.2%, logging its worst week since April, while late buyers lifted the S&P 500 and Dow into the green.

Breadth improved into the close… equal-weight steadied, and value, staples, energy, and utilities quietly took leadership back from megacap tech.

Gold held the $4,000 line, 10-year yields hovered near 4.09%, and Bitcoin stayed pinned around $100,000. A fresh Senate proposal to end the shutdown helped erase a midday 2% Nasdaq drop, but not the fatigue underneath.

AI-heavy names stayed at the fault line. Semis and software gave back premium, Asia mirrored the unwind, and SoftBank’s 20% slide turned into the global barometer for crowded AI risk.

Add in a weak Michigan sentiment print, and the week closed with a message: confidence cracked, credit didn’t.

With official data still dark, traders are pricing on instinct. Estimates have replaced evidence, and that’s why this tape feels uneasy.

But the action read less like panic, more like pressure relief with a market choosing maintenance over mayhem, leaking speculation while protecting its structure.

Investor Signal

Stay with the stance, sharpen the execution. Tighten gross exposure, trim single-theme AI trades, and let breadth confirm any rebound before leaning back in.

Favor equal-weight exposure, quality balance sheets, and cash-flow defensives on pullbacks. Use rallies to roll hedges forward and reset strikes.

If jobless claims drift higher and leadership keeps narrowing, expect a 5–10% reset; a calibration that rebuilds sponsorship.

The next leg won’t belong to belief… it’ll belong to proof.

PREMIER FEATURE

The TRUTH About Trump and Musk?

If you think there's something strange about the "feud" between Trump and Musk…

Because it explains what could REALLY be going on behind the scenes…

And how it could hand investors a stake in a $12 trillion revolution.

CONSUMER WATCH

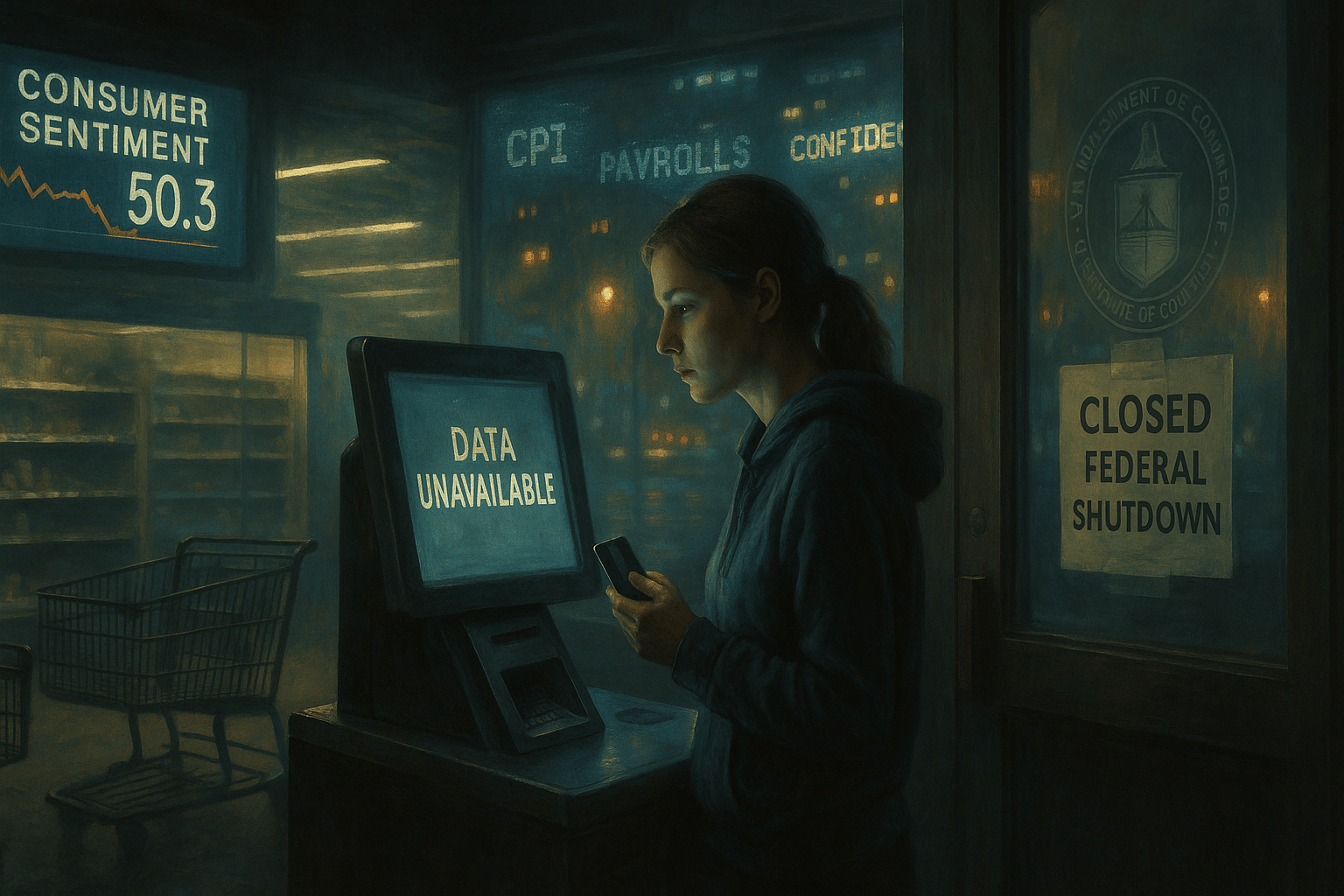

The Consumer’s Breaking Point: Confidence Collapses in the Data Void

The U.S. consumer just blinked… and markets noticed.

With the shutdown freezing official data, the University of Michigan sentiment index has become the only pulse left to read. November’s print dropped to 50.3 from 53.6, one of the lowest readings in decades and barely above the 2022 trough.

Analysts expected a mild dip. Instead, they got confirmation that confidence is cracking where it counts: at the checkout line.

The story isn't about inflation anymore… It's uncertainty. After a month without data, households are flying blind, and it’s starting to show up in spending patterns.

Survey director Joanne Hsu said it plainly: consumers fear the shutdown’s fallout more than inflation itself.

Confidence among lower-income groups has collapsed, and even affluent households are losing conviction that growth will hold without guidance from Washington.

Markets flinched fast.

The S&P fell 1%, Dow 400 points, and Nasdaq 2%, its worst week since April. Tech weakness took the blame, but the break runs deeper: when consumers lose faith, earnings lose altitude.

If confidence keeps sliding, the next “data print” won’t come from the Fed, it’ll come from your grocery bill.

Deeper Read: The Economy’s Mirror Cracks

With payrolls, CPI, and spending reports offline, sentiment has become the proxy for reality… and it’s flashing contraction.

Readings near 50 have historically preceded slower demand, hiring freezes, and stimulus chatter.

The twist this time: fear isn’t about fundamentals, it’s about not knowing them. The blind spot is the risk.

Investor Signal

This isn’t noise… it’s the first tremor of behavior change.

Confidence this low means consumers are tightening before data confirms it. Markets are pricing faith, not facts, and that gap widens when visibility disappears.

Expect flows to shift toward defensives, healthcare, and utilities, where stability still earns a premium.

In a market flying on sentiment, the smartest trade is clarity, and right now, that means caution.

FINTECH WATCH

Affirm’s Warning Shot: The Consumer’s Credit Tap Is Tightening

If spending is the story, Affirm’s data just revealed the plot twist by posting a record quarter… and a quiet red flag.

CEO Max Levchin admitted what most retailers won’t: furloughed federal workers, now in week six without pay, are “showing a subtle loss of interest in shopping.”

The comment barely hit headlines, but it’s the first real-time tell that the shutdown is bleeding into spending behavior.

Roughly 1.4 million federal employees are either unpaid or sidelined, and the spillover runs far past Washington’s walls. The FAA’s 10% flight reduction is grounding travel plans, SNAP benefits for 42 million Americans are paused, and IRS delays are freezing refunds.

The result isn’t panic, it’s hesitation.

Consumers aren’t just spending less; they’re planning less.

Affirm’s travel and ticketing volume surged this quarter, but Levchin called it “fine, for now”... but fine sounds fragile when confidence is cracking.

Deeper Read: The Shutdown’s Shadow Economy

Affirm’s transaction data is becoming the market’s best proxy for a silenced economy.

With payrolls, retail sales, and CPI frozen, payment networks are writing the first draft of reality, and it shows consumers shifting from can’t afford to don’t bother.

Discretionary purchases are pausing, travel bookings are stalling, and big-ticket buys are being deferred.

The next hit will ripple through contractors, suppliers, and service jobs tied to federal demand.

Momentum, once broken, takes months to rebuild.

Investor Signal

Affirm’s numbers glow, but the glow hides fatigue.

The shutdown isn’t collapsing consumption, it’s corroding it. Each week without pay or data chips away at confidence and future demand.

This is how a soft patch becomes a slowdown.

Expect weakness to creep through leisure, travel, and discretionary retail before it shows up in macro data.

For positioning, favor credit networks, staples, and short-duration debt… sectors that trade on cash flow, not confidence.

When consumers stop wanting to spend, even strong balance sheets feel smaller.

FROM OUR PARTNERS

90% of AI Runs Through This Company

Case in point:

The database provider now embedded into the big three cloud platforms - with access to 90% of the market.

You’ll find the name and ticker of this newly-minted giant in our 10 Best AI Stocks to Own in 2025 report, along with:

The chip giant holding 80% of the AI data center market.

A plucky challenger with 28% revenue growth forecasts.

A multi-cloud operator with high-end analyst targets near $440.

Plus 6 other AI stocks set to take off.

ENERGY WATCH

Constellation’s Quiet Beat: When Power Meets Perfection

Constellation Energy just proved what happens when strength stops surprising.

After a 57% run this year, powered by the AI data-center boom and nuclear’s comeback, the company’s third-quarter report landed… well… not phenomenal.

Earnings of $3.04 a share missed by a hair, revenue of $6.6 billion topped forecasts, and full-year guidance narrowed.

The stock slipped 4% pre-market, not because anything broke, but because perfection became the baseline.

Constellation now trades like an AI proxy in disguise and if AI keeps guzzling power at this pace, utilities may outgrow tech itself.

Its nuclear fleet ran at 97% capacity, a near-flawless performance that cements its role as the grid’s backbone in a power-hungry data era.

But without fresh hyperscale contracts or progress on the $26.6 billion Calpine deal, investors saw steadiness, not spark.

CEO Joe Dominguez called it “stability,” saying nuclear’s value in the data economy is finally being recognized.

Translation: the thesis is solid… it’s just taking a breather.

When reliability becomes routine, the next surprise has to be scale.

Deeper Read:

This isn’t a stumble; it’s saturation.

When a sector prices perfection, “good” results read as fatigue. The entire utility complex has become a derivative of the AI trade, and Constellation sits at its center, supplying the clean, constant power that makes compute possible.

But capacity takes time to expand, permitting lags are real, and balance sheets can’t compound as fast as investor enthusiasm.

The coming year will test whether the utility-nuclear hybrid model can scale profitably without eroding margins in a race to meet insatiable data-center loads.

Investor Signal:

Constellation’s pause confirms the AI-power trade has moved from discovery to discipline.

Short-term softness is digestion, not decline. The opportunity shifts to operators that can blend nuclear, gas, and renewables into one reliable system, turning stability itself into alpha.

For investors, this isn’t a “miss.”

It’s a reminder: once you become the market’s darling, delivering extraordinary means meeting impossible.

MEDIA WATCH

Comcast’s Land Grab: The Empire Strikes Vertical

Comcast is moving like a company that’s done waiting for the future to arrive.

The cable-and-content giant is reportedly circling ITV’s streaming and broadcast arm in a $2.1 billion deal, while quietly sizing up a far bigger swing… a run at Warner Bros. Discovery.

The timing is deliberate.

Cable revenues are shrinking, streaming margins are evaporating, and Silicon Valley now dictates how the world watches TV. So Comcast is doing what legacy media used to do best: own the pipe and the picture.

By spinning off its aging linear networks into the new Versant entity, Comcast freed itself from ballast. Now, it’s rebuilding what the digital era dismantled: a vertically integrated entertainment empire under NBCUniversal and Sky.

If it pulls this off, the result won’t look like Netflix, it’ll look like Disney 2.0: a global studio-and-streaming ecosystem where creation, distribution, and monetization all live inside one moat.

Deeper Read: Power Flows Upstream Again

This is a reversion.

Media is cycling back to the old physics of control, where owning the studio, the signal, and the screen delivers leverage no algorithm can replace.

For Comcast, ITV would lock in a European base of production and distribution; Warner Bros. Discovery would give it American scale — content that sells itself and the pipes that deliver it.

The “build your own app” era is dying a slow, expensive death.

Profitability now belongs to whoever can collapse complexity: bundling, cross-licensing, and distributing at scale.

The subscriber race is over. The new scoreboard is content per dollar of bandwidth.

Investor Signal

Comcast’s pivot marks the return of vertical power: a full-stack defense against rising costs and platform dependency.

Streaming’s chaos phase is ending; structure is back in style.

Expect more studio tie-ups, cross-border mergers, and telecom-media hybrids as incumbents rebuild moats around exclusive content and owned distribution.

In the next media cycle, the winners won’t be those with the most viewers, they’ll be the ones who own the view.

FROM OUR PARTNERS

Institutions Are Quietly Buying This “Unsexy” Crypto

Crypto just had its biggest shakeout ever — and while most traders sold in panic, smart money was buying.

One overlooked DeFi protocol is quietly becoming Wall Street’s favorite entry point into decentralized finance.

It’s profitable, revenue-generating, and still trading at a massive discount.

Find out why institutions are piling in before retail catches on.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

GEOPOLITICS WATCH

China’s Rare Earth Reset: Relief Without Surrender

Beijing is loosening its grip… but only just enough to remind everyone it still holds the lever.

China is reportedly drafting a new export regime that grants yearlong licenses to select rare earth suppliers, a technical fix to ease months of bottlenecks that rattled automakers and defense contractors alike.

If Beijing’s easing feels generous, you’re reading it wrong. At first glance, it looks like détente. In practice, it’s calibration.

Defense-linked buyers and high-tech manufacturers will remain tightly screened, and the broader curbs that froze supply chains since April stay largely intact.

The White House called the move a “de facto end” to export controls; insiders call that wishful thinking.

Beijing’s message is simple: it will loosen enough to look cooperative, never enough to lose control.

The market sighed in relief; the strategists didn’t.

Even with eased flows, China still processes over 90% of global rare earths, and its ability to choke the tap at will hasn’t changed.

This isn’t reconciliation; it’s a reminder of who sets the terms. And when Beijing plays generous, it’s usually playing for time.

Deeper Read: The Comfort Trap

This is the paradox of relief and reliance.

A modest thaw brings short-term calm, EV and defense firms get breathing room, but it risks freezing progress on diversification.

For months, scarcity was forcing the West to invest in domestic refining, recycling, and mining from Australia to Texas.

Now, that urgency fades just as it was starting to bear fruit.

China’s easing isn’t a concession; it’s a containment strategy.

By offering access without autonomy, Beijing resets the clock, cooling diplomatic tension ahead of 2026 trade talks while keeping leverage firmly in hand.

Dependency, after all, is more useful than disruption.

Investor Signal

This is a tactical reprieve, not a turning point.

Short-term, expect supply chain stability and margin relief across EVs, defense, and electronics into early 2026.

Long-term, nothing fundamental has changed: China still owns the choke point in the minerals powering the AI, EV, and weapons economies.

The real trade sits upstream in Western refiners, recyclers, and magnet-makers building capacity that outlasts diplomacy.

Geopolitics moves in headlines. Supply chains move in decades.

And this “reset” is really a stall, the kind that keeps everyone waiting on Beijing’s next move.

CLOSING LENS

This week ended the way all overextended runs do: with new perspective.

AI lost its shine, consumer confidence dimmed, and Wall Street rediscovered what gravity feels like. The rally didn’t fail; it matured. The strongest trades didn’t disappear; they evolved.

We’re watching markets move from instinct to intention, from narrative to numbers. That shift always feels slow… until it isn’t.

For investors, that means the easy story is over.

The next phase isn’t about calling tops or chasing bottoms, it’s about holding conviction that earns its keep.

Proof has replaced promise, and the portfolios that adapt first will own the calm that follows.