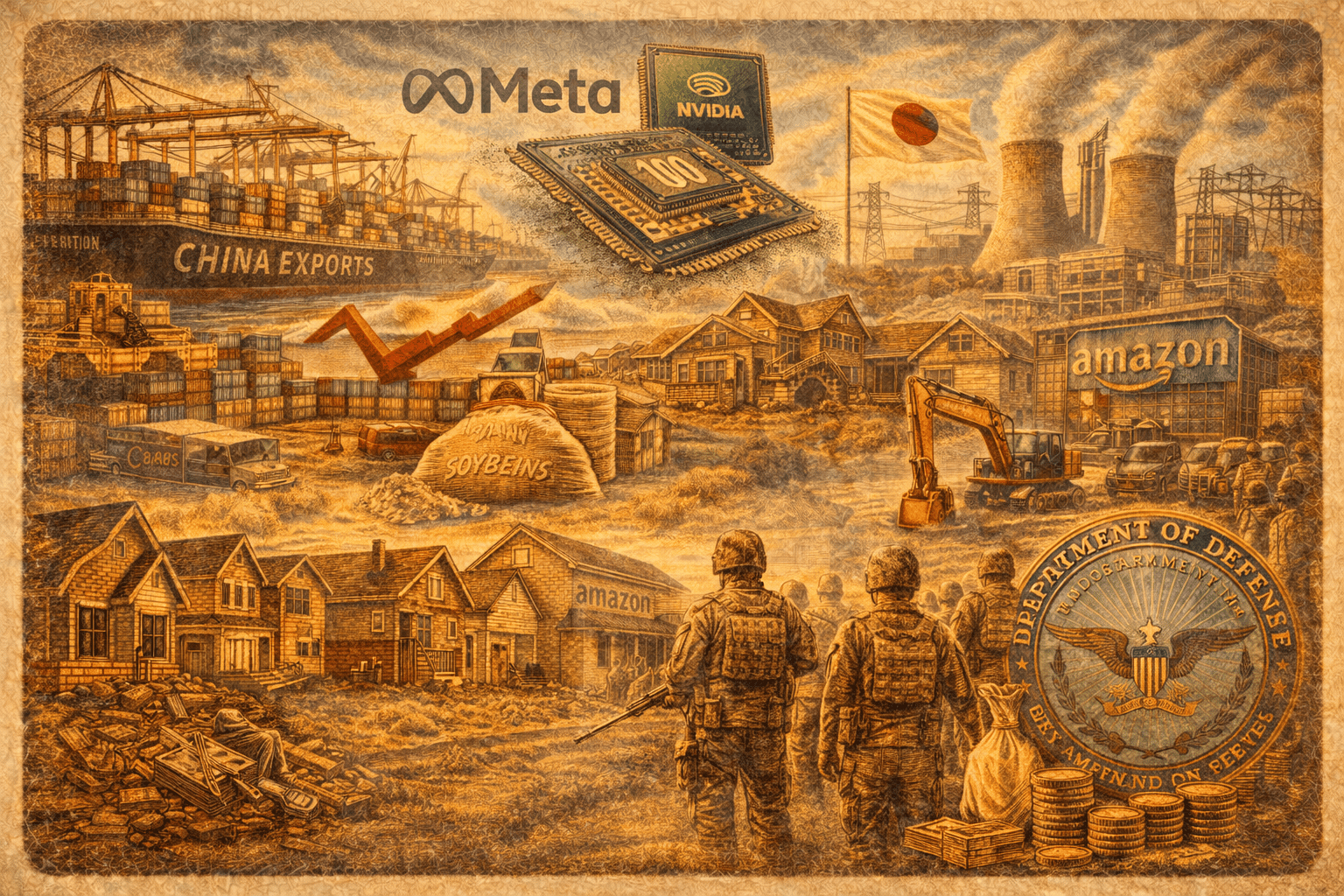

AI capex accelerates as soybean exports slump and freight rates soften. Infrastructure wins capital. Trade loses it.

MARKET PULSE

Capital Tilts Toward Infrastructure Before The Bell

There’s a steady bid in the air this morning.

Not exuberant.

Directed.

Nvidia is firm in premarket trade.

Analog Devices is sharply higher on earnings.

The AI buildout is getting capital where visibility exists.

Software remains uneven.

High-multiple names are not seeing reflexive support.

The tolerance is conditional.

Oil is climbing toward $69.

The dollar is firm.

None of this is dramatic, but together it tightens liquidity at the margin.

Beyond the tape, the reallocation continues.

Japanese capital is backing U.S. baseload power.

Baseload power is being built because AI demand is not slowing.

And while AI builds, freight tied to China is softening.

The open is not about momentum.

Momentum is broad.

This is narrow.

Capital Rotation

Nvidia-linked names draw premarket inflows on confirmed capex.

Software dispersion widens as guidance resets expectations.

Oil strength and a firmer dollar tighten conditions quietly.

Defense and infrastructure capital remains resilient.

Export channels tied to China show persistent weakness.

The Opening Frame

The market is pricing durability in infrastructure and compute.

The risk is a split. Exports are softening. Capex is accelerating.

Leadership is narrowing before the bell.

PREMIER FEATURE

The Market Is Bleeding — But This Altcoin Is Thriving

Crypto prices are sliding. Fear is everywhere. Retail is selling first and asking questions later.

But beneath the surface, one altcoin is doing the opposite.

While the market bleeds, usage on this project is accelerating. Billions are flowing through its protocol because it solves a real problem — especially when volatility spikes.

Whales have noticed. They’re accumulating quietly while sentiment collapses.

This altcoin is still priced like the market hasn’t caught on.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

REAL ESTATE WATCH

AI Buildout Collides With Housing Supply

A home site sells for $50 million.

Five years later, it sells for $700 million — to build servers.

That is not a software cycle.

It is a land cycle.

In Northern Virginia, data-center developers are outbidding home builders at levels residential math cannot match.

Amazon agreed to pay $700 million for land once slated for housing.

Other parcels now fetch $1 million an acre, sometimes far more.

This is not a demand story.

Demand for housing did not evaporate.

Land did.

Land Shift

Data centers account for up to 30% of regional development in recent years.

Parcels once priced for subdivisions now clear at multiples for server farms.

A 55-home neighborhood near Chicago was demolished for data facilities.

Labor and materials are pulled toward AI campuses over residential builds.

Local officials tighten zoning as housing shortages widen.

Housing supply does not disappear overnight.

It gets repriced out.

The Dirt War

The market is currently pricing AI as a capex story.

It is about who gets the land.

When data centers can pay 10x housing values, residential supply compresses.

That pressure hits affordability. It hits local politics. It hits inflation math.

Housing and AI are now competing for the same dirt.

ENERGY WATCH

Foreign Capital Builds America’s AI Power Base

A $33 billion gas plant is not routine capex.

It is infrastructure for an AI economy.

The centerpiece is a 9.2 gigawatt natural gas facility in Ohio — positioned as the largest of its kind.

That scale is not about incremental demand.

It is about baseload certainty.

Electricity demand from data centers is rising fast.

The grid must keep up.

Capacity Build

Japan finances projects tied to oil exports, gas generation, and critical minerals.

A 9.2 gigawatt Ohio gas plant anchors the package.

Texas GulfLink expands crude export capacity off the Gulf Coast.

Georgia gains a synthetic diamond facility critical to semiconductor supply.

Foreign capital flows through equity, loans, and state-backed guarantees.

This is not a cycle.

It is new capacity.

The Infrastructure Lever

The market is currently pricing AI as a software and chip race.

The binding variable is power.

Baseload power is becoming strategic.

Foreign capital is funding U.S. energy buildouts.

That ties competitiveness to geopolitics.

Energy is no longer a commodity input.

It sets the ceiling on AI expansion.

That makes it a national leverage point.

FROM OUR PARTNERS

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

The world's wealthiest individuals are making huge moves with their money.

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

FREIGHT WATCH

Trade Splits As AI Builds While Exports Fade

The cranes are still moving. The mix has changed.

Total cargo fell 12% year over year. Imports dropped 13%.

Exports remain the weak link.

Soybeans to China are down 80%.

That is not seasonal noise. It reflects deeper trade fragmentation.

Argentina and Brazil have absorbed contracts once routed through U.S. ports.

This is not a collapse.

Domestic capex is strong.

Exports are not.

Cargo Split

Total January volumes fall to roughly 812,000 TEUs.

Containerized exports to China decline sharply, led by agriculture.

Ocean freight rates drop toward carrier break-even levels.

Carriers cancel sailings to stabilize pricing.

Southeast Asia offsets part of China’s decline.

Manufacturing softness and AI capex can coexist.

They are running on separate tracks.

The Fragmentation

The market is currently pricing resilience in AI infrastructure and defense.

Traditional export channels tell a different story.

Agricultural flows are weakening. Freight rates are compressing. That makes the trade split structural.

The U.S. economy is splitting.

Capex booms in AI can mask softness in goods trade, but they do not replace it.

SEMICONDUCTOR WATCH

Meta Locks In Full-Stack AI Supply

Millions of chips. Standalone CPUs. Rack-scale systems.

This is not a refresh order.

It is architecture.

The company will deploy millions of next-generation GPUs, Grace standalone CPUs, Vera rack systems, and Nvidia networking gear across U.S. data centers.

Financial terms were not disclosed, but analysts expect the commitment to run into the tens of billions.

This confirms one thing clearly: hyperscaler capex is not easing.

It is broadening.

Stack Shift

Meta commits to millions of Nvidia GPUs and standalone Grace CPUs.

Vera rack-scale systems enter deployment roadmap for 2027.

Networking and security layers are bundled into the buildout.

AMD shares fall as Nvidia deepens vertical integration.

Blackwell and Rubin supply is secured amid ongoing back orders.

AI spending is no longer a single-layer race.

GPUs are not enough.

Power, networking, racks, and CPUs move together.

That is infrastructure convergence.

The Vertical Turn

The market is currently pricing AI as a model competition.

The constraint is supply security.

CPUs, GPUs, networking, and racks are now built together.

Integration becomes the moat.

Full-stack control now matters as much as algorithmic innovation.

PRIVATE EQUITY WATCH

Defense Funds Defy Broader Fundraising Freeze

Fundraising is tight. Defense is not.

Veritas Capital closed more than $15 billion for its latest flagship strategy.

That is a 40% jump from its prior fund.

Defense capital is expanding.

This is not momentum chasing.

It is mandate allocation.

Limited partners include large public pensions.

Congress has approved an $838 billion defense budget.

White House officials have signaled openness to private capital supporting national security priorities.

When liquidity is scarce, capital becomes selective.

Capital Flow

Veritas raises $15.3 billion across flagship and related vehicles.

Fund IX exceeds its predecessor by roughly 40%.

PE fundraising overall falls more than 30% year over year.

LPs include CalPERS and major state retirement systems.

Defense exits slow, yet allocations continue.

That divergence is instructive.

The Sovereign Tilt

The market is currently pricing caution across private markets.

Defense stands apart.

LPs are committing fresh capital during a downturn.

That signals policy-backed durability.

Defense tech is becoming policy-backed capital.

Budgets anchor it.

Cycles matter less.

FROM OUR PARTNERS

Great Companies Don’t Stay Under the Radar Forever

Most great stocks look boring when the real opportunity begins.

They’re still building scale, executing quietly, and being ignored by most investors.

The original market leaders didn’t become obvious overnight.

Our analysts believe the same pattern is forming again.

In These 7 Stocks Will Be Magnificent in 2026, we highlight companies that may look unremarkable today…

But you’ll soon see they all have the traits that historically define future market leaders.

CLOSING LENS

The economy is not cooling evenly. It is being reweighted.

Land once earmarked for homes is selling to server farms.

Foreign capital is underwriting U.S. baseload generation.

Defense funds are closing oversubscribed vehicles while generalist managers wait for exits.

Meanwhile, freight tied to China weakens and agricultural exports stall.

This is a constraint cycle.

Power is limited.

Land is limited.

Supply chains are limited.

Capital is flowing to where limits exist.

That shift hits housing affordability.

It hits regional politics.

It hits credit spreads.

It reshapes equity leadership.

The next question is not whether AI spending continues.

It is what gets crowded out as it does.