From record highs to record deals, markets lean on momentum…all under the shadow of tomorrow’s CPI.

MARKET PULSE

AI Mania Meets Cooling Inflation: Record Highs Without a Whisper of Caution

Wall Street’s highs got louder Wednesday. The S&P 500 and Nasdaq both closed at fresh record highs, powered by Oracle’s blockbuster AI-fueled jump. Meanwhile, extended positioning and a looming inflation print kept a quiet unease buzzing beneath the surface.

What just happened:

Oracle soared up 35–40%, its biggest intraday rally since 1992, on the back of a massive AI-cloud order backlog and bullish revenue projections.

Producer prices came in weaker-than-feared, bolstering hopes for a Fed rate cut. Markets now fully price in a 25-bp cut next week, with a ~10% chance of a 50-bp move.

The Dow lagged, weighed down by cyclical and consumer discretionary sectors, a sign that tech-led optimism is carrying the broader indices.

Investor angle: This rally has a theme…and it’s AI. But as tech blazes ahead, the rest of the market remains fragile. If tomorrow’s CPI or Powell rattles expectations, the tape may turn in a heartbeat.

Takeaway: Momentum is winning today, but only because optimism isn’t optional. Watch for cracks in other sectors and listen for the Fed’s music cue. One false note, and the applause could turn to unease.

PREMIER FEATURE

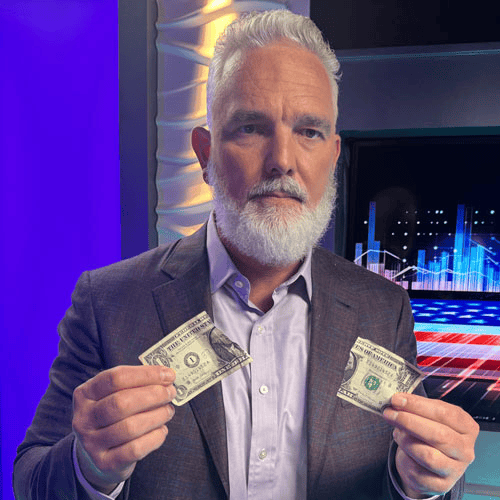

Do you have money in any of these banks?

Chase. Bank of America. Citigroup. Wells Fargo. U.S. Bancorp.

If you do…

Click here now because they're preparing for what could be the biggest change to our financial system in 54 years.

This could have a huge impact on your wealth.

DISRUPTION WATCH

Oracle’s $300 Billion Bet Redraws the Map

Oracle shocked Wall Street with a $300 billion cloud-computing pact with OpenAI, one of the largest corporate deals ever signed. The stock’s reaction was seismic: the biggest one-day gain in company history, a re-rating that vaulted Oracle from “legacy software stalwart” to front-row contender in the AI arms race.

The upside: Overnight, Oracle has been recast as a hyperscale infrastructure player. The deal cements it alongside Amazon, Microsoft, and Google as a critical supplier of AI compute, and investors are repricing its entire future accordingly.

The risk: Mega-deals magnify execution strain. Meeting demand on this scale requires flawless supply-chain coordination, outsized capex, and a margin structure that doesn’t crack under the weight. If the flywheel stalls, the narrative could unwind as fast as it arrived.

Investor angle: This isn’t just an earnings beat, it’s a regime shift. Oracle has crossed into Big Tech territory, and markets are treating it like a new species entirely.

Callback: On the 9th, we spotlighted OpenAI’s governance fight… critics warning that a pivot to profit risks mission drift. Today shows the flip side: that same profit engine is now powering one of the most consequential corporate deals in history.

For investors, it’s proof that principle may spark debates, but profit writes the contracts.

Takeaway: The AI trade has a new anchor tenant. Oracle isn’t chasing the story anymore… It is the story.

CONSUMER FRONT

Ford Bets on Nostalgia in a High-Stakes Reset

Ford has launched its “Ready, Set, Ford” campaign — a nationwide ad blitz designed to rekindle brand energy just as EV adoption shows signs of fatigue. The pitch blends nostalgia with promises of affordability and innovation, a bid to reframe Ford as both accessible and forward-looking.

The good: A bold marketing reset signals fight. In an industry locked in a bruising EV price war, brand momentum can matter. Stronger identity and consumer buzz may help Ford defend market share while rivals fight on cost alone.

The bad: Ads don’t fix math. Ballooning union contracts, battery bottlenecks, and relentless competition from Tesla and Chinese automakers all weigh heavier than taglines. Investors know slogans can buy attention, but not earnings.

Reality check: This campaign is less about reinvention and more about buying time. Ford must show sales traction and margin resilience to convince the market it’s more than just messaging.

Investor takeaway: Marketing can spark a rally, but only execution sustains it. For now, Ford’s ad push is a story — not yet a solution.

FROM OUR PARTNERS

Zacks Reveals 5 Top Stocks Set to Double in 2025 — Free Investor Report

Recession fears are easing, inflation remains sticky, but the market is creating perfect conditions for the right stocks.

Not just any stocks — Zacks experts have pinpointed 5 with huge potential for big gains.

Are you ready to profit while other investors sit on the sidelines?

RETAIL SPOTLIGHT

Nike’s Jog Toward Redemption

Nike shares edged higher after analysts pointed to early evidence that the company’s turnaround is beginning to stick. Streamlined product lines, tighter inventories, and renewed emphasis on core franchises are starting to restore discipline inside the swoosh.

The upside: Investors are rewarding the signs of stability. A leaner Nike that focuses on what it does best — from Air Jordans to performance apparel — has a clearer path to steady cash flow after years of overextension.

The downside: Rival pressure hasn’t disappeared. Adidas remains a force in Europe, while nimble upstarts continue to chip away at younger consumers. Add in patchy global demand, and Nike’s rebound still faces headwinds.

Investor angle: This is less a sprint to dominance than a careful jog back to form. For long-term holders, it’s a story of stabilization, not yet acceleration.

Takeaway: The swoosh isn’t soaring, but it’s no longer slipping. In retail, that’s the kind of quiet progress Wall Street notices.

DEAL FLOW

Klarna IPO Ignites on Wall Street

Klarna lit up the NYSE on Wednesday, pricing its IPO above range and surging more than 20% in its debut. The buy-now-pay-later pioneer raised $1.37 billion, landing a $28 billion valuation and giving Wall Street its biggest consumer-tech float in years.

The upside: Demand was undeniable. Oversubscription and a strong opening trade show the IPO window isn’t just cracked open, it’s swinging wider, particularly for high-recognition consumer names. For bankers, Klarna’s success signals that dormant pipelines may start moving again.

The downside: Excitement doesn’t erase math. Klarna is still unprofitable, and its BNPL model is exposed in a higher-for-longer rate environment where consumer credit stress is rising. Valuations can only defy fundamentals for so long.

Macro watch: On Sept 8, we flagged this as the headliner in the busiest IPO week in years under our “IPO Fireworks” framing. Today confirms the fireworks are real, but the bigger test is sustainability. Can this wave extend beyond opening pops, or does it risk fizzling once the glow fades?

Investor takeaway: Klarna’s debut is a vote of confidence for the IPO market, but the burden shifts quickly from hype to profitability. In this cycle, sparks alone won’t keep the fire burning.

HEALTH WATCH

Novo Nordisk Cuts Jobs, Slashes Outlook

Novo Nordisk jolted the weight-loss trade Wednesday, announcing 9,000 job cuts and trimming its profit forecast. Once the undisputed growth engine of the GLP-1 boom, the company now faces the reality of slowing momentum in what was considered an untouchable sector.

The upside: Aggressive cost cuts signal discipline. Management is moving quickly to defend margins and reassure investors that profitability, not just growth, is the new mandate.

The downside: The aura of inevitability is gone. If even the category leader is cutting guidance, investors are forced to ask whether the hyper-growth era for GLP-1s has already peaked. Competitors and upstarts now have more room to challenge.

Investor takeaway: Weight-loss stocks are shifting from “automatic winners” to execution stories. The trade is still alive, but investors will have to separate those who can deliver sustainable margins from those who were riding hype.

Signal Check: While Novo leans on austerity, Novartis is buying growth, striking a deal for a U.S. biotech in the $1–3 billion range. It’s a reminder that capital is rotating beyond GLP-1 giants and into the broader biotech pipeline.

THE CLOSING LENS

AI Shockwaves, Macro Stillness

Wednesday offered investors a split-screen. Oracle’s $300 billion AI leap and Klarna’s roaring IPO reminded markets that appetite for growth is alive and ferocious. Ford and Nike showed that reinvention stories still move the needle, while Novo’s stumble proved no trade is bulletproof.

Yet the real tell wasn’t in stocks, it was in bonds. Producer prices passed quietly, keeping yields anchored near 4.0% and Fed cut bets intact. Tomorrow’s CPI now looms as the arbiter of whether this rally deepens or deflates.

Momentum is undeniable. But every wave meets gravity. Thursday’s print will decide whether Wall Street’s highs hold, or whether the air under this rally proves thinner than it looks.