Calm today doesn’t erase constraint tomorrow. This tape is quietly choosing who fits the future.

MARKET PULSE

Records Hold, But The System Tightens

Relief is visible.

Conviction is not.

Futures point to a steady open after the S&P 500 carved out fresh records this week…

But the mood underneath is narrower than the price action suggests.

Leadership is rotating away from pure beta and toward control, balance sheets, scale, and assets that can absorb friction without breaking.

Big Tech still anchors sentiment, but this tape is no longer rewarding ambition alone.

Metals ripping to new highs reflects geopolitical insurance and currency doubt, not growth optimism.

Financials and industrials are holding up, yet small caps lag, another signal that scale is acting as a shield.

Rates drifting lower help the surface calm, but the real story is constraint showing up everywhere at once.

Trade friction is clogging logistics.

Tariffs are resetting cost curves.

Energy output is bumping into physical limits.

AI investment is colliding with balance-sheet reality.

Growth is still present, but it’s conditional.

This is a market advancing while quietly sorting who can operate inside tighter corridors and who cannot.

Investor Signal

The market isn’t pricing slowdown, it’s pricing selectivity.

Capital is flowing toward control, compliance, and execution rather than vision.

This tape rewards survival inside constraints, not scale in theory.

PREMIER FEATURE

The Greatest Stock Story Ever?

I had to share this today.

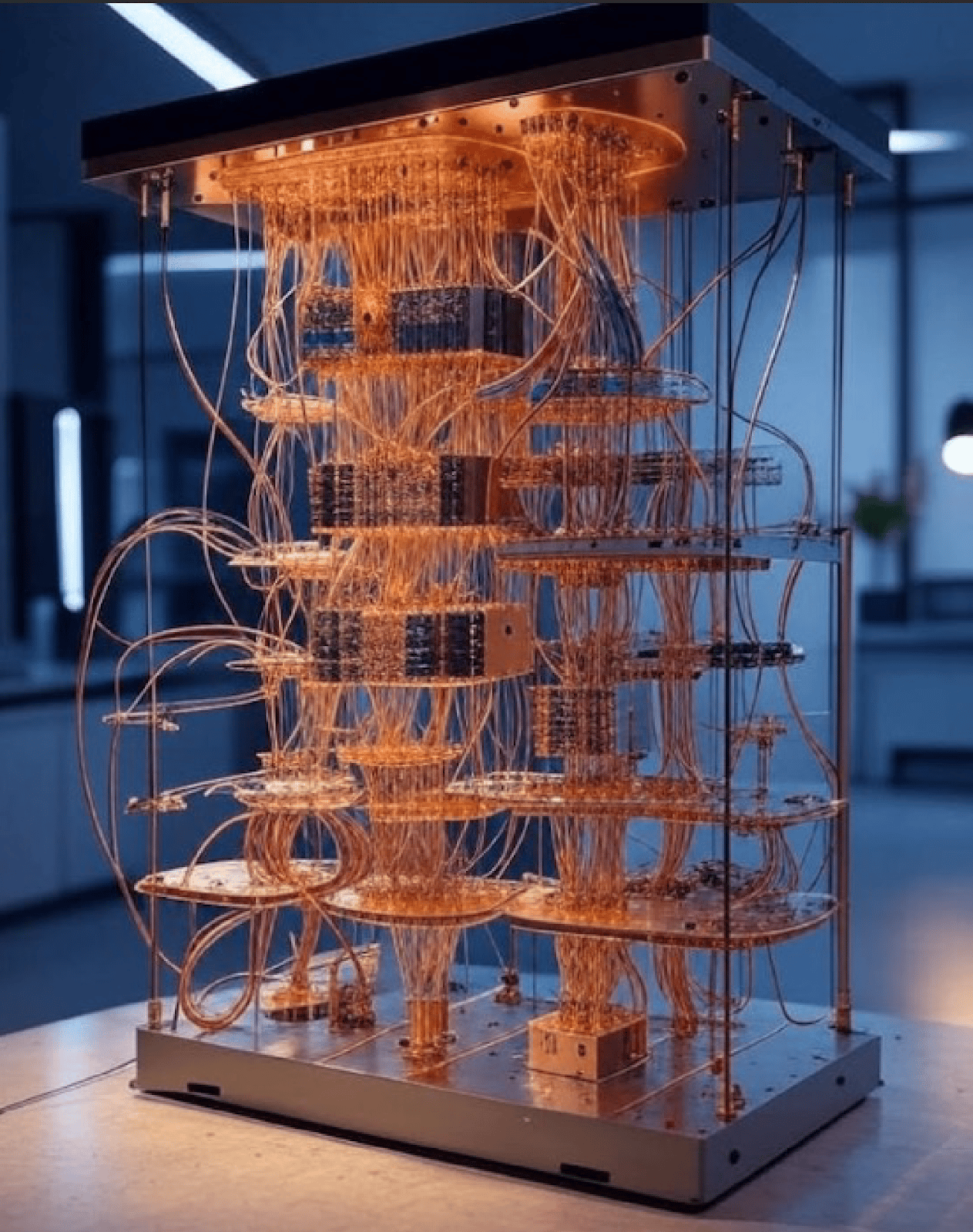

A strange new “wonder material” just shattered two world records — and the company behind it is suddenly partnering with some of the biggest names in tech.

We’re talking Samsung, LG, Lenovo, Dell, Xiaomi… and Nvidia.

Nvidia is already racing to deploy this technology inside its new AI super-factories.

Why the urgency?

Because this breakthrough could become critical to the next phase of AI. And if any tiny stock has the potential to repeat Nvidia’s 35,600% climb, this might be it.

SANCTIONS WATCH

Beijing Draws a Line But Markets Barely Blink

Beijing’s move targets firms tied to Taiwan arms sales, freezing assets and banning executives.

On paper, it looks severe.

In practice, most affected contractors generate little to no China revenue, limiting any direct earnings impact.

Taiwan is being reinforced as a permanent geopolitical fault line, not a negotiable trade issue.

Beijing isn’t trying to punish balance sheets.

It’s reminding investors that this relationship carries fixed friction regardless of market calm or diplomatic tone.

Defense stocks aren’t trading on global demand cycles or China exposure.

They’re trading on policy certainty, long-duration contracts, and insulation from cross-border retaliation.

Sanctions like this underline why defense cash flows remain structurally resilient even as geopolitical headlines escalate.

The escalation risk isn’t economic shock, it’s normalization.

Each symbolic move hardens the framework without disrupting the tape, conditioning markets to treat Taiwan tension as background structure, not event risk.

Investor Signal

Markets are pricing defense as policy-anchored, not geopolitically fragile.

Symbolic sanctions reinforce insulation rather than introduce volatility.

Taiwan risk remains real, but increasingly contained within expectations, not multiples.

TRADE WATCH

When Borders Become Bottlenecks, Not Gateways

Customs just turned from a formality into a choke point, and the market is starting to price it.

Packages that once sailed through are now detained, returned, or destroyed over origin and tariff data that many buyers and sellers simply don’t have.

What used to be frictionless commerce is now paperwork-first trade.

This isn’t headline protectionism.

It’s operational drag becoming policy.

Costs rise quietly through delays, lost inventory, higher brokerage fees, and carrier surcharges.

Small businesses and consumers absorb the shock first, while larger players with compliance teams, sourcing transparency, and carrier leverage adapt faster.

Cross-border trade is being re-ranked, not reduced.

Volume still moves, but only through channels built for scrutiny.

The market isn’t reacting to tariffs themselves, it’s adjusting to who can function when friction is permanent.

The implication is structural.

Scale, documentation, and logistics infrastructure now determine who clears the border and who doesn’t.

Investor Signal

Trade friction is being priced as a fixed operating cost, not a temporary disruption.

Logistics, carriers, and scaled importers gain advantage as compliance becomes the moat.

Small-parcel globalization isn’t ending, it’s becoming selective, slower, and more expensive.

FROM OUR PARTNERS

Is Nvidia about to Trigger Another 150X

Opportunity?

Nvidia gave investors a chance to make more than 150 times their money with its AI chips known as graphic processing units. Legendary investor Louis Navellier believes this new invention could be even more revolutionary and mint a new wave of millionaires.

TECH WATCH

Oracle’s Software Economics Collide With Infrastructure Reality

Oracle’s AI bet just stopped trading like vision and started trading like debt.

The OpenAI partnership promised scale and relevance, but the market is now focused on the bill.

Credit default swaps widening tells you where attention has shifted.

This isn’t about whether AI demand exists.

It’s about whether Oracle can execute an infrastructure pivot without breaking its balance sheet.

Software margins are giving way to data-center economics, just as rates, construction costs, and competitive pressure compress returns.

What once looked like backlog-driven upside now reads as long-duration risk.

The stock’s worst quarter since 2001 reflects a repricing of certainty.

Markets aren’t punishing ambition.

They’re discounting execution risk, customer concentration, and the time value of capital tied up for years before cash flows turn positive.

This is the cost of leaving asset-light comfort and stepping into capital-heavy reality.

Investor Signal

AI infrastructure is no longer rewarded on scale alone.

Balance-sheet durability is becoming the gating factor.

The market is sorting builders from financers, and not treating them the same.

RETAIL WATCH

Target Faces Activist Investor Pressure Amid Sales Decline

Target’s stock didn’t rally on hope, it rallied on pressure.

Remodels, headcount cuts, and incremental cost discipline haven’t translated into traffic or pricing power, while Walmart continues to widen the gap through scale, essentials dominance, and fulfillment efficiency.

The market isn’t debating whether Target has a plan.

It’s questioning whether the plan is fast enough.

Margin strain from tariffs, cautious consumers, and promotional intensity are colliding just as execution risk rises.

Activism here isn’t about financial engineering or asset splits.

It’s about forcing urgency when organic momentum hasn’t shown up.

It reinforces a broader repricing in retail: scale alone is no longer insulation.

Without visible competitive acceleration, patience compresses quickly, and outside pressure fills the vacuum.

Investors are recalibrating how long they’re willing to wait for self-help stories in a price-led environment.

The stock reaction reflects optionality, not resolution.

Investor Signal

Retail is trading on execution velocity, not restructuring promises.

Activism is emerging where narratives stall, not where balance sheets break.

Markets are quietly ranking who can regain momentum, and who needs a push.

FROM OUR PARTNERS

Bitcoin Is Running Out—and the Smart Money Knows What Comes Next

For the first time in nearly 7 years, less than 15% of all Bitcoin remains on exchanges. At the same time, institutions are buying faster than new BTC can be mined. ETFs, corporations, and governments are creating a real supply shock.

When demand overwhelms supply, price has only one direction to go. This isn’t hype—it’s math. And the next major crypto move may already be setting up.

That’s why 27 top crypto experts are revealing how they’re positioning ahead of this shift.

For a limited time, you can attend FREE.

AI WATCH

Growth Is Rising Faster Than Payrolls Can Keep Up

AI is lifting GDP, but it may be quietly eroding the tax base that pays for it.

Markets are pricing that strength as durable.

What they’re not pricing is how uneven that growth becomes once labor displacement enters the equation.

The data already shows a shift.

Capital deepening is accelerating faster than wage growth, and productivity gains are being front-loaded while employment effects lag.

Even optimistic models show AI-driven efficiency barely moves Social Security’s funding math unless jobs and wages expand alongside it.

If automation trims payrolls before policy adapts, contributions fall precisely when demographic pressure peaks.

Entitlement stability is a long-duration macro input.

Markets don’t react to it daily, but they reprice quickly once confidence cracks.

AI-driven growth that bypasses payroll taxes doesn’t fix fiscal stress, it compounds it over time.

This isn’t an argument against AI investment.

It’s a reminder that timing risk is real.

Investor Signal

AI growth is being rewarded today, but labor substitution is a deferred liability.

Productivity without payroll expansion reshapes long-term fiscal assumptions.

The market is celebrating output while quietly ignoring who’s still paying in.

CLOSING LENS

Constraint isn’t a shock anymore, it’s the framework.

Across energy, trade, AI, labor, and geopolitics, limits are no longer hypothetical; they are operational, visible, and increasingly priced.

The system keeps moving forward, but only where control exists.

The next move belongs to those who fit inside the narrowing lanes.