Quick Read:

- Walmart's Warning: Beat sales, missed profits due to tariff margin squeeze

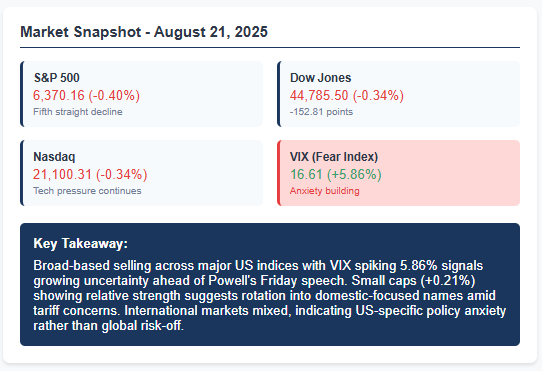

- Fed Mismatch: 88% expect dovish Powell, data suggests hawkish Friday

- The Trade: Policy arbitrage era ending, infrastructure over software wins

Why This Matters: Walmart's inability to pass through tariff costs despite record efficiency reveals the hidden inflation mechanism pressuring the Fed toward hawkishness, not dovishness. Friday's Jackson Hole speech could trigger a major sentiment reversal as markets realize they're positioned wrong.

Market Pulse: Why Walmart's "Good" Earnings Just Triggered a Sell-Off

Here's what happened: Walmart crushed sales estimates (+4.6% vs +4% expected) and raised guidance, yet fell 3% because profit margins got crushed. For the first time since 2022, America's most efficient retailer couldn't make the math work.

The Real Story: Tariffs are quietly destroying corporate profits faster than companies can raise prices. Walmart's CFO admitted they're absorbing costs they "cannot fully pass through." If Walmart can't navigate this, who can?

What This Means for Your Portfolio: Every consumer discretionary stock just got a warning shot. The companies that survive this margin compression cycle will dominate the next decade.

From Our Partners

90% of AI Runs Through This Company

The biggest AI wins often come from companies you don’t hear about every day.

Case in point:

The database provider now embedded into the big three cloud platforms - with access to 90% of the market.

You’ll find the name and ticker of this newly-minted giant in our 10 Best AI Stocks to Own in 2025 report, along with:

• The chip giant holding 80% of the AI data center market.

• A plucky challenger with 28% revenue growth forecasts.

• A multi-cloud operator with high-end analyst targets near $440.

Plus 6 other AI stocks set to take off.

Get the full list today, while it’s still free.

AI GAMBLE?

The $10 Billion AI Bet That Changes Everything

Anthropic is about to close one of the largest private funding rounds in tech history: $10 billion. This isn't just another startup raising money. When private funding hits $10B+ levels, it typically signals 12-18 months before sector consolidation, making this a timing signal, not just fundraising news.

Why This Matters: We're in the final sprint phase of the AI arms race, where companies either deploy massive capital now or get permanently left behind. The window for market positioning is closing fast.

Investment Angle: The AI infrastructure providers (data centers, chips, cloud services) will capture more value than the AI software companies. Follow the money flow, not the hype.

AEROSPACE & DEFENSE

Boeing's Secret Weapon: The China Strategy No One Saw Coming

While every other sector gets crushed by trade tensions, Boeing just proved aerospace transcends geopolitics. The company is negotiating a massive aircraft sale to China: potentially hundreds of planes as part of broader trade normalization.

The Bigger Picture: Boeing found the ultimate tariff hedge by becoming too strategically important to fail. This isn't just about aircraft sales; it's about companies learning to play geopolitical chess instead of just business strategy.

Profit Opportunity: Aerospace and defense companies are the only sector that benefits from both trade tensions (defense spending) and trade normalization (commercial sales). That's called a perfect hedge.

POLICY & REGULATION

Tesla's Regulatory Problem Just Got Worse

Federal regulators are investigating Tesla for missing crash report deadlines, but this is bigger than paperwork. It's a sign that the "move fast and break things" era is officially over, especially for companies dealing with public safety.

What Changed: Regulatory tolerance for compliance gaps has evaporated. What used to get overlooked during hypergrowth phases now draws existential scrutiny. Tesla's governance issues could become its biggest competitive disadvantage.

Investor Reality Check: Tesla's innovation advantage won't matter if it can't meet basic compliance standards. The regulatory environment has shifted permanently against disruptors who cut corners.

MERGERS & ACQUISITIONS

Media Deals Just Hit a Wall

The DOJ is investigating the Paramount-Skydance merger, signaling a new era of aggressive media antitrust enforcement. This isn't about one deal; it's about the end of the mega-merger era in entertainment.

What This Means: Media consolidation just became exponentially harder. Companies betting on growth-through-acquisition strategies need new playbooks.

Investment Impact: Media stocks with merger premiums built in are about to get repriced. Look for standalone value, not deal speculation.

JACKSON HOLE

The Powell Speech That Could Move Markets 10%

Friday's Jackson Hole speech isn't just another Fed update: it's Powell's last chance to solve an impossible equation. How do you fight tariff-driven inflation without crushing employment? Here's the critical disconnect: 88% of traders expect rate cuts in September, but Fed minutes suggest policymakers are more worried about inflation persistence than labor market cooling.

The Setup: This classic sentiment/reality divergence creates explosive moves when it resolves. Markets are positioned for dovishness while the data supports hawkishness, a mismatch that typically triggers 5-10% moves in 24-48 hours.

What to Watch: Powell needs to signal that the Fed can handle inflation without triggering a recession. If he can't thread that needle, expect volatility to spike 50%+ by Monday.

Your Move: Position for Fed hawkishness, not dovishness. The market is leaning the wrong way, and Friday could trigger a major reset.

BEHIND THE HEADLINES

The Three Trades Everyone's Missing

While markets obsess over Powell's speech, a massive structural shift is creating once-in-a-decade opportunities: the systematic collapse of traditional policy arbitrage.

The Pattern: Every major story today represents the same phenomenon. Easy alpha generation through regulatory gaps, cost-shifting, and policy loopholes is ending. Walmart can't fully pass through tariff costs. Tesla faces existential compliance pressure. Media mergers hit regulatory walls. The companies that built competitive advantages through policy arbitrage are losing their edge.

The Tariff-Resistant Trade: Focus on companies with domestic supply chains that benefit from reshoring rather than just survive it. These businesses don't just avoid tariff costs; they gain competitive advantages as rivals get squeezed.

The Compliance-as-Moat Trade: Regulatory complexity is becoming a competitive advantage. Companies with strong governance capabilities will systematically gain market share from disruptors who can't adapt to the new compliance reality.

The Infrastructure-Over-Software Trade: AI's infrastructure providers will capture more value than AI software companies as the capital deployment phase reaches its peak. Data centers, chips, and cloud services represent the real money in this cycle.

Bottom Line: The investment landscape has fundamentally shifted from growth-at-any-cost toward policy-resistant, compliance-strong, infrastructure-heavy businesses. The companies positioning for this reality today will dominate tomorrow's market while those clinging to the old playbook get systematically eliminated.