Sector Snapshot

Sector Synopsis

Markets opened the week with tariff tension as the dominant theme. Tech investors braced for a big week of earnings, while the Fed’s policy trajectory continued to cast a shadow. Defensive sectors saw mixed action: Utilities and data center proxies sold off on AMZN leasing headlines, while gold miners broke out. Risk appetite showed signs of fragility, though crypto bucked the trend with strong flows into Bitcoin and miners.

Autos, Retail, Consumer Staples & Restaurants: Tesla shares slipped again ahead of earnings, with analyst Dan Ives urging Musk to refocus on Tesla amid reports of a delay in the launch of a lower-cost Model Y. Uber dropped after the FTC filed suit alleging deceptive practices tied to its subscription service. Amazon was downgraded at Raymond James on EBIT pressure concerns. Trump is reportedly meeting with executives from Walmart, Target, Home Depot, and Lowe's as retail-sector anxiety over tariffs grows.

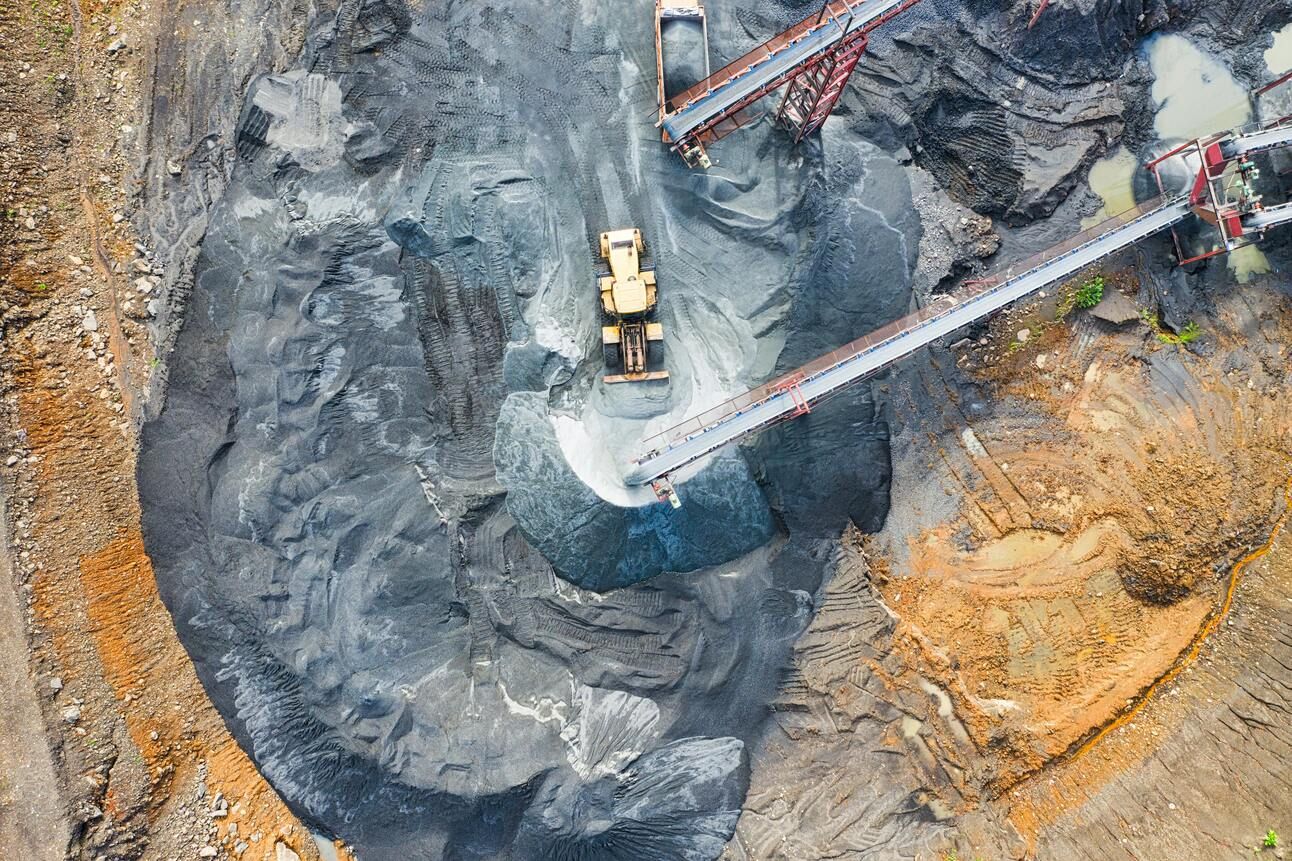

Energy, Industrials & Materials: In oil and gas, KeyBanc downgraded MUR and cut price targets across the board on lower oil estimates, though they raised natural gas forecasts. Chevron launched production at the Ballymore prospect, part of its push to hit 300K barrels/day in the Gulf by 2026. LYB and DOW were upgraded to Buy at Deutsche Bank ahead of earnings. In data centers, Amazon reportedly paused some U.S. colocation leasing, causing a selloff in utility and infrastructure names. Gold miners surged to 52-week highs as gold prices jumped 3%.

Banks, Brokers, Asset Managers: Comerica beat on NIM and provision metrics, while Canadian banks were downgraded by Jefferies on rising credit risks. Several smaller banks, including INDB and SFNC, posted mixed results. In M&A, Capital One received final approval to acquire Discover, creating the largest credit card issuer by volume.

Insurance, Bitcoin, FinTech, Payments: Global Payments sold its Issuer Solutions unit to FIS for $13.5B, with both companies' ratings adjusted accordingly. Bitcoin continued its rally, topping $88K, as MicroStrategy disclosed a 6,556 BTC purchase funded by recent equity sales. Crypto mining stocks outperformed.

Biotech & Pharma: XBI and IBB caught a bounce as new FDA Commissioner Marty Makary struck a pro-innovation tone, signaling support for streamlined approval pathways and orphan drug acceleration. REGN and SNY received FDA approval for Dupixent in treating chronic hives. Hospital chains underperformed amid political scrutiny over Medicaid profits. Tempus AI (TEM) was initiated with a Buy rating at BTIG.

Internet, Media & Telecom: Netflix surged post-earnings after strong guidance and a solid Q2 outlook. Disney was upgraded at Wolfe Research, while Warner Music was downgraded on soft expectations. In semis, NVDA slipped after Huawei reportedly began mass shipping a domestic AI chip. Semi-equipment names traded down ahead of earnings. In software, Salesforce was upgraded by Guggenheim, while DA Davidson downgraded it on valuation concerns.

Featured Articles

U.S. Banks Brace for Trade War Fallout: America's largest banks are warning of cooling global credit demand and slower multinational lending as the latest round of tariffs spooks cross-border clients. JPMorgan and Citigroup execs cited lower appetite for corporate borrowing and risk-off behavior among sovereign borrowers.

Luxury Stocks Pressured by Strong Gold, Weak Dollar: High-end brands are now facing a triple threat—tariffs, softening Chinese demand, and FX pressure. With the dollar weakening and gold at record highs, retailers like LVMH and Richemont are struggling to protect margins. Analysts are beginning to question 2025 growth assumptions.

Tech Earnings and Tariffs Collide This Week: The market is bracing for one of the most consequential earnings stretches in recent memory as Tesla, Apple, Alphabet, Meta, Microsoft, Amazon, and Nvidia all report within days of each other. Meanwhile, tariff headlines threaten to drown out strong fundamentals.

Amazon Pulls Back on Data Center Leases: Amazon Web Services is reportedly hitting pause on several U.S.-based colocation lease negotiations, according to Wells Fargo. The news spooked utility and infrastructure names Monday, as the hyperscaler slowdown could signal a broader cooldown in data center expansion.

Inside the Earnings Call - DHI

Q2 FY2025 Earnings Call Summary

Theme | Q2 FY2025 | Q1 FY2025 | Q4 FY2024 | Q3 FY2024 |

|---|---|---|---|---|

Orders & Closings | New orders up 14% y/y | Closings up 12% y/y | Orders flat, closings -2% | Orders down, cancelations up |

Margins | Gross margin +60bps y/y | Margin guidance held firm | Margins compressed y/y | Lower margins due to input costs |

Pricing & Demand | ASP slightly down y/y | ASP up slightly | ASP flat y/y | ASP under pressure |

Inventory & Land | Controlled inventory buildup | Strategic land buys | Adjusted land spend | Pullback on land acquisition |

Affordability Trends | Buyer interest firm | Mixed across regions | Rising incentives offered | Demand patchy on rates |

Guidance | Raised FY25 rev and EPS | Maintained FY25 guidance | Initial cautious guide | Pulled FY guidance |

Takeaway for Investors

D.R. Horton is proving to be a standout in a tough housing tape. Despite affordability headwinds, new orders rose double digits and margins expanded. ASPs softened slightly but were more than offset by volume gains. Management raised full-year guidance and remains focused on balancing inventory growth with capital discipline. If mortgage rates ease in the second half, DHI is well-positioned to capitalize.