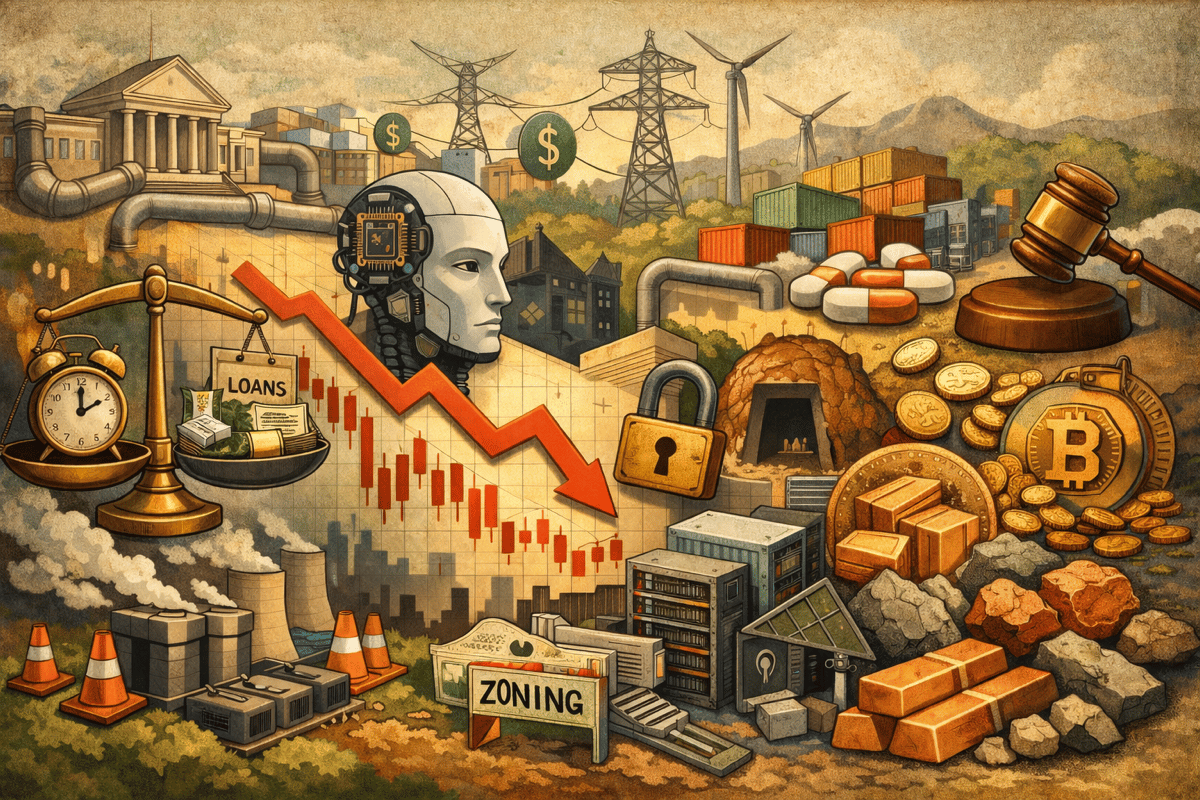

Indexes closed lower, but the system held. Last week wasn’t about panic. It was about tighter standards around funding, power, verification, and the speed at which spending becomes cash flow.

MARKET PULSE

Last week closed lower across the board.

The S&P, Nasdaq, and Dow each slipped roughly 1% week over week. Nothing dramatic. No forced unwind. No systemic stress. Just steady repricing.

Credit markets remained orderly. Volatility rose but stayed contained. Liquidity did not disappear.

What changed was tolerance.

As the week unfolded, the same pattern repeated in different sectors and geographies.

When a story relied on patience, cheap funding, or frictionless execution, the market marked it down.

When a business could demonstrate enforceable demand, visible cash flow, or control over scarce inputs, it retained sponsorship.

This was not a fear week.

It was a standards week.

Below are the six themes we unearthed over the course of the week that mattered most to price action, and why.

PREMIER FEATURE

The $300 Crypto Smart Money Is Targeting for February

This isn’t a hype-driven flyer.

It’s a DeFi protocol trading near $300 that our research suggests could have a realistic path toward $3,000+, based on fundamentals institutions care about.

Real, growing revenue

$60+ billion in total value locked

Institutional adoption accelerating

Token supply shrinking through buybacks

With new regulations opening the door for institutional capital, trillions in managed assets can now access this protocol. That’s why we believe this could be the #1 crypto to own heading into January.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Signal One | The Dow Above 50,000 Became a Liquidity Test, Not a Celebration

The cleanest surface signal was psychological, but the interpretation was structural.

The Dow holding near 50,000 mattered less as a milestone and more as proof that liquidity still appears when the setup clears institutional scrutiny.

The index level did not insulate portfolios from losses. It functioned as a checkpoint.

The rallies that emerged during the week were not broad invitations back into high beta. They behaved like triage. Breadth improved at the margin, but participation narrowed.

Capital circled industrial exposure tied to physical buildouts, balance sheets with cash visibility, and infrastructure-linked earnings, while longer-duration software and narrative-heavy AI adjacency remained capped.

The tape did not collapse. It filtered.

Investor Signal

When a headline level turns into a test, positioning shifts from optimism to qualification. The risk in this environment is not systemic breakage. It is that rallies remain selective and require revalidation every time.

Signal Two | AI Stayed Funded, But the Hierarchy Moved Down the Stack

AI did not lose its structural tailwind last week. It lost the assumption that scale is automatic.

The market increasingly rewarded the physical layer. Chips, memory, equipment, power distribution, and automation infrastructure absorbed flows because demand there is contractual and harder to defer.

TSMC’s January surge forced the debate into factory utilization and shipment schedules. Siemens’ raised guidance reinforced that AI enthusiasm is translating into substations, cooling systems, and grid logic.

At the same time, competition within silicon shifted from speed to efficiency.

Inference economics began to redraw the battlefield, tilting attention toward cost per token and throughput per dollar.

This was not a rejection of AI. It was a repricing of where durability sits inside the stack.

Investor Signal

AI exposure is now sorted by delivery certainty. The market is funding usage that converts quickly and penalizing layers that depend on adoption curves or extended timelines.

FROM OUR PARTNERS

Stocks Don’t Move Because of News. They Move Because of Demand

Legendary investor William O’Neil said it best:

When institutions move, prices follow.

The problem?

Nearly half of those orders are hidden in Dark Pools — invisible to most retail traders.

TradeAlgo’s Dark Pool A.I. scans these secret exchanges and alerts you by text message the instant unusual institutional buying or selling appears.

No waiting. No reports. Just the signal.

Signal Three | Financing Became the Real AI Narrative: Debt, Duration, and Leverage

One of the most important shifts last week came from the funding mix.

AI expansion is increasingly being underwritten by credit rather than equity multiple expansion.

Alphabet’s ultra-long issuance, including century appetite and broader long-dated funding, reframed hyperscaler spending as financed infrastructure, not optional growth.

That changes the sequencing of risk. When debt markets fund the buildout, discipline surfaces first through spreads, duration appetite, and refinancing math before equity multiples fully reset.

SoftBank’s leverage against core holdings to deepen OpenAI exposure illustrated the same compression from another angle.

Borrowed conviction accelerates both opportunity and sensitivity. If timelines extend or rate conditions shift, the balance sheet becomes the transmission channel.

Private markets reinforced the divergence. Select AI platforms can still command aggressive valuations in private rounds, even as public software multiples compress. That gap is not noise. It is a tension that must eventually resolve.

Investor Signal

The AI cycle is not ending. It is maturing. Watch the credit complex. Spreads and issuance cadence will telegraph discipline before equity headlines do.

Signal Four | Verification Replaced Reputation in Private Credit

The $400 million hit inside BlackRock’s HPS unit was not a systemic event. It was a reminder.

Private credit scaled rapidly in an era of abundant liquidity and compressed spreads.

When collateral is opaque and price discovery is limited, trust substitutes for transparency. That model works best when capital is plentiful and growth assumptions are cooperative.

Last week’s reaction underscored a broader shift. Investors are no longer debating return targets first. They are interrogating verification, audit trails, and collateral traceability.

The repricing was subtle but instructive. Smooth marks no longer command automatic confidence.

Investor Signal

Hurdles have shifted from yield to proof. Strategies built on opaque assets will face higher scrutiny even if defaults remain contained.

FROM OUR PARTNERS

DO THIS Before Gold Hits $10K

Gold’s recent run-up has been nothing short of historic — and many experts believe it’s far from over.

Some forecasts now point to gold reaching $10,000 an ounce… with one analyst even projecting $20,000.

But no matter how high gold ultimately goes, it’s critical that you know how to position yourself for the next major move.

Signal Five | Time Risk Was Priced Explicitly: Regulation, Infrastructure, and Approval Velocity

Last week repeatedly showed that time is no longer an implicit assumption. It is being priced.

Corporate transactions increasingly underwrite delay itself through ticking fees and enhanced breakup protections. Cross-border infrastructure disputes revealed how neutral assets can become bargaining instruments. Deregulatory shifts fragmented authority rather than eliminating it, extending timelines instead of clearing them.

Markets absorbed these developments not as volatility catalysts but as duration penalties.

Projects that depend on clean approvals, singular rulebooks, or uninterrupted logistics now carry wider required returns. Execution still clears. It just takes longer and costs more.

Investor Signal

Governance and enforceability have reentered valuation math. Assets with adaptable compliance paths and shorter feedback loops retain advantage as resolution windows widen.

Signal Six | The Consumer Held, But Fragmented, Reshaping Margin Math

The consumer did not break last week. It clarified.

Corporate commentary and retail data pointed to a split. Premium brands and travel-related exposure continued to find buyers willing to absorb price. Mass-market and mid-tier operators leaned more heavily on promotions and mix management as elasticity returned.

Delinquencies and credit stress edged higher into middle-income brackets. Electricity inflation, driven in part by infrastructure expansion, began to show up in household cost structures.

The result is not collapse. It is segmentation.

When demand fragments by income cohort, margin architecture shifts.

Pricing authority becomes selective. Earnings durability depends more on customer composition than on aggregate consumption.

Investor Signal

Consumer exposure now demands income clarity. Franchises tied to affluent balance sheets or repeat demand retain insulation. Models reliant on broad middle-income momentum face narrower pricing corridors.

FROM OUR PARTNERS

How Traders Are Hitting 1,000%+ Memecoin Gains in Days

While Bitcoin takes months to move, memecoins can explode 1,000%+ in a matter of days.

Two analysts on our team have cracked a system for spotting these breakout coins before momentum hits.

Recent wins include 433% in three days, 889% in three days, and even an 8,200% run in just five months.

This isn’t about holding for years, these moves happen fast.

Right now, they’ve identified a new memecoin showing the same early signals as past winners.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

CLOSING LENS

Last week did not deliver panic. It delivered pressure.

Indexes closed in the red. Credit stayed functional. Liquidity held.

But the bar moved higher.

AI remained funded, yet leadership consolidated around throughput and cost discipline.

Financing shifted toward debt duration and leverage sensitivity.

Private credit faced verification tests.

Time risk embedded itself into infrastructure and regulatory math.

The consumer held up, but segmentation reshaped margin expectations.

Markets did not abandon growth. They demanded proof of it.

The system stayed open.

Admission simply became more expensive.

FINAL SPOTLIGHT

AI Stocks Are Moving Again, But Not All Moves Stick

Some runs attract real participation.

Others fade within days.

Our analysts track one participation read that separates continuation moves from short-lived reactions.

Right now, many popular names look active, but only a few show institutions entering before sustained momentum.