This isn’t a risk-off tape. It’s a selective one. From Nvidia suppliers to European wind, politics and physics are setting the terms of progress.

MARKET PULSE

A Record Close, Powered by Metals and Muscle

The Dow didn’t hesitate.

It pushed through 49,000 as investors leaned into the fallout from Venezuela rather than stepping back from it.

Blue chips led, not defensives.

This was money rotating into consequence, not hiding from it.

Energy stocks caught the first wave.

Chevron jumped as the only U.S. oil major still operating in Venezuela, with Halliburton, SLB, and Valero surging on rebuilding math, not near-term barrels.

Crude wobbled, then recovered… a reminder that supply timelines matter more than political theater.

The louder signal came from metals.

That’s not panic… that’s a market repricing scarcity while equities still bid growth.

Defense followed.

Rheinmetall, Lockheed, and Northrop hit fresh highs as traders priced a world where intervention isn’t hypothetical.

Meanwhile, Nvidia and AMD rallied into CES, then faded.

This wasn’t fear buying.

It was selective aggression at new prices.

Investor Signal

The market is comfortable with risk, but only when it can see the payoff path.

Rebuilding trades, metals, defense, and infrastructure cleared easily; vague growth stories stalled.

If copper keeps leading while crude lags, expect capital to keep favoring things that take time to replace over things that promise speed.

PREMIER FEATURE

The Three Key Men Who Could Ignite The Biggest Gold Bull Run in Over 50 Years

According to Dr. David Eifrig, a former Goldman Sachs VP, three powerful men inside the highest levels of the U.S. government are advancing a strange plan that could impact your wealth in a MAJOR way. And in the process, it could spark the biggest gold frenzy in over half a century.

Dr. Eifrig urges you to move your money to his No. 1 gold stock immediately (1,000% upside potential.) He warns if you wait a second longer, you could get priced out.

METALS WATCH

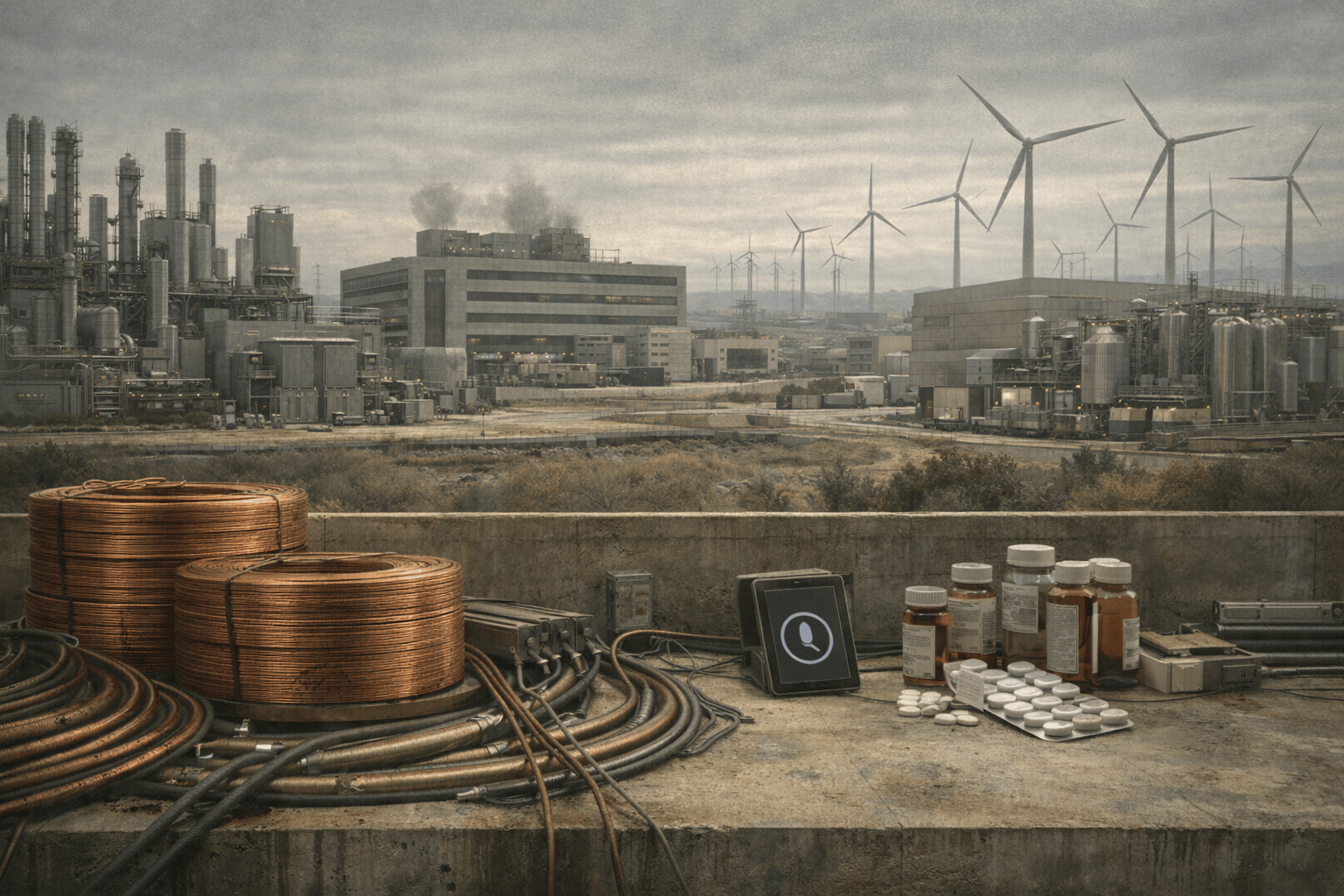

Copper Reprices as AI’s Hardest Infrastructure Constraint

Copper didn’t break records quietly, it forced the market’s hand.

Prices above $13,000 aren’t about cyclical recovery or China restocking.

They’re about collision.

Data centers, grid expansion, EV wiring, and electrification are all drawing from the same finite pool, while spare capacity is already exhausted.

Disruptions at Grasberg and Mantoverde didn’t create the move, they exposed how little slack was left.

That’s what the tape is acknowledging.

Copper is no longer clearing as an industrial input.

It’s clearing as prerequisite infrastructure.

Venezuela noise, tariff speculation, and stockpiling behavior are accelerants, not drivers.

This is the tension setting up 2026.

Demand is visible and near-term.

Supply is political, slow, and capital-heavy.

The market isn’t pricing scarcity today, it’s pricing what it takes to prevent it tomorrow.

Investor Signal

Copper is trading like a gatekeeper, not a commodity.

Price action suggests the market is underwriting future supply, not current balance.

When inputs reprice before output responds, volatility becomes structural, not tactical.

TECH WATCH

AI’s Second Wave Hits the Semiconductor Bottlenecks

The AI trade just changed lanes, and the tape followed.

Chip equipment names aren’t rallying on Nvidia headlines or CES theatrics alone.

As data-center builds accelerate, the constraint isn’t demand, it’s tools, timing, and throughput.

Applied, Lam, KLA, ASML.

These aren’t sympathy trades.

They’re choke points.

Long lead times are forcing advance orders.

Double- and triple-booking is creeping back in.

Process control, lithography, and metrology are where ambition meets physics.

CES may provide the soundbite, but the real driver is the realization that scaling AI creates new bottlenecks faster than it clears old ones.

This is the familiar phase of every infrastructure cycle.

The obvious winners get crowded.

Then capital rotates toward what breaks next.

Semicap sits right there, essential, scarce, and slow to expand.

The risk isn’t demand fading.

It’s enthusiasm racing ahead of deliverable timelines.

The tape isn’t chasing stories anymore.

It’s paying for friction.

Investor Signal

AI exposure is widening, not peaking.

The market is rewarding picks-and-shovels tied to constrained capacity.

When bottlenecks outperform platforms, it signals belief in duration, with patience wearing thinner.

FROM OUR PARTNERS

7 Buy-and-Hold Stocks You’ll Wish You’d Found Sooner

Not every great buy-and-hold stock is a household name. Our 7 Stocks to Buy and Hold Forever report includes under-the-radar leaders quietly dominating their niches - alongside global brands with unmatched staying power.

Together, they form a portfolio core that can produce rising income and steady growth year after year.

AI WATCH

Amazon Pulls Alexa Onto The Web To Reset AI Stakes

Alexa just stepped out of the kitchen.

This isn’t a feature update or a late reaction to ChatGPT hype.

Moving Alexa into the browser shifts it from a device-bound assistant into a daily surface, where habits form, prompts repeat, and retention can actually be measured.

Voice was distribution.

Web is engagement.

That’s what the market is starting to price.

A browser-based Alexa puts Amazon into the same competitive frame as ChatGPT, Gemini, and Claude, while giving it something those rivals don’t control at scale.

It also shortens iteration cycles.

No hardware gate.

No app friction.

Just usage data, fast feedback, and sharper signals on what sticks.

This is a platform repositioning, not a launch moment.

The question isn’t whether Alexa can answer better.

It’s whether Amazon can convert reach into differentiated utility, and then route that utility into transactions, services, and stickier Prime adjacency.

If Alexa lives where users already are, the economics change.

Investor Signal

The market is watching for engagement, not demos.

Browser access raises the bar on retention and monetization clarity.

Distribution was never the issue, conversion now decides whether this becomes an asset or a cost center.

HEALTHCARE WATCH

Novo Turns GLP-1 Into A Convenience And Access War

Novo just reframed the fight.

The first GLP-1 pill is here and it isn’t about efficacy bragging rights or a marginal upgrade to injections.

It’s about removing the biggest friction in the category.

A daily oral option, priced hundreds below weekly shots and placed across 70,000 pharmacies, shifts the market from scarcity to scale.

That’s the move the tape is watching.

Oral delivery widens the funnel, cash pay, retail pharmacy, telehealth, direct channels, all at once.

It creates a new adoption curve driven by convenience, persistence, and distribution economics rather than physician bottlenecks.

Novo isn’t defending share here.

It’s expanding the addressable universe before competitors can fully respond.

That matters heading into Lilly’s pill decisions.

Once pills reset expectations, injections stop being the default.

The category tilts toward whoever controls channels, pricing flexibility, and patient stickiness, not just clinical headlines.

This isn’t a product launch.

It’s a format shift that forces the market to reprice the entire GLP-1 stack.

Investor Signal

The market is rewarding reach, not just results.

Oral GLP-1s raise the bar on convenience and distribution economics.

As access widens, competition intensifies, and category leadership becomes a question of scale, not science.

FROM OUR PARTNERS

America’s Top Billionaires Quietly Backed This Startup

When billionaires like Jeff Bezos and Bill Gates back an emerging technology, it’s worth paying attention.

That’s exactly what’s happening with a little-known company founded by an ex-Google visionary. Alexander Green calls it “one of the most overlooked opportunities in AI right now” — and he’s even an investor himself.

He’s now sharing the full story, including why early investors are watching closely and why he believes widespread adoption could be just one announcement away.

GEOPOLITICS WATCH

Europe’s Wind Build Runs Into China’s Industrial Reach

Europe wants turbines.

Politics wants leverage.

Wind is supposed to be the clean part of the energy transition.

Chinese wind OEMs are pushing into Europe just as local manufacturers are stretched, margins are thin, and decarbonization deadlines are closing in.

Prices are attractive.

Control is not.

Energy equipment is no longer neutral hardware.

Embedded chips, remote updates, and software control turn procurement into strategic screening.

Governments are increasingly willing to treat turbines like telecom gear or semiconductors, assets that carry geopolitical risk alongside kilowatts.

That reframes the buildout.

Capacity can still grow, but vendor access, localization demands, and margin structures will be shaped by policy as much as cost curves.

Chinese suppliers bring scale.

Europe brings regulation.

The collision slows decisions and reshapes who captures value.

Renewables aren’t hitting a demand wall.

They’re running into a sovereignty filter.

Investor Signal

The wind rollout continues, but the rules are changing.

Political scrutiny will influence vendor selection and economics across the stack.

As security overlays pricing, volatility shifts from demand to margins and access.

CLOSING LENS

The common thread isn’t growth, it’s constraint.

Copper’s surge, semicap strength into CES, Amazon’s Alexa repositioning, Novo’s GLP-1 rollout, and Europe’s wind standoff all reflect the same market logic: progress now runs through bottlenecks.

Capital is flowing toward assets that enable scale, ration access, or control distribution.

Demand is visible everywhere.

Supply, permission, and timing are not.

That gap is where pricing power is forming.

This cycle isn’t ending, but it is narrowing.

Infrastructure, whether physical, digital, or political, is no longer a background variable.

It’s the gatekeeper.