Markets aren’t calm… they’re front-running a world that doesn’t exist yet. The question is what reality does to that trade.

MARKET PULSE

Markets Split Between Long-Horizon Confidence and Near-Term Strain

Markets opened like they knew two timelines were colliding.

A tape suspended between trillion-dollar future bets and a real economy starting to exhale in shorter breaths.

Big Tech and Big Pharma are building for the decade, not the quarter.

India-scale AI fortresses, GLP-1 production grids, quantum systems engineered like public infrastructure.

Money is rushing into ambition at the exact moment real-world demand is cooling… a divergence that forces the market to price tomorrow’s dominance against today’s drag.

Manufacturers slowing orders, commodities choking on politically stranded supply, and a billion-barrel oil backlog all say the same thing:

Physical throughput is slipping while sovereign and corporate capex keeps accelerating.

Tariff anxiety is freezing industrial plans, and a 10-year pinned near 4.2% signals a market bracing for tighter liquidity even as capital spending goes vertical.

Oracle softens under its AI debt load, GameStop cracks on fading demand, while Blue Owl rallies on capital stability.

Growth fear and capital discipline trading in the same breath.

A clean tell that traders want breadth… but don’t trust the foundation beneath it.

Investor Signal

The market isn’t trading growth or slowdown.

It’s trading the gap between what corporations are building and what the real economy is absorbing.

The next move hinges on which story blinks first.

PREMIER FEATURE

The Crypto Forecast I Wasn’t Supposed to Share

For years, I’ve interviewed billionaire founders, hedge fund managers, and early Bitcoin insiders.

But recently, behind closed doors, they all started preparing for the same thing — an event they believe could trigger the biggest wealth transfer in crypto history.

After 600 insider interviews and 17 million podcast downloads, I finally connected the dots and revealed everything in my new book Crypto Revolution — now FREE.

Inside, you’ll see:

• Why insiders believe Bitcoin could reach $300,000

• The hidden accumulation pattern forming right now

• And the “point of no return” most people won’t see coming

Once this goes mainstream, the early edge disappears.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

ENERGY WATCH

A Sanctions Squeeze That’s Freezing the Real Clearing Price

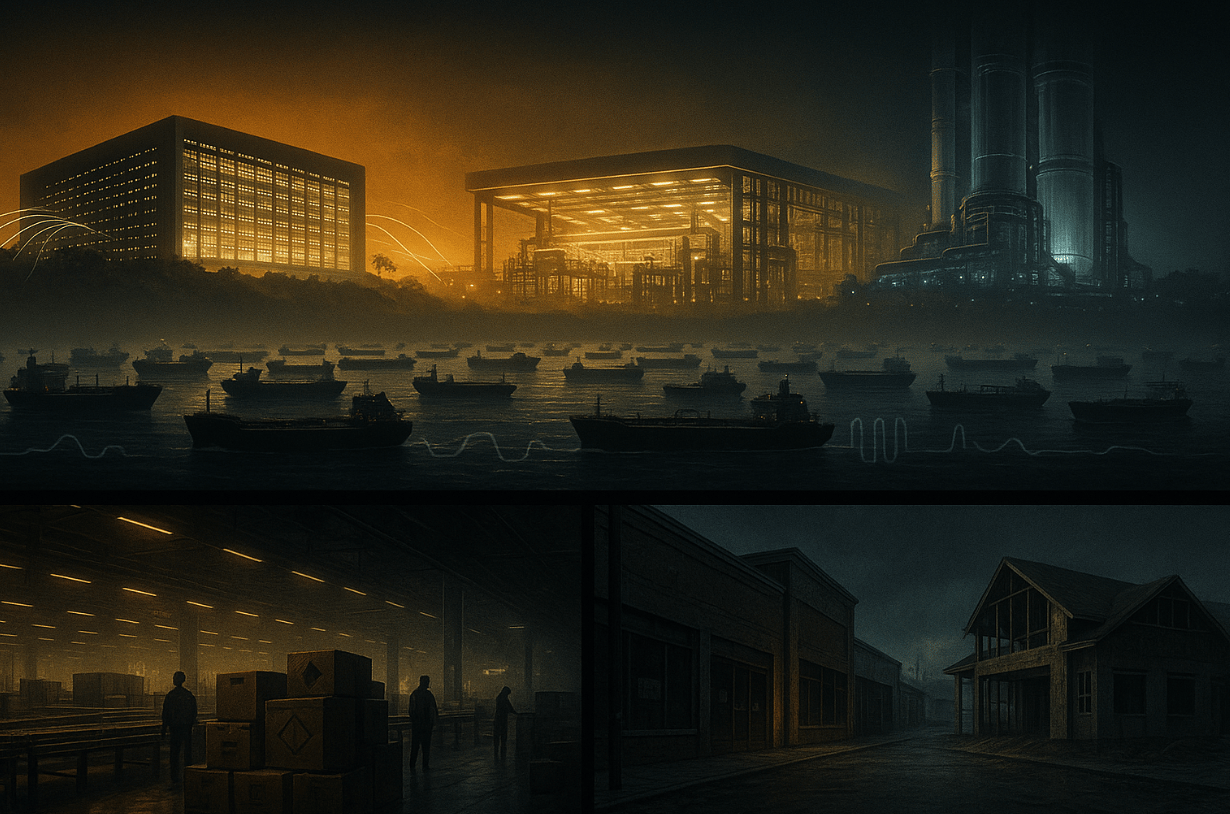

The tape looks tranquil, but the ocean isn’t.

Nearly 1.4 billion barrels now sit on ships: crude that exists, flows, and yet can’t legally land.

Sanctions have turned Russian, Iranian, and Venezuelan output into stranded inventory, creating a backlog driven less by soft demand than by geopolitical blockage.

The market isn’t short of oil; it’s short of legal pathways.

Underneath the apparent stability, the tape is quietly tightening.

China’s accelerated stockpiling and the shadow fleet’s slow rerouting are absorbing barrels that would have forced a decisive break in pricing.

What looks like balance is political bottlenecking, not economic equilibrium.

Brent’s stability in the $61–$66 range reflects a market insulated from the very barrels that should be clearing it.

And that’s where the real tension sits.

This floating crude is latent shock, warehoused volatility waiting for a mechanism.

If even a slice re-enters the system through new intermediaries, ship-to-ship transfers, or relaxed enforcement, the move won’t be gradual.

It will be a downside reset triggered by barrels the market pretended not to see.

Investor Signal

This isn’t a calm market; it’s a compressed one.

The curve now hinges on whether stranded supply actually stays stranded.

If those barrels start moving again, producers tied to clean, transparent flows could rerate higher.

Benchmarks, meanwhile, would face pressure because their support has come from political blockage, not true demand.

TARIFF WATCH

Tariff Uncertainty Turns Demand Into a Moving Target

The slowdown didn’t start with weaker customers.

It started with companies planning around a policy shock they can’t time.

As the Supreme Court weighs the administration’s reciprocal tariffs, manufacturers have pulled orders to the lowest level since May.

Not because demand collapsed, but because uncertainty is now the dominant cost driver.

The market is looking at a demand curve rewritten by politics, not prices.

But below the headlines, the market is bracing.

Firms are treating tariffs as a persistent overhead, recalibrating procurement and delaying throughput to avoid being caught on the wrong side of a ruling.

It’s no longer a question of price pass-through; it’s capital allocation frozen by ambiguity.

Supply chains aren’t soft, they’re defensive.

And that’s where the signal lands.

If the levies unwind, the release of delayed orders could be sharp.

Until then, manufacturers operate as if volatility is the baseline, keeping activity muted even as global peers hold steadier.

Investor Signal

Markets are trading policy opacity, not true demand.

The ruling’s direction will dictate whether today’s compression becomes a snapback or an extended drag, tilting advantage toward firms structured for low-visibility operating conditions.

FROM OUR PARTNERS

He bought Amazon when it was trading around $30...

Netflix when it was around $2...

And Apple when it was less than $1 a share...

And now...

Market millionaire Alexander Green says he's discovered the "Perfect Stock" that could be the key to your retirement.

AI WATCH

Amazon’s $35 Billion Bet Redraws the Global AI Map

India just became the most contested piece of real estate in the global AI power grid.

Amazon’s $35 billion commitment wasn’t pitched as expansion capital, it read like an attempt to lock in compute dominance where the next billion AI users will actually emerge.

For markets, the signal is cleaner than the headline:

Hyperscalers aren’t spreading globally for growth; they’re fortifying sovereign footholds before the U.S.–China tech split hardens into permanent geography.

Amazon is matching Microsoft’s $17.5 billion push because India offers something no Western region can.

That’s why this matters far beyond cloud revenue.

AI competition is shifting away from model releases and toward control of physical compute in population-dense centers of adoption.

Whoever builds India’s AI backbone owns the next decade of enterprise demand, consumer digital behavior, and labor-productivity leverage.

The market is quietly pricing that shift, not as a capex race, but as the beginning of a geopolitical capacity war.

INVESTOR SIGNAL

This move tells you where the next real pricing power sits: in regions where AI demand will scale faster than regulation can.

Watch hyperscaler capex patterns.

Geography, not model performance, is starting to dictate who wins the next leg of AI growth.

HEALTH WATCH

Pfizer’s China Deal and Lilly’s U.S. Build Signal a New Obesity Race

The GLP-1 race just crossed the line from pharma innovation into industrial strategy.

The next leg of the obesity boom will be won by whoever controls manufacturing capacity, not molecule differentiation.

Pfizer is buying time after failed internal bets by tapping Chinese scale to keep a pipeline alive.

Lilly is locking down domestic API output before tariffs, supply risk, and political scrutiny can reshape the economics of obesity care.

Markets see this shift clearly:

GLP-1s are becoming national assets, priced through supply resilience and geopolitical insulation rather than just clinical data.

That’s why today’s tape didn’t trade efficacy, it traded control.

Capacity, onshoring incentives, and tariff-proof distribution now define where the profit pool settles in a market expected to hit $100 billion.

Discovery wins headlines.

Manufacturing wins margins.

Deeper Read

GLP-1s have outgrown pharma economics and migrated into industrial strategy, where capacity, not chemistry, decides winners.

Every new plant or licensing deal now signals supply-chain fortification, not scientific ambition.

The market is recalibrating accordingly.

Dominance goes to whoever can manufacture at scale without tripping over tariffs, politics, or foreign dependency.

Investor Signal

Follow where capacity concentrates.

The market is rewarding firms securing protected, scalable output, not those with the most promising molecules.

The winners in GLP-1s will be the companies that own the production throttle as policy pressure and demand both accelerate.

FROM OUR PARTNERS

90% of AI Runs Through This Company

The biggest AI wins often come from companies you don’t hear about every day.

Case in point:

The database provider now embedded into the big three cloud platforms - with access to 90% of the market.

You’ll find the name and ticker of this newly-minted giant in our 10 Best AI Stocks to Own in 2026 report, along with:

• The chip giant holding 80% of the AI data center market.

• A plucky challenger with 28% revenue growth forecasts.

• A multi-cloud operator with high-end analyst targets near $440.

Plus 6 other AI stocks set to take off.

TECH WATCH

IBM Turns Quantum Into a Long-Horizon Infrastructure Play

Quantum isn’t breaking out, it’s maturing.

And IBM is the first major player acting like the next compute era won’t be built in startup labs chasing the next benchmark, but in diversified incumbents with the balance sheet to survive a decade-long build.

IBM’s latest push reframes quantum as infrastructure, not a moonshot.

This is a bet on continuity… on backwards-compatibility, ecosystem durability, and enterprise-grade engineering, at a time when the pure-plays are trading on volatility, not viability.

The company is using its existing cloud, consulting, and software scaffolding to pull quantum out of the hype cycle and into the realm of long-cycle industrial R&D.

The market signal isn’t about qubit counts or shiny demos.

It’s that IBM is structurally positioned to absorb the slow grind toward fault tolerance while others burn capital hoping for a shortcut.

If quantum becomes core compute the winners will be the operators that can fund the waiting game.

Investor Signal

Investors aren’t pricing quantum breakthroughs; they’re pricing who can outlast the timeline.

IBM’s edge isn’t speed, it’s survivability.

And in a future where quantum becomes foundational infrastructure, durability may be the only moat that matters.

CLOSING LENS

Future Outruns Present

Across sectors, capital is moving faster than demand can validate it.

AI capacity is being built years ahead of monetization, drug manufacturing is scaling before approvals, and quantum is being funded like infrastructure despite timelines measured in decades.

Meanwhile, physical markets, from freight to oil to industrial inputs, are flashing early signs of strain as policy uncertainty and excess inventory interrupt throughput.

This is the new market tension: ambition at the top, absorption at the bottom.

The next move depends on which timeline cracks first.