Investors hedge with record gold and $7.7T in cash as equities hover near highs. Powell’s post-cut remarks tomorrow could tip the balance.

MARKET PULSE

Gold’s New Highs Signal Caution, Not Paranoia

Gold just cleared $3,700 an ounce, another record.

That’s not just a shiny headline, it’s a signal. Investors are bracing for more Fed cuts while still hedging against sticky inflation.

Why the rush into gold? Central banks are stocking up, the dollar is softening, and geopolitical friction keeps safe havens in demand. In short: when big money wants insurance, it shows up in gold first.

The S&P 500 and Nasdaq have been living at record levels as well, but they’re taking a breather.

Energy is carrying the load on higher crude, while banks and industrials are dragging their feet. Yields are parked around 4.1%, and the dollar is slipping, the kind of setup that can be interpreted as investors quietly shifting weight toward safety rather than chasing new highs.

Fed in the Spotlight; More Rate Cuts on Deck?

The Fed trimmed rates by a quarter point last week, down to 4.00–4.25%. The message was crafted around the cooling labor market, but inflation hasn’t fully bowed out. Now all eyes are on Jerome Powell’s remarks this week. The question for investors isn’t what the Fed just did, it’s whether Powell hints that more cuts are already in the pipeline ahead of October.

Investor signal: Cuts are a double-edged sword, they can juice risk assets in the short run, but if inflation proves stubborn, more easing risks spooking bond markets and weakening confidence.

Policy noise in Washington is keeping markets on edge. Trump’s visa proposal rattled tech, while Congress is staring down yet another shutdown deadline with no deal in sight. Layer on stubborn inflation and real rates that are still positive even after the Fed’s cut, and you’ve got a backdrop that makes investors more selective about where they put money, rather than charging in blindly.

Investor Takeaway

The rally isn’t broken, but it’s not cruising either. Gold’s surge, sticky yields, and political crosscurrents show investors are still paying for insurance. If inflation or jobs data land hotter than expected, the hawks get louder and money rotates back into hedges. If Powell sounds dovish this week, risk assets get another tailwind. In short: the next move depends less on momentum and more on whether the Fed’s story lines up with reality.

PREMIER FEATURE

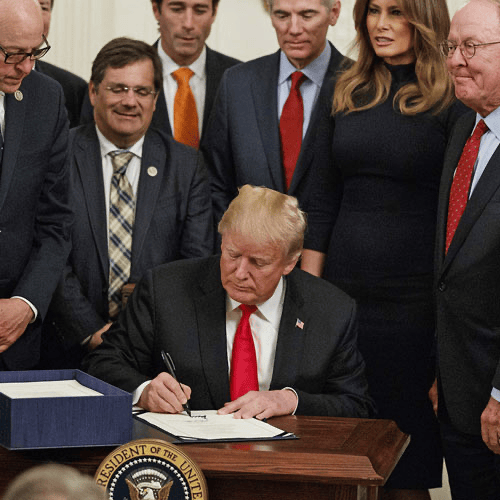

Breaking News: Trump Unlocks $21 Trillion for Everyday Americans?

President Trump just signed a new law…

That could unlock $21 trillion for everyday folks like you…

And potentially impact every checking and savings account in America.

Click here now because Chase, Bank of America, Citigroup, Wells Fargo, and U.S. Bancorp are already preparing for what could be the biggest change to our financial system in 54 years.

IMMIGRATION COSTS

Trump’s Visa Plan Puts Tech Talent in the Crosshairs

The Trump administration is floating a new H-1B visa plan: a $100,000 charge per visa with the tab picked up by sponsoring companies or foreign governments. With about 85,000 of these visas issued each year, mostly to tech and finance, the numbers add up fast.

For Silicon Valley and Wall Street, that fee would fundamentally change the cost of hiring foreign engineers, coders, and quants. Industry groups are warning it could accelerate offshoring or reroute talent to Canada and Europe. Some banks are already modeling a “brain drain” scenario where relocating entire teams abroad becomes cheaper than paying the new levy.

Investor Signal

Higher labor costs could squeeze margins, especially for startups and mid-cap growth firms that don’t have balance sheets to swallow a six-figure head tax. Mega-caps like Google or JPMorgan can absorb it, but smaller players may shift jobs overseas or rethink hiring altogether. The risk here isn’t just cost; it’s the possibility of America ceding slices of the global talent pool to competitors.

BUFFETT EXITS

Berkshire Sells Out of BYD

Warren Buffett and Charlie Munger have officially closed the book on their long-time bet in China’s BYD. Berkshire Hathaway disclosed it fully exited the automaker, a stake first taken in 2008 that ballooned into billions at its peak.

The retreat wasn’t sudden. Berkshire has been trimming for years, and the final sale reflects a mix of factors: BYD’s rich valuation, intensifying competition at home, and the geopolitical headwinds that now hang over Chinese firms.

BYD is still an EV powerhouse — pushing into Europe and Latin America with strong market share — but U.S.–China trade friction and tariffs are making its future less straightforward.

Investor Signal

Buffett’s exit is more than just portfolio housekeeping. It’s a reminder that even the strongest long-term winners aren’t insulated from policy and geopolitical risk. For investors, the question now shifts to whether Tesla, Rivian, and U.S. automakers can consolidate share as Chinese EVs face growing barriers.

FROM OUR PARTNERS

40% Crash Coming?

Former Goldman Sachs exec and now the CEO of MarketWise (parent company of Stansberry, Chaikin Analytics, and Altimetry) just issued what he calls the most urgent warning of his career.

He thinks your hard-earned savings could be on the verge of a 40% collapse. He lays out all the proof... plus a detailed plan for exactly what to do. (And it doesn't require shorting... options... or perfectly "timing the market.").

APPLE INTEGRATES

iPhone Chips Go Fully In-House

Apple just pulled the last lever on chip independence. The iPhone now runs entirely on silicon designed in Cupertino with the CPU, GPU, and AI accelerators all built in-house. No more reliance on third-party suppliers for the core brains of the device.

The priority is AI. Apple is promising smoother on-device intelligence that leans less on the cloud, giving users faster, more private features while keeping them locked deeper into the ecosystem.

The ripple effects run wide. Suppliers like Broadcom and Qualcomm lose ground as Apple narrows their slice of the hardware pie. Taiwan Semiconductor, however, stays essential as the company’s manufacturing partner for advanced nodes.

Investor Signal

Apple’s bet is that vertical integration plus AI-first design will stretch the iPhone upgrade cycle and funnel users into services tied to the hardware.For investors, the upside hinges on whether Apple can turn chip control into recurring revenue — and for suppliers, the squeeze is already real.

OZEMPIC’S REBOUND

Novo Nordisk Tries to Regain Momentum

Novo Nordisk, once the runaway leader in GLP-1 weight-loss drugs, has spent the past year on its back foot. Eli Lilly’s Zepbound grabbed market share, compounded knockoffs undercut sales, and Novo’s stock slid more than 50%.

Now there are signs of a turnaround. New trial data show Novo’s oral Wegovy pill matches the injection’s weight-loss results with fewer side effects. The FDA is also tightening oversight on compounders, a move that could wipe out one of Novo’s biggest headwinds.

Shares have rallied, though the company still trades at just 15x forward earnings versus Lilly’s 27x.

New CEO Mike Doustdar is pressing the accelerator: cutting 11% of staff, launching 130+ lawsuits against unauthorized sellers, and pushing forward a broader pipeline that includes Alzheimer’s trials and combo drugs like CagriSema, which has posted >20% weight-loss in studies.

Investor Signal

Novo may not reclaim the crown, but second place in a $100B market is still an empire. If the Wegovy pill lands cleanly and regulators follow through on compounders, Novo can close some of the gap with Lilly. For investors, the story is less about who wins outright and more about how big the pie gets — and Novo still has plenty of room at the table.

CASH PILE

Investors Keep Hoarding Cash at Record Levels

Markets are near highs, the Fed has begun cutting, and yet investors are piling into cash like never before.

Money-market funds hit a record $7.7 trillion last week, with $60B flowing in during just the first four days of September. That’s more than double where balances sat before the Fed’s hiking cycle began in 2022.

The math explains the loyalty: money funds still yield ~4.1%, compared to just 0.6% for an average savings account. For households and institutions alike, cash is doing double duty, a cushion for downside risk and a call option on the next dip. As Peter Crane of Crane Data put it: “It is indeed a wall of cash, because it ain’t going anywhere.”

Allocations remain well above pre-hike norms. While Société Générale urged clients to slash their cash in half, most investors are in no rush. With equities trading rich, many prefer to wait until valuations cool.

Investor Signal

This “cash mountain” is both ballast and powder. It dampens near-term buying power as money sits idle, but if markets wobble, that $7.7T can flip into a powerful bid. The likely path? More inflows toward the $8T milestone — unless earnings reset valuations and finally tempt sidelined cash back into risk.

CLOSING LENS

Monday’s session was a tug-of-war. Gold and cash showed investors hedging for safety, even as equities hovered near peaks.

Policy noise — from Trump’s visa plan to Apple’s chip play — kept tech in focus, while Buffett’s exit and Novo’s rebound reminded markets that strategy shifts matter as much as headlines.

The next inflection comes tomorrow, when Powell speaks for the first time since the Fed’s cut. The question isn’t just whether he signals more easing, it’s whether he can calm markets that are hedging against the risk that cuts reignite inflation. Bonds will be listening closely, and so will everyone else.