Why stability this year required discipline, filtration, and real constraint.

The Cost of Continuity

Markets did not collapse in 2025.

They did something more difficult.

They stayed upright.

At a glance, that sounds unremarkable. Indexes held near highs. Liquidity never vanished. The system functioned.

But continuity this year was not free flowing or automatic. It was earned through constraint, filtration, and selective movement.

Capital advanced, but only where clearance existed. Risk stayed on, but only where justification remained intact.

This was not a year of acceleration. It was a year of control.

And that distinction matters heading into what comes next.

PREMIER FEATURE

7 Income Machines Built to Make You Rich

The 7 Stocks to Buy and Hold Forever aren’t just plays for the next quarter - they’re built to deliver for decades.

These are blue-chip companies with fortress balance sheets, elite dividend track records, and the staying power to outperform in bull and bear markets alike.

Some are Dividend Kings, others are on the path there, and all are proven wealth compounding machines.

Continuity Became the Objective

Early in the year, markets flirted with familiar instincts.

Momentum trades resurfaced. Narrative cycles spun up quickly. The reflex to chase growth returned in pockets. There were moments when it felt like the old playbook might reassert itself.

But as the year progressed, a quieter reality took hold. The objective was no longer to outrun risk. It was to remain functional inside it.

What defined 2025 was not optimism or fear. It was discipline.

Capital allocation became more deliberate. Participation narrowed. Advancement required structure.

The market did not reject risk. It rationed it. The cost of staying invested rose, not in price, but in standards.

That is how continuity was maintained.

Permission Replaced Momentum

One of the clearest shifts this year was behavioral.

Markets stopped rewarding speed for its own sake. They began rewarding clearance.

Stocks did not move simply because they could. They moved because conditions allowed them to.

Balance sheets mattered again. Policy alignment mattered. Demand durability mattered. The difference between narrative enthusiasm and operational permission widened.

This was visible across sectors. Rallies were narrower. Breakouts were conditional. Pullbacks were tolerated rather than feared. The tape learned to pause without breaking.

Momentum still existed, but it required validation. The era of frictionless advance faded. What replaced it was a market that asked permission before moving forward.

FROM OUR PARTNERS

The AI Stock 6 Tech Giants Are Buying

Twenty years ago, $7,000 spread across the original Magnificent Seven could be worth $1.18 million today.

Now, the famous investor who called 4 of the best performing stocks of the last 20 years says:

And one of them recently pulled off something insane...

Apple, Nvidia, Google, Intel, Samsung and AMD have ALL bought shares of this company.

The same analyst who found Nvidia at $1.10 (split-adjusted) is now revealing the details — including all seven stocks he believes could lead the next AI wave.

Liquidity Was Present, but Not Indiscriminate

One of the more misunderstood aspects of 2025 was liquidity itself.

It never disappeared. Funding markets functioned. Credit stayed available. Capital moved. But liquidity became selective rather than expansive. It flowed toward clarity, not curiosity.

Access depended on credibility. Issuers with stable cash flows, operational visibility, and policy alignment found receptive markets.

Those without faced wider spreads, slower demand, or outright hesitation.

This was not a tightening cycle in the traditional sense. It was a filtration cycle. Liquidity was present, but it demanded structure in return.

That dynamic reinforced discipline across asset classes and quietly underpinned the year’s stability.

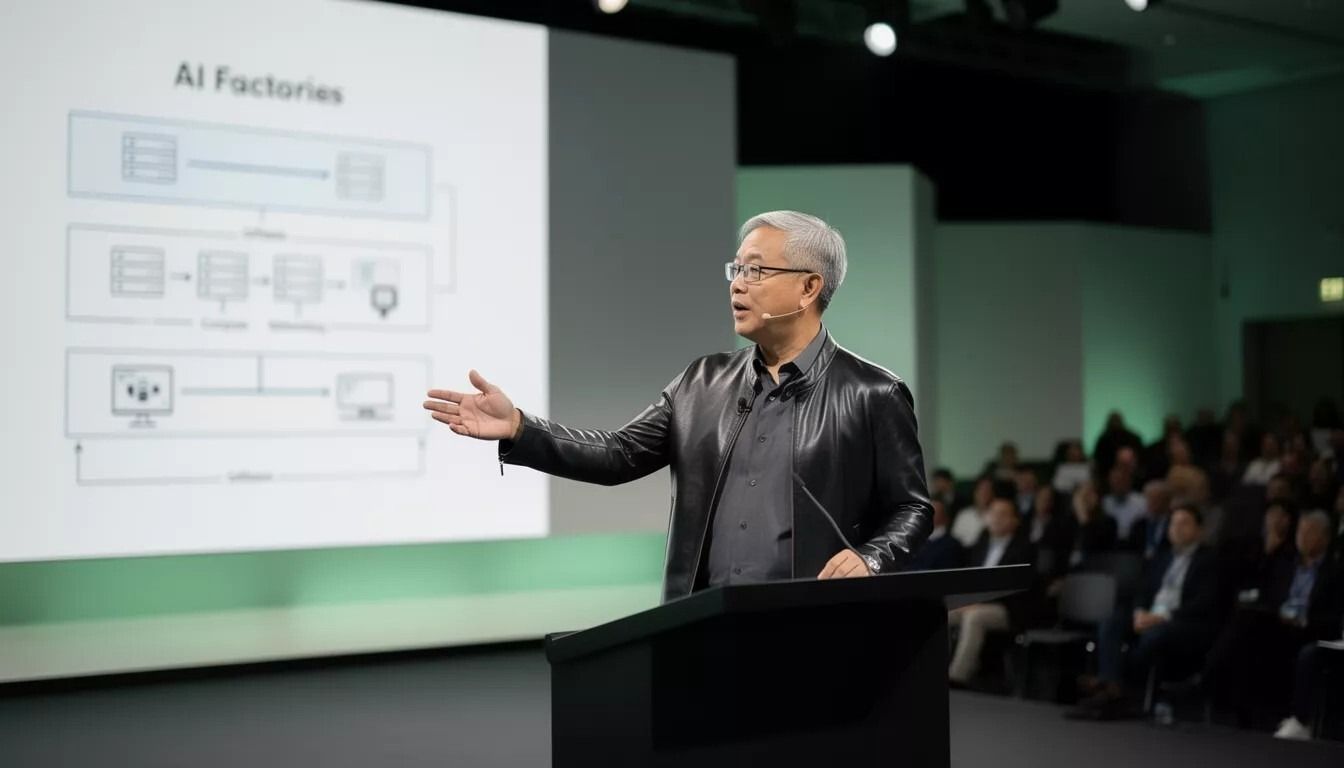

AI Stopped Being a Story and Became Infrastructure

Nowhere was this clearer than in artificial intelligence.

Early enthusiasm framed AI as a limitless growth engine. By year end, that framing no longer held. AI was still powerful. Still transformative. But it was no longer abstract.

It became physical.

Compute capacity, power availability, cooling, grid access, capital intensity, customer concentration, and monetization timelines all moved to the foreground.

The conversation shifted from what AI could do to what it required.

That shift did not kill the trade. It matured it.

Companies that could demonstrate operational readiness continued to attract capital.

Those that relied on story alone faced volatility. Infrastructure, not imagination, became the gating factor.

AI remained a defining force in 2025. But it did so as a systems problem, not a narrative one.

Policy Turned into Operating Environment

Another quiet but powerful change unfolded this year.

Policy stopped being episodic risk and became ambient friction.

Trade rules, industrial policy, export controls, tariff regimes, regulatory oversight, and government involvement in strategic sectors moved from the periphery into the operating environment. Markets adjusted accordingly.

This did not produce panic. It produced calibration.

Companies with diversified supply chains, domestic capacity, or policy alignment found favor.

Those with concentrated exposure learned to price in uncertainty. The market stopped assuming policy noise would pass quickly. It began treating it as structural.

That reframing reinforced selectivity. Winners were not those best positioned for growth in theory, but those best positioned to function within constraint.

FROM OUR PARTNERS

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

The world's wealthiest individuals are making huge moves with their money.

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

Selectivity Replaced Abundance

If there was a defining visual for 2025, it was not a broad rally. It was a narrowing corridor.

Leadership concentrated. Breadth mattered, but it was intentional rather than expansive. Capital flowed toward companies that could prove resilience rather than promise upside.

Defensive characteristics reasserted relevance without crowding out growth.

This was not a retreat. It was a filter.

The market allowed advancement, but not everywhere at once. It rewarded clarity over optionality. Execution over ambition. Balance over bravado.

Continuity required discrimination.

What Did Not Matter as Much as It Felt Like It Did

In hindsight, much of the daily noise that dominated attention this year proved less consequential than it appeared in real time.

Geopolitical headlines flared without destabilizing the system.

Volatility spikes faded quickly.

Data surprises adjusted expectations without breaking trend.

Political drama rarely translated into sustained dislocation.

That does not mean risks disappeared. It means markets learned how to absorb them.

The system’s resilience was not built on denial. It was built on adaptation. By the end of the year, investors had internalized uncertainty rather than reacting to it.

FROM OUR PARTNERS

The Setup Behind the Biggest Memecoin Runs

The largest memecoin gains don’t come from luck.

They follow a repeatable setup — one that appears before prices explode and headlines follow.

In past cycles, this same pattern preceded moves of 3,000%+, 4,900%, even 8,000%. Most investors only noticed after the run was already underway.

That setup is forming again.

A new memecoin has just triggered the full signal stack — and early buyers are already positioning.

The Hidden Trade of 2025

The most important trade this year was not directional.

It was structural.

Markets priced continuity.

They priced the ability of institutions, companies, and systems to function under pressure. They priced endurance rather than expansion. They priced control.

This explains why extremes struggled. Why valuation discipline reasserted itself. Why some narratives stalled while quieter compounders advanced.

It also explains why this market never felt euphoric, even near highs. Continuity came with a cost, and participants knew it.

What Carries Forward

As the calendar turns, markets are not resetting.

They are carrying forward a posture.

The posture is measured. The posture is selective. The posture assumes friction rather than ignores it.

This does not preclude opportunity. It reframes it.

Advancement in 2026 will still exist, but it will likely continue to demand permission.

Systems will need to support growth. Policy will remain part of the equation. Infrastructure constraints will matter.

Leadership will rotate, but breadth will remain earned.

The market enters the new year standing, not because conditions were easy, but because behavior adapted.

Closing Lens

Continuity was not free in 2025.

It was purchased through restraint, filtration, and discipline.

Markets did not sprint. They stabilized.

They did not ignore risk. They absorbed it.

They did not expand indiscriminately. They chose carefully.

That is not a fragile outcome.

It is a durable one.

And it is the environment investors wake up into tomorrow.