📈 Reality Check: Markets Hit the Brakes

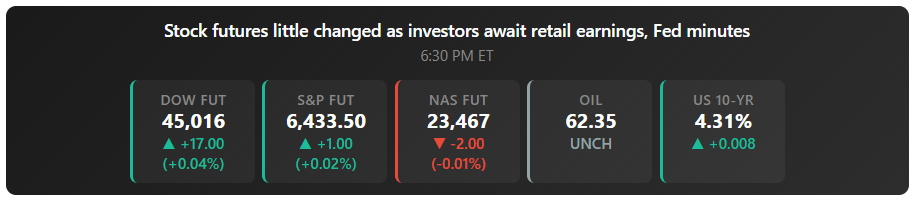

U.S. equities pulled back from record highs as cautious Fed commentary and weakness in the Magnificent 7 tech names weighed on sentiment. The Dow managed to close slightly positive, but the S&P 500 and Nasdaq drifted lower, reversing Monday's strong momentum. Treasury yields fell with the 10-year settling near 4.3% as investors recalibrated expectations around how long rates may stay elevated.

Overseas markets reflected mixed sentiment — European equities softened as energy names pulled back, while Asian trading showed divergence with Tokyo stronger but Hong Kong weighed down by tech weakness. The market's tone suggests investors are digesting recent gains while parsing Fed signals for clues on the pace of future policy shifts. When tech leadership wavers and yields compress, it often signals a more cautious positioning ahead of key economic data.

End the Chaos. Start Engineering Control.

The average trader lives in chaos.

Impulse buys. Revenge meme trades. Blind hope.

They enter on gut feelings.

They exit on fear.

And they’re shocked when the results look more like roulette than trading.

The top 10% of traders operate differently.

They don’t guess… they engineer.

They use confluence: layering signals, indicators, and structure until the trade is undeniable.

Managing risk like scientists.

Trading less… but usually earning more.

That’s the exact framework inside The Confluence Code.

It’s the difference between chaos and control.

Between gambling and professionalism.

Between being wiped out… and being consistent.

(Even if it boring “boring” and wont get you a bunch of Reddit or X clout)

For less than the cost of a bad trade, you can stop rolling the dice and start trading with conviction.

Tactical Edge

Intel's $2B SoftBank Lifeline Sparks Dot-Com Déjà Vu

Intel surged after a $2 billion capital infusion from SoftBank to boost domestic AI infrastructure, fueling a rally that pushed its valuation back into dot-com era territory. The move signals a growing blend of corporate ambition and "national economic strategy" in tech — where Trump's new brand of corporate statecraft meets Silicon Valley cash flows.

Analysts argue this isn't just another funding round — it's a volume + margin story that could reshape how the market values chipmakers fighting for AI dominance. The full SoftBank deal breakdown reveals whether this aggressive pricing strategy can force competitors to recalibrate their own approaches.

Investor Takeaway: The AI funding wave is real, but Intel's rally only works if execution in foundry services and product cycles finally closes the gap with rivals. Intel's $25B rally now mirrors its dot-com peak — and Lutnick's insider perspective suggests this is more than just market exuberance.

Cybersecurity Plays

Cyber Defense Gets Its Moment Back

Palo Alto Networks beat earnings expectations and raised its outlook, reigniting confidence in the cybersecurity space after months of budget uncertainty. The money is still flowing in — especially to threat detection and zero-trust buildouts — but executives' remarks hint at a coming shakeout between companies with "real defensive moats" and those riding the security scare wave. If you want the exact phrasing and context from their guidance, read MarketWatch's earnings breakdown and analyst takes.

Reality Check: When cyber budgets expand while everything else contracts, allocators listen. But history shows spending discipline is still very much in play. Treat this as a sorting signal, not a sector-wide windfall: revenue quality, customer retention, and margin expansion usually decide who survives the next budget cycle.

Triage your cyber basket: Separate platform players with recurring revenue from "point solution" specialists; tighten stops on the latter if they can't show integration wins.

Follow the enterprise spending: If capex for cyber defense keeps rising while other IT budgets shrink, that's your signal that threat environments have fundamentally shifted.

Mind the valuation gap: Elevated multiples + crowded positioning can mean sharp corrections on any guidance disappointment.

Trade & Manufacturing Pivots

Japanese Carmakers Engineer Around Tariff Pain

Japanese automakers are tweaking engine specifications to sidestep upcoming U.S. tariffs, reclassifying models to lower import levies. It's a costly workaround that The Economist says signals these fixes are temporary in what's shaping up to be a longer-term trade realignment. For smaller players without flexible production footprints, the engineering costs provide short-term relief but highlight deeper structural vulnerabilities.

Positioning Tip: Look for automakers with diversified production footprints and flexible platforms. Exposure here can act as a leveraged play on both trade policy shifts and North American manufacturing capacity — a double tailwind if supply chain localization accelerates.

Behavioral Edge

When Reorgs Signal Panic, Not Progress

Meta re-shuffled its AI org for the second time this year, centralizing R&D to accelerate toward "superintelligent" systems. The churn reflects rising urgency amid an intensifying AI arms race — but frequent reorgs often mask deeper execution problems rather than solve them. If you want the full scope of what this latest restructuring entails, Bloomberg walks through the organizational changes and timeline pressures.

Investor Angle: Reorgs can create either synergy or distraction. Retail and pros alike struggle with the same question: when does management shuffle signal confidence versus desperation? Meta's next product cycle will reveal whether this reset boosts developer retention or fuels more talent exodus.

Private Capital Flows

The 401(k) Access That Nobody Wanted

Despite gaining broader access through 401(k) plans, private equity firms continue to underperform public markets. The brand that once drew hype for its exclusivity is now weighed down by high debt loads, slowing growth, and concerns over fees and valuation transparency. The Wall Street Journal says the "democratization" promises look more manageable behind closed doors than under quarterly public scrutiny.

Macro Watch: Another reminder that capital markets remain selective. The democratization of alternatives won't deliver if cost structures remain opaque and retail investors discover the downsides of long-cycle timing. The question is whether this signals broader trouble for alternative asset classes, or just a pricing correction after years of institutional preference.

Closing View

Why This Week Matters

Jackson Hole looms large. AI infrastructure funding, the health of housing, trade policy shifts, and asset allocation debates are colliding in one concentrated window. Narratives may swing markets short term, but fundamentals and disciplined execution remain the primary drivers of returns. The question is whether this convergence creates clarity or compounds uncertainty.

Actionable Setups to Consider

AI infrastructure positioning: If SoftBank deals signal broader funding waves, focus on infrastructure plays with pricing power; if execution stumbles, rotate toward established revenue models.

Fed policy sensitivity: A dovish tone favors growth and cyclicals; a hawkish surprise argues for defensive positioning and shorter-duration tech.

Trade policy hedges: Scale positions in companies with geographic diversification; use trailing stops on pure-play import/export names ahead of policy announcements.

Sector rotation signals: If cybersecurity budgets expand while other IT spending contracts, that's your cue that enterprise priorities have fundamentally shifted.

What Could Flip the Script

A hawkish read from Jackson Hole that pushes out rate cut expectations.

AI infrastructure deals that signal renewed demand acceleration rather than defensive positioning.

Geopolitical headlines that elevate volatility and crowd out the policy narrative.