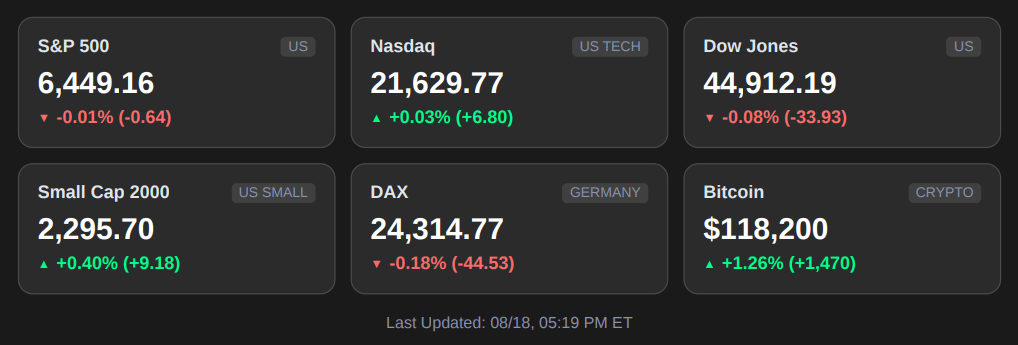

📈 Market Pulse: Markets are stuck in neutral ahead of Jackson Hole

The S&P 500 closed flat Monday as traders held fire before Powell's Friday speech. The real question isn't what he'll say about rates—it's whether markets can hold these levels if he pushes back on September cut expectations.

Meanwhile, Ukraine drama continues with Zelensky lobbying Trump directly. But here's the thing: geopolitical headlines have barely moved markets this year. Oil's flat, defense stocks aren't popping, and the VIX is still under 15. Either investors are numb to the news or they're not pricing in real escalation risk.

Three trades to consider:

If Powell sounds dovish: Tech will rip. QQQ calls expiring next week are cheap insurance.

If he stays hawkish: Small caps get crushed again. IWM puts or just rotate into dividend plays.

If geopolitics actually matter: Watch crude oil, not cable news. XLE has been dead money for months.

The setup: Markets love to fake out before Fed speeches. Don't chase the initial move—wait 30 minutes after Powell starts talking to see if institutions are actually repositioning or just algos having a seizure.

From Our Partners

Stop looking for that one “Magic” Indicator. This Blueprint Outperforms Them All.

If you’ve been in the markets for more than a week, you’ve seen it:

The endless parade of “secret” indicators and magic chart hacks.

RSI tweaks. MACD crossovers. YouTube gurus swearing by their one signal that “never fails.”

Here’s the harsh truth… every single losing trader has the same problem:

They’re addicted to chasing the next Holy Grail.

But the real veteran traders… the ones who survive bear markets, flash crashes, and manipulation… don’t ever bet everything on one tool.

They stack confirmations across multiple layers: price action, structure, momentum, context.

They filter out false signals until what’s left is undeniable.

And that’s exactly what The Confluence Code gives you.

It’s not another signal service. Not a shiny indicator. Not hype.

It’s the framework hedge funds have quietly used for decades to stay three moves ahead.

Now you can finally stop chasing gimmicks and start trading with conviction.

Tactical Edge

Wegovy Gets Another Boost

Novo Nordisk shares surged after the FDA gave Wegovy the green light for treating liver disease — a move that CNBC says added $25 billion in market cap overnight. At the same time, Novo slashed the out-of-pocket price of Ozempic to $499/month, a rare price reset that Bloomberg calls a shot across the bow of every rival in the GLP-1 space. Analysts argue the dual play — approval plus pricing — could reshape how payors, patients, and competitors approach the category. And if you want to see which tickers MarketWatch thinks could be the surprise winners, it’s worth a closer read.

Investor Takeaway: This isn’t just another FDA headline. It’s a volume + margin story that could spark a GLP-1 price war. Watch NVO against LLY this week — relative performance may be the tell on whether Novo’s bold move forces rivals to blink first.

AI Mania Monitor

Altman Warns of an AI Bubble

OpenAI chief Sam Altman is throwing a little cold water on the trade, cautioning that parts of the AI market look “well ahead of fundamentals.” The money is still flooding in—especially to data and compute build-outs—but Altman’s remarks hint at a coming shakeout between story stocks and real revenue engines. If you want the exact phrasing and context from his interview, read CNBC’s recap and pull quotes.

Reality Check: When the face of Gen-AI says “froth,” allocators listen. But history is littered with false bubble calls. Treat this as a sorting signal, not a fire drill: cash flows, customer retention, and unit economics usually decide who survives the hype cycle.

Triage your AI basket: Separate revenue-backed names from “story-first” plays; tighten stops on the latter into catalysts.

Follow the picks-and-shovels: If capex for data/compute keeps compounding, infra beneficiaries may out-earn app layers.

Mind liquidity risk: Elevated valuations + crowded positioning can mean sharp air pockets on any guidance miss.

Has AI already peaked in potential?

Data Center & Energy Pivots

Google Bets on Terawulf

Terawulf shares ripped higher after Google disclosed a stake tied to data center expansion. It’s a rare move that CNBC says signals hyperscalers are no longer content to just lease space—they’re buying into the grid itself. For smaller players like Terawulf, the backing provides capital, credibility, and a wedge into the AI compute land grab.

Positioning Tip: Energy-linked AI infrastructure is morphing into a hot sub-sector. Exposure here can act as a levered play on both AI demand and U.S. grid stress — a double tailwind if power markets tighten.

Behavioral Edge

Don’t Sell Your Winners Too Soon

A new study finds that many financial advisers consistently clip gains too early—leaving performance on the table. One firm says it built guardrails to fight that impulse. If you want the playbook they used and the evidence behind it, MarketWatch walks through the bias, the backtests, and the fix.

Investor Angle: This isn’t just an adviser problem. Retail and pros alike struggle with the same two killers: cutting winners and riding losers. Systems beat moods.

Pre-write exits: Set sell rules before entry (price target + invalidation) to avoid emotional trims.

Let leaders breathe: Use trailing stops or time-based holds to keep compounding runs intact.

Quarantine temptation: Move winners to a “no-touch” sleeve with size caps and periodic rebalance windows.

Post-mortems: Track every early sale. If follow-on performance outpaced your replacement, tighten rules.

Private Capital Flows

Soho House Eyes Take-Private

Members club operator Soho House is nearing a deal to go private after a rocky stint in the public markets. The brand that once drew hype for its exclusivity has been weighed down by high debt loads, slowing growth, and a fickle member base. The Wall Street Journal says private equity is circling precisely because those “flaws” look more manageable behind closed doors.

Macro Watch: Another reminder that capital markets remain selective. Soho House’s likely buyout underscores how private capital is repositioning: scooping up public misfires where leverage and churn are tough to stomach under quarterly reporting, but more palatable in a private structure. The question is whether this is the start of a broader exit wave for lifestyle and consumer names, or just a niche deal reflecting valuation distress.

Closing View

Why This Week Matters

Markets are trading near record highs, but momentum faces key tests. Housing data will show whether higher borrowing costs are cooling the sector or if pent-up demand is holding firm. FOMC minutes will clarify whether policymakers are truly ready to pivot in September. And Jackson Hole will dominate the back half of the week, with Powell’s words carrying the weight to reset expectations heading into fall.

Actionable Setups to Consider

Housing read-through: If sales surprise to the upside, lean into homebuilders, building products, and mortgage-sensitive names; if soft, shift toward defensive REITs and repair/remodel plays.

Rate-cut sensitivity: A dovish tone favors small caps and cyclicals; a hawkish tone argues for cash-flow defensives and shorter-duration tech.

Jackson Hole volatility: Scale positions in thirds and use trailing stops; consider light hedges (index puts or VIX calls) into the speech window.

Curve + dollar watch: If the 10-yr eases and dollar softens, overweight megacap tech/semis; if yields rise and dollar firms, rotate toward energy and value factor.

What Could Flip the Script

A hawkish read in FOMC minutes or at Jackson Hole that pushes out cut expectations.

Housing data that signals renewed demand weakness rather than resilience.

Geopolitical headlines that elevate volatility and crowd out the policy narrative.