Indexes stayed composed, but the week’s true scorecard was written in funding, power, governance, and cost curves. Markets did not exit risk. They raised the hurdle rate for assumptions.

MARKET PULSE

Last week looked calm if you only watched the indexes.

The S&P kept its footing. Volatility stayed contained. Credit never screamed.

But the market did not feel easy. It felt audited.

Across five mornings and four afternoons, the same idea kept surfacing through different channels: capital is still willing to stay invested, but it is no longer willing to subsidize uncertainty.

Not in governance. Not in timelines. Not in unit economics. Not in physical reliability.

This was not a week where investors chose between growth and recession.

It was a week where investors chose between control and narrative.

That is why the tape often looked “normal” while the internals were anything but. Gold held a leadership role even when equities stabilized. The yen and the dollar moved on intent and posture, not just data.

Healthcare repriced on a rate table before fundamentals changed. Software sold off even when earnings cleared because margin math was being reworked beneath the headline beats.

Infrastructure and throughput assets kept finding sponsorship because they offered something scarce right now: predictability.

Below are the six stories we surfaced over the week that actually shaped how capital behaved, and why price moved the way it did.

PREMIER FEATURE

An Investment Once Reserved for the Wealthy Just Opened Up

For decades, this corner of the market was largely inaccessible to everyday investors. Then a recent executive order quietly changed the rules. What was once off-limits is now available in a much more accessible way — and it’s already drawing attention.

Signal One | Governance Became a Market Variable Again

The cleanest change in the week’s psychology was that governance stopped being a background assumption. It became a tradable input.

You saw it in the way markets responded to the Fed narrative. Early in the week, the focus was not a new rate path. It was a shift in tone and supervision.

When bank oversight softens, conditions can ease without a single policy move. That is not theory. That is how risk gets delayed. The system gets quieter before it gets safer.

By Friday, the governance theme intensified with the Warsh pick. The market reaction did not look like fear. It looked like recalibration.

The dollar firmed. Metals reversed violently. Long yields rose and then steadied.

That mix signaled something important: the trade was not “cuts versus no cuts.” The trade was whether institutional restraint remains credible enough to anchor the pricing of time.

This is why term premium matters even when the front end stays contained. Governance risk expresses itself through duration before it expresses itself through growth.

The week reminded investors that independence is not a philosophical concept. It is a discount rate input.

Investor Signal

The market is not reacting to policy outcomes. It is reacting to how predictable the decision-making process still feels.

Long-duration assets are being repriced because confidence in institutional continuity now matters more than the near-term rate path. What is being underappreciated is how quickly leadership uncertainty feeds into funding costs even without a policy change.

Trades that assumed the long end would stay anchored by habit are starting to leak. Balance sheets that do not depend on cooperative duration are carrying the advantage.

Signal Two | The Market Began Pricing FX and Funding on Intent, Not Flow

This week made clear that currency stability is increasingly an active policy choice. Not a passive byproduct.

The yen became a recurring tell. Moves were driven as much by signaling and coordination cues as by explicit intervention. That matters because the yen is not just a macro line item. It is plumbing.

If funding currencies shift, carry trades reprice, hedging costs move, and second order effects travel quickly through risk assets.

At the same time, the dollar’s behavior reinforced the point.

A strong dollar stance, even when repeated as rhetoric, still functions as a stabilizer for funding expectations.

A softer dollar, even without panic, has consequences at the long end of Treasurys because it changes the real return calculus for foreign buyers.

That is how yields can tighten conditions without the Fed doing anything.

This was the broader lesson: markets are no longer waiting for a single big event. They are responding to policy intent as a real lever.

Currency now transmits governance and fiscal confidence, and funding costs follow.

Investor Signal

Currency markets are no longer waiting for confirmation. They are moving on posture.

That shift matters because funding stress can now arrive without a data surprise or a central bank action. The risk being missed is that FX-driven tightening shows up incrementally, not dramatically, and still alters return math.

Carry strategies that relied on predictable hedging costs are becoming more fragile than price action implies. Exposure is being reduced quietly before the pressure reaches rates.

FROM OUR PARTNERS

Why Smart Traders Only Show Up for 45–90 Minutes

Here’s a “dirty secret” Wall Street algorithms don’t want retail traders to know: the real money is made while you sleep — not while you stare at the screen all day.

For the last 20 years, the market has been mostly flat between 9:30 AM and 4:00 PM.

The real moves happen overnight, when stocks “gap” up or down at the open.

Most traders miss this by starting after 10 AM, after the easy money is already gone.

The 9:35 AM Protocol focuses on identifying the gap, riding the correction for 45–90 minutes, then closing the laptop by 11:00 AM.

Stop trading the noise.

Signal Three | Healthcare Repriced on Administrative Math, Not Economic Cycles

The most immediate repricing of the week happened in healthcare, and it did not require a recession scare, a utilization shock, or a demand collapse. It required a table.

CMS guidance reset Medicare Advantage expectations in real time.

UnitedHealth moved first, and the rest of the complex followed. The message was not that demand disappeared. It was that reimbursement assumptions were wrong.

In a sector built on small percentage points applied to millions of lives, administrative math arrives faster than fundamentals.

What mattered was persistence. The move did not stabilize quickly. It behaved like a lane narrowing, not a one day overreaction.

That is why the Dow lagged while the broader market held.

The repricing was concentrated, mechanical, and rational, but it also served as a reminder that policy tolerance is a first order risk in sectors built on government payment architecture.

This theme extended beyond insurers. The week also showed pharma pricing resetting under negotiated Medicare structures, another signal that the era of routing around policy constraints is fading.

Healthcare is still durable. It is simply more governed.

Investor Signal

Healthcare sold off because a spreadsheet changed, not because demand weakened. That distinction matters.

Administrative decisions are now traveling faster than earnings revisions. The mispricing is assuming scale can absorb policy compression the way it absorbed utilization noise in prior cycles.

Margin protection that depends on regulatory tolerance is being discounted earlier in the process.

Operators with flexible benefit design and cost structures are being separated from those defending legacy economics.

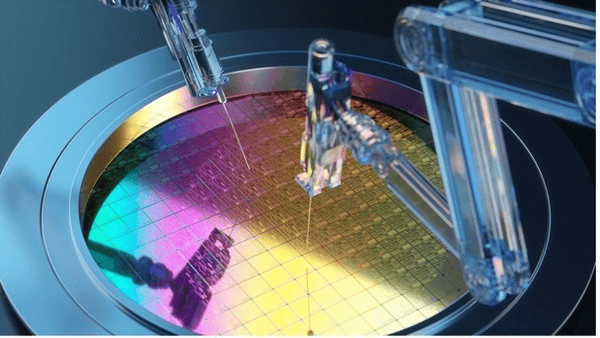

Signal Four | AI Continued to Rotate Up the Stack: Power, Chips, Capacity, Control

AI did not lose leadership this week. It lost uniformity.

Markets kept separating AI exposure into two categories: conversion stories and capacity stories.

On one side, platforms that convert AI into near term revenue and operating leverage continued to clear.

On the other, infrastructure heavy builds were increasingly judged on funded capacity, power access, and cost per token.

The market is treating AI as an infrastructure cycle, not a software cycle. The strongest tells came from the stack itself.

ASML orders acted like a multiyear commitment signal.

Samsung’s margin surge showed how scarcity is being monetized upstream, while that same scarcity pushes costs downstream into devices and consumer electronics.

Nvidia’s investment into CoreWeave was not read as speculative. It was read as capacity control, a way to hardwire power and deployment timelines into an AI factory buildout.

Then came Microsoft’s custom silicon angle. Maia is not just a chip story. It is a unit economics story.

When hyperscalers internalize inference cost curves, cloud competition becomes a control contest, not a procurement contest.

This is what investors priced all week. AI advantage is increasingly determined by who can finance, permit, energize, and schedule capacity cleanly, then repeat it.

Investor Signal

AI exposure is no longer being judged by ambition or adoption curves. It is being judged by who controls the bottlenecks.

The risk being underestimated is how easily demand turns into delay when capacity, power, or funding slips. Software-like margin assumptions are being stripped out of models quietly.

Platforms that can schedule delivery are holding their footing while others lose narrative support.

FROM OUR PARTNERS

Crypto’s Retirement Window Is Opening

This week, something interesting came up in conversations with top crypto hedge fund managers.

They’re seeing three major forces align:

Institutional money pouring in through new ETFs

Regulatory pressure easing

Technical signals not seen since the last major cycle

What surprised me most?

Many believe individual investors actually have an edge right now — able to move faster and position ahead of big money.

I’ve pulled these insights into a clear crypto retirement blueprint, outlining how smart investors are preparing before the wave hits.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Signal Five | Software’s Margin Shield Broke, Even When Earnings Looked Fine

The most important equity factor shift of the week was that software stopped trading like a protected compounder by default.

We saw multiples compress even when earnings beat and guidance rose.

That seems contradictory until you recognize the new question the market is asking: does recurring revenue still translate into durable margins when AI turns compute into cost of goods sold?

AI is not simply a feature layer for many software franchises. It is a cost layer and a competitive accelerant. Iteration speed collapses switching costs. Substitutes become credible. Customers gain negotiating leverage.

The consequence is that renewal can hold while expansion math tightens, and expansion is what supported premium multiples.

This week also showed the second order effect: credit markets and equity markets can agree on the same risk. If software debt starts demanding wider spreads while infrastructure appetite holds, the market is telling you exactly where perceived durability lives.

The takeaway is not that software is broken. It is that software must now prove unit economics under AI load. Guidance is no longer enough if the margin bridge is uncertain.

Investor Signal

Software did not sell off because results disappointed. It sold off because certainty did.

The market is questioning whether recurring revenue still protects margins when AI raises cost to serve and accelerates substitution. The risk is that revenue stability masks economic decay until pricing power is already gone.

Multiples that depended on habit rather than proof are being withdrawn. Businesses that can demonstrate margin defense under faster competition are retaining sponsorship.

Signal Six | Physical Reliability Became a Macro Input, Not a Side Story

The week also reminded investors that physical systems are back in the narrative as real constraints.

Energy stress showed up in the most direct way: winter reliability, gas spikes, utility bills that behave like rent, and political surface area expanding around affordability.

These are not isolated headlines. They are mechanisms that reshape household behavior, inflation expectations, and policy response risk.

At the same time, the market kept rewarding hard assets tied to uptime and throughput. Nuclear policy initiatives were not treated as speculative technology talk.

They were treated as an effort to turn baseload power into financeable infrastructure under a clearer permitting and supply chain frame.

Ports ownership likewise reframed logistics as controlled capacity, not just cyclical trade exposure.

Even the cyber story fit here. Enforcement against gray infrastructure turned “digital plumbing” into a control regime.

When courts and platforms align on treating internet layers as critical infrastructure, the valuation lens shifts toward accountability and licensing, not just growth.

The unifying idea is simple. Reliability is being repriced across physical and digital systems. Markets are paying for uptime, enforcement, and controllable bottlenecks.

Investor Signal

Reliability is no longer a background assumption. It is being priced explicitly.

Energy, logistics, and digital infrastructure are clearing only when uptime can be defended without inviting political backlash. The underappreciated risk is that necessity assets attract oversight at the same time they attract demand.

Operators that assumed essential usage guaranteed insulation are being repriced. Assets that combine scale with regulatory tolerance are holding value where others are not.

FROM OUR PARTNERS

The Most Important Company in the World by Next Year?

Silicon is dead. And one tiny company just killed it.

CLOSING LENS

Last week did not deliver a clean narrative. It delivered a clearer rulebook.

Governance shifted from background to input, and duration responded first.

FX and funding moved on intent, and the long end began enforcing discipline beneath the surface.

Healthcare repriced on administrative math, reminding investors that policy tolerance is an earnings variable.

AI continued its migration into infrastructure, with advantage consolidating around power, capacity, and cost curve control.

Software learned that recurring revenue does not automatically protect multiples when AI becomes a margin question.

And reliability, from grids to ports to cyber enforcement, kept reasserting itself as a constraint markets can actually measure.

The system never broke.

It simply raised the bar.