Energy shocks meet tech reality as Washington wades deeper into markets and traders weigh whether conviction can outlast momentum.

MARKET PULSE

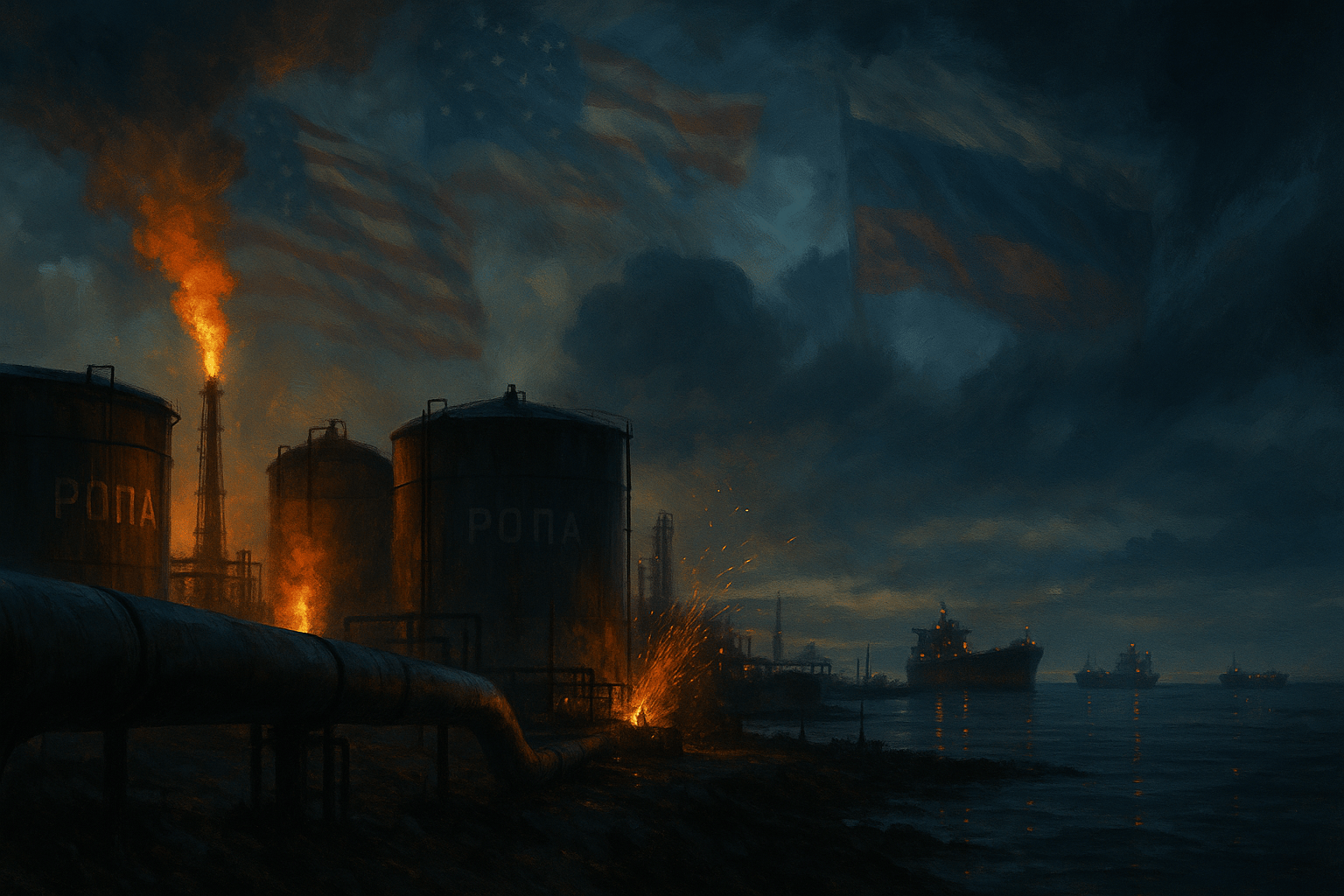

Oil Sanctions Break the Calm

Markets opened in half-light. Futures held their breath while crude surged more than five percent, the biggest one-day move since June.

The trigger: new U.S. sanctions on Russia’s oil giants Rosneft and Lukoil, paired with Europe’s ban on Russian LNG.

The shock rippled fast, energy stocks higher, Dow futures softer, gold finding a pulse after two days of pain.

Tesla and IBM both slipped post-earnings, their tone swallowed by the roar of geopolitics.

DEEPER READ: When Politics Sets the Tape

This rally has been running on belief; now it’s being tested by policy.

The sanctions story isn’t just about oil supply, it’s about control. With Washington shuttered and the Fed in blackout, traders are reading tone, not data.

Each move feels heavier in the vacuum.

That the S&P 500 still hovers near record highs after a geopolitical shock says as much about liquidity as it does about conviction. Markets don’t trust the narrative, but they keep trading it anyway.

Investor Signal

Momentum is intact, conviction is conditional.

Watch crude’s follow-through: sustained strength with tight spreads would extend the energy bid; a fade would argue “headline spike, range intact.”

Watch reaction to misses: if Tesla/IBM weakness is contained and Intel is rewarded for clean prints, breadth holds. If sellers hit winners indiscriminately, respect the risk-off rotation.

Keep an eye on credit and gold together: widening spreads plus a renewed metal bid would flag de-risking; calm credit and soft havens keep the dip-buy script alive.

A market this quiet isn’t calm, it’s calculating. Into CPI and the back half of earnings, the question isn’t whether numbers beat, it’s whether belief can keep carrying the tape when geopolitics is setting the open.

PREMIER FEATURE

10 Stocks for Income and Triple-Digit Potential

Our new report reveals 10 “Double Engine” stocks — companies built for rising dividends and breakout price gains.

Each has the scale, cash flow, and catalysts to outperform as markets rotate after the Fed’s pivot.

These are portfolio workhorses — reliable payouts today, compounding gains tomorrow.

GEOPOLITICS WATCH

Oil Surges as Sanctions Redraw the Map

Markets woke up to a geopolitical jolt. Brent crude jumped more than 5% and WTI tracked close behind after President Trump slapped fresh sanctions on Russia’s two largest oil companies, Rosneft and Lukoil.

Energy stocks rallied in premarket trading, with BP, Shell, and Exxon all higher. Futures were mixed: S&P and Nasdaq contracts slightly green, Dow futures lagging as Tesla and IBM weighed after earnings.

Trump called the sanctions “tremendous” but “hopefully temporary,” saying the goal is to push Putin toward a peace deal. European officials welcomed the move, calling it a decisive step toward “depriving Russia of the means to fund the war.”

The question now is whether the sanctions stick, and whether China or India will keep buying Russian oil.

If global buyers hold firm, today’s rally could prove short-lived. But if trade routes seize up, energy markets may be looking at their biggest supply shock since 2022.

DEEPER READ: Energy Tightens, Policy Loosens

The sanctions arrive at an uneasy time for markets already running on belief, not data. A fresh oil spike could test the “soft landing” narrative investors have clung to all month.

Inflation expectations are muted, but a sustained jump in energy prices would complicate the Fed’s path, especially with no official guidance during blackout.

This isn’t just a commodities story. It’s a stress test for risk appetite. The rally that began on liquidity is now brushing up against geopolitics, and traders are recalculating whether momentum alone can carry them through a world of higher input costs.

Investor Signal

The short-term trade is clear: energy strength, tech fatigue. But beyond the pop, the move signals a rotation risk, from optimism priced in policy to caution priced in commodities. Watch whether oil stabilizes above $60; that level now doubles as both a technical line and a test of belief.

TECH & POLICY

Washington Eyes Equity in Quantum Firms

The Trump administration is preparing to take equity stakes in several U.S. quantum-computing companies, signaling a more direct government hand in critical technologies once left entirely to the market.

Firms including IonQ, Rigetti, D-Wave, and Quantum Computing Inc. are in talks with the Commerce Department for funding packages starting around $10 million apiece.

Deputy Commerce Secretary Paul Dabbar, himself a former quantum executive, is leading negotiations. The program draws from reallocated CHIPS Act funds and marks one of the first sizable federal bets on quantum hardware, a field viewed as essential to national security and next-generation computing.

The administration’s logic is simple: if taxpayer capital underwrites strategic industries, taxpayers should share in the upside.

The policy echoes the government’s recent 10% stake in Intel, a landmark conversion of $9 billion in grants into equity that made Washington the chipmaker’s largest shareholder.

DEEPER READ: State Capitalism, American Edition

What began as industrial policy is quickly turning into industrial partnership. By taking direct stakes in private firms, the U.S. is shifting from subsidizing innovation to co-owning it, a posture long associated with Beijing, not Washington.

The calculus is part security, part sovereignty. Quantum computing sits at the intersection of national defense, cryptography, and AI; whoever controls its breakthroughs will shape the next technological order.

But equity ownership also blurs the traditional separation between regulator and participant, raising questions about how government influence might steer corporate risk-taking.

Investor Signal

Quantum computing has graduated from frontier science to strategic asset class. Federal equity involvement could accelerate commercialization but may also distort capital allocation as political priorities mix with market signals.

For investors, the takeaway is less about ideology than velocity, public money is moving from grants to ownership, and that shift could define where innovation clusters next.

FROM OUR PARTNERS

Urgent: $3,452.50/Month in Passive “AI Equity Checks”

AI giants built their empires using your data — and now they’re being forced to pay up.

Under new regulations, a select group of firms is distributing “AI Equity Checks” worth as much as $3,452.50 per month to everyday Americans.

It’s part of a $5.39 billion payout program, and the window to claim your share is closing fast.

AUTO & ENERGY WATCH

Tesla’s Mixed Quarter Proves the Stock’s Story Is Changing

Tesla’s third-quarter report checked the wrong boxes for traders. Revenue grew 12% to a record $28.1 billion, ending two quarters of declines, but profits fell 37%, and earnings missed estimates as R&D costs for AI and robotics climbed. The stock slipped nearly 5% in after-hours trading.

The miss wasn’t catastrophic; it was clarifying. The core car business is slowing, especially in Europe, where sales are down and Musk’s politics have alienated some buyers.

Tesla’s $4 billion in free cash flow proves it’s still self-funding, but the margin pressure shows that the easy part of the EV boom is over.

DEEPER READ: Tesla Is Evolving From Automaker to Infrastructure Company

What used to be a car story is now an ecosystem story. Tesla’s next chapter depends less on vehicles and more on energy systems, robotics, and software.

Musk talked about “building a robot army” and teased the Optimus humanoid’s next demo for early 2026, alongside ambitions for robotaxis in ten cities by year-end.

Yet for all the futuristic talk, the quarter exposed a more immediate truth: Tesla’s automotive margins are compressing just as competition in China and Europe intensifies. The pivot to AI and autonomy may protect the narrative, but it doesn’t yet protect the stock.

Investor Signal

Tesla remains a liquidity-rich platform, not a growth stock. The valuation now rests on faith that robotics and energy will replace automotive margins, a long bridge for investors to cross. The stock’s next move won’t come from vehicle deliveries, but from evidence that Tesla can scale the infrastructure powering everyone else’s AI ambitions.

TECH WATCH

China’s Chipmakers Are Rewriting the Rules of the Silicon War

Innovation under embargo has become China’s new industrial art form.

America’s export bans were meant to hobble China’s tech ambitions. Instead, they’ve forced a wave of creative workarounds that may prove just as dangerous to U.S. dominance.

Huawei is clustering hundreds of smaller chips into giant processing grids, building power-hungry but powerful AI systems that rival Nvidia’s in total output.

Others are rewriting software to squeeze extra performance from aging hardware and simplifying how AI models handle data to reduce computing needs.

What Beijing lacks in precision, it’s making up for in persistence. Each workaround, from overclocked factories to clever code, moves China a little closer to a self-sustaining tech stack built outside Western control.

DEEPER READ: The Edge as Advantage

The chip war has shifted from a contest of technology to a contest of creativity. America still controls the frontier, but China is mastering the edges, pushing old equipment past its limits and designing systems that prize scale over perfection.

Approximation replaces precision.

The result is an ecosystem optimized for endurance rather than elegance. Domestic fabs like SMIC and Huawei are still years from true parity, yet their hybrid designs already power AI inference engines competitive enough for military, surveillance, and industrial use.

What they can’t build perfectly, they build at scale, and that may be enough to shift the balance of digital sovereignty.

Investor Signal

The semiconductor divide is becoming a tale of constraint as catalyst. U.S. controls have slowed China’s ascent at the bleeding edge but accelerated its capacity at the middle tier, a zone where global demand is exploding.

Expect Chinese firms to dominate the “good-enough” AI chip market across Southeast Asia and Africa while Western giants chase ultra-premium nodes.

Investors should watch for supply-chain realignment in optical networking, power-management chips, and alternative computing formats. The next frontier of semiconductors won’t be defined by the smallest transistor, but by who adapts fastest when the rules change.

FROM OUR PARTNERS

AI's NEXT Magnificent Seven

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

MARKETS WATCH

Leveraged ETFs Are Booming — and Bleeding Investors Dry

The leveraged ETF craze has hit a painful reality check. Funds promising to double the daily moves of single stocks, from Tesla to MicroStrategy, have exploded in popularity, ballooning to nearly $40 billion in assets.

The problem is “volatility decay.” The more a stock whipsaws, the faster these products drift away from the asset they mirror.

MicroStrategy shares are up 28% over the past year; one fund designed to amplify those gains is down 65%. For many retail traders, it’s been a brutal education in what compounding means when markets churn.

Despite the wreckage, issuers keep cranking out new products, 200 leveraged equity ETFs this year alone, chasing fees as high as 1%.

Volatility Shares has even filed to launch America’s first 5x funds, which could vaporize entirely on a 20% down day. The SEC, still frozen by the government shutdown, has yet to review them.

DEEPER READ: When Leverage Meets the Retail Imagination

Leverage isn’t new, but social media turned it into a lifestyle. Retail traders learned that more exposure doesn’t mean more control, it means more math.

Each reversal cuts deeper, and each rally recovers less. The market’s wildest new products have become a mirror of investor psychology: a hunger for speed without understanding drag.

The irony is that professional money is profiting from the carnage. Hedge funds like David Einhorn’s have been shorting the very ETFs retail traders chase, calling them “destined to fail.” In a market obsessed with momentum, leverage has become both the accelerant and the burn.

Investor Signal

Leveraged ETFs aren’t investments, they’re intraday instruments. The longer they’re held, the more math works against the holder. These funds reset daily and erode with volatility, making them tradeable only for short tactical windows. Their growing popularity should be read as a sentiment gauge, not a buying opportunity. When investors start chasing amplified returns to keep pace with the rally, it’s time to slow down and check the math.

CLOSING LENS

The market spent the day balancing conviction against consequence. Oil’s surge on Russia sanctions gave traders something tangible to price, but beneath it the mood was cautious, not fearful, just deliberate. Yields held under four percent, gold regained its footing, and the S&P stayed within reach of record highs.

This wasn’t a chase; it was a calibration. Investors are learning to trade through noise again, not around it. Every headline feels like it should matter more than it does, yet liquidity keeps winning the argument. The discipline now is patience, waiting for guidance, for Friday’s CPI, for a signal that this rally still runs on belief rather than habit.

For all the motion, the story hasn’t changed: the market’s calm isn’t comfort, it’s concentration. The tape is holding its breath, not losing it.