Inflation held steady at 2.9% core, giving markets relief. But Washington’s tariff blitz is redrawing supply chains, shale execs warn “the model is broken,” and Costco’s earnings show even defensive giants feel the squeeze.

MARKET PULSE

Wall Street finally got its answer this morning. The Fed’s preferred inflation gauge, core PCE, rose 0.2% in August, right in line with forecasts.

Headline PCE ticked up to 2.7% year-over-year, while core held at 2.9%. At the same time, consumer spending climbed 0.6%, showing households are still opening their wallets even as prices stay sticky.

The market’s response was relief: futures pushed higher, bond yields eased, and the dollar softened. Investors see the print as “just right”, hot enough to keep growth intact, but not so hot that it forces Powell into more hikes.

Still, the tension remains. A resilient consumer props up GDP, but it also keeps the Fed cautious about declaring victory.

Energy stayed firm on supply risk, gold cooled as real yields stayed elevated, and stock leadership has tilted defensive. Meanwhile, single-stock moves told their own stories: Intel surged on capital talks with Apple, while CarMax tumbled on tariff-linked auto worries.

Investor Signal

This isn’t a breakdown, it’s a breather. Inflation didn’t surprise higher, giving dip-buyers more confidence. But with policy risks…from tariffs to shutdown threats… hanging over Q4, expect chop where energy, defensives, and selective tech leadership carry the load.

PREMIER FEATURE

Robotics Plays Poised to Breakout This Fall

Robotics is no longer a concept—it’s a $200B+ growth market. From defense drones to surgical platforms and warehouse automation, adoption is accelerating fast.

Delivering real-world solutions across defense, medicine, and automation

Attracting institutional capital and fresh analyst upgrades

Positioned to ride the next leg of this megatrend—still in its early innings

These aren’t speculative fads. They’re companies are already executing in one of the most powerful growth markets of this decade.

(By clicking the links above, you agree to receive future emails from us and bonus subscriptions from our partners. You can opt out at any time. - Privacy Policy)

SPOTLIGHT

Big Pharma Feels the Heat as Trump Turns Trade into Industrial Policy

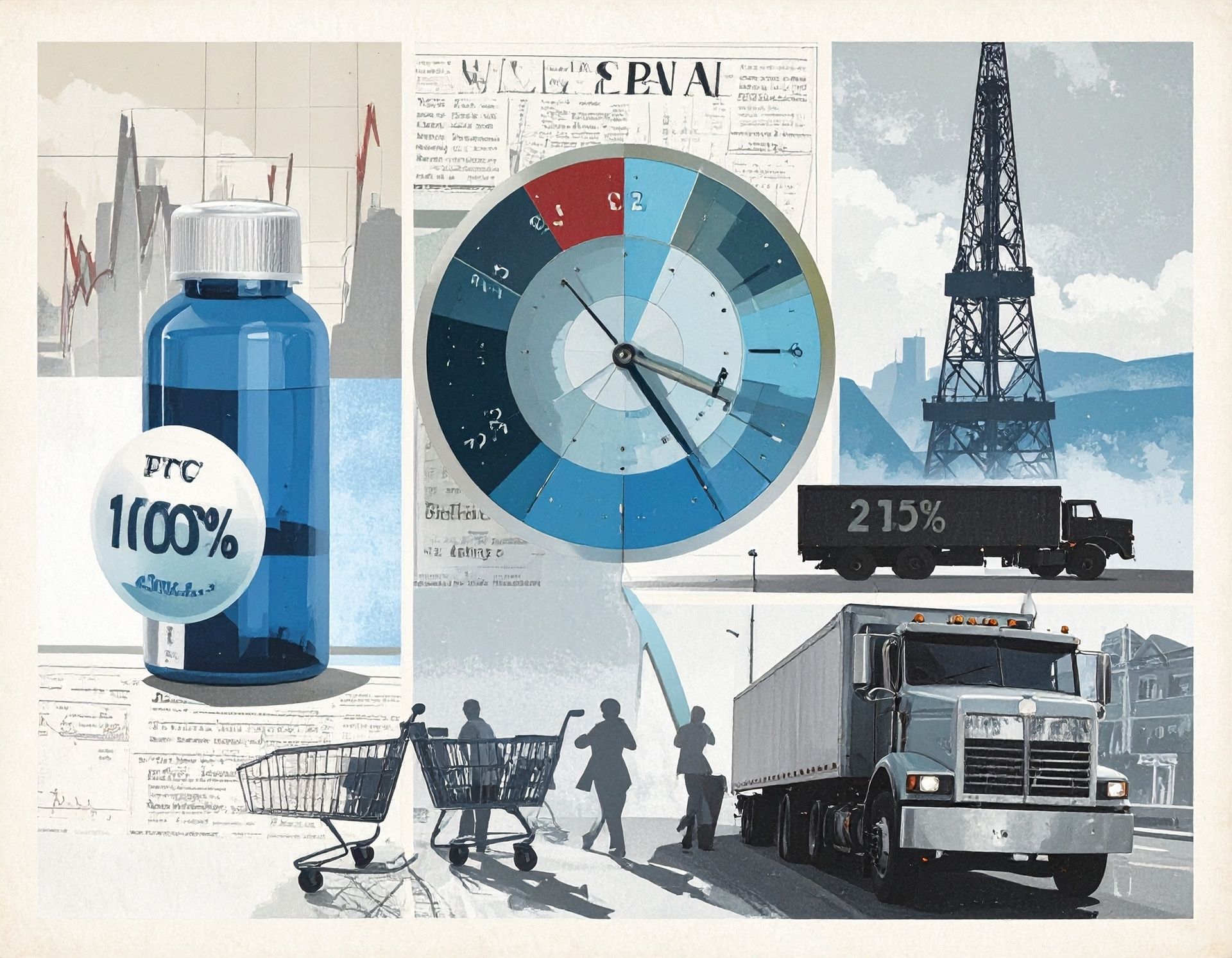

President Trump escalated trade tensions into the pharmaceutical aisle, announcing plans for a 100% tariff on branded, patented drugs unless manufacturers build plants on U.S. soil. The target: a $150B+ import market led by European giants.

The White House framed the move as a national security play, tying healthcare to supply-chain resilience.

Markets heard something different: margin compression and supply disruption. Big pharma stocks slipped on the headlines, while U.S. generics, contract manufacturers, and domestic biotech platforms surged on hopes of reshored production.

Either path risks higher drug prices, embedding healthcare deeper into the political crossfire ahead of 2026.

Investor Signal

Lean into domestic winners. U.S.-based generics and contract producers stand to benefit, while multinationals with heavy European footprints face earnings drag and headline volatility. For long-horizon investors, pharma’s selloff may offer selective entry points, but the policy overhang means healthcare won’t be a “safe sector” play anytime soon.

CAPITAL FLOWS

U.S. Becomes “Safe Haven Again” in Global Flows

After months of favoring overseas markets, global fund managers are shifting capital back into U.S. equities. The reversal marks the end of this year’s “rest-of-world” trade, with inflows signaling that despite political noise and sticky inflation.

Wall Street remains the world’s preferred destination for cross-border money.

This isn’t just about patriotism, it’s about liquidity and resilience. The U.S. still offers the deepest capital markets, the strongest tech platforms, and a currency that strengthens when fear rises. For allocators burned in Europe, China, and emerging markets, America once again looks like the least-worst option.

Investor Signal

The U.S. regaining its safe-haven status creates a tailwind that can offset domestic headwinds like tariffs and rate risk. For portfolios, it strengthens the case for U.S. large caps — particularly tech and healthcare — as global capital rotation adds another buyer at the margin. The key takeaway: global money is voting with its feet, and it’s voting for U.S. markets.

FROM OUR PARTNERS

Trump Schedules Controversial 'Market Reset' for September 30

Behind closed doors, the White House has ordered a historic reset of the U.S. economy that will affect 65 million Americans and half of all U.S. stocks... including Nvidia, Microsoft, and Google.

By law, this MUST happen on or before September 30, 2025.

POLICY WATCH

Tariffs Hit the Highway: Trump Slaps 25% Levy on Heavy Trucks

Starting October 1, imported heavy trucks from China, Mexico, and Europe will face a 25% tariff. The White House is framing the move as a way to shield U.S. manufacturers like Paccar and Navistar and force foreign automakers to build plants on American soil. But the impact stretches far beyond factory gates.

Markets showed the divide immediately. Domestic OEMs rallied on hopes of stronger demand and pricing power. Meanwhile, logistics firms, trucking fleets, and retailers tied to freight costs braced for pain. The auto sector was already wobbling from earlier tariffs and weak sales, this new layer only tightens the screws.

Macro Watch: Freight isn’t just another industry, it’s the bloodstream of U.S. commerce. Layering tariffs on heavy trucks means higher costs ripple through warehouses, distribution networks, and ultimately, store shelves.

With peak shipping season around the corner, that sets up the risk of second-round inflation: even if goods demand softens, the cost to move them will rise. What looks like industrial protection could translate into higher consumer prices and tighter margins across multiple sectors.

Investor Signal

Domestic truck producers and U.S.-based parts suppliers are clear winners. Multinationals and import-heavy fleets, on the other hand, take the hit. For broader portfolios, the inflation ripple may matter more than the OEM rally… rising freight costs feed directly into commodities and energy, making hard assets a natural hedge.

Investors should see this less as a truck story and more as another sign the tariff economy is bleeding into inflation strategy.

The oil patch that made the U.S. a top energy player now faces rising costs, shrinking budgets, and new export hurdles.

At a Houston summit, top U.S. shale executives sounded the alarm: tariffs, trade restrictions, and regulatory whiplash are undermining investment and breaking the business model that once powered America’s energy boom.

Shale, once the poster child for U.S. energy independence, is now stagnating. Rig counts have flatlined, financing costs are climbing, and exports face new political barriers. What was once a growth engine is now a margin squeeze, with executives warning that capital discipline has turned into capital retreat.

Macro Watch: If shale slows, the ripple extends well beyond Texas oilfields. A weaker U.S. supply base gives OPEC+ and Russia more pricing power, tightening global markets and dulling Washington’s “energy dominance” narrative. In effect, America’s competitive advantage in energy is being traded away for tariff leverage elsewhere.

Investor Signal

Mid-sized exploration and production firms (E&Ps), along with oilfield service providers that depend on drilling budgets, could see more volatility as spending slows.

For investors, the tilt looks stronger toward large-cap energy names with global operations and steady cash flow, while smaller shale-only players, often carrying heavy debt, face the rougher path ahead.

EARNINGS WATCH

Shoppers Stick Around, Margins Don’t

Costco’s Q4 results showed both strength and strain.

Same-store sales held firm and membership renewal rates stayed above 90%, proof of loyalty even in tighter times. But profits were squeezed as the chain leaned on discounts and carried higher labor costs. Online sales also slowed compared to rivals, raising questions about Costco’s edge in digital retail.

Shares barely moved as investors weighed the trade-off: reliable traffic and loyalty on one side, thinner margins on the other. Analysts still see Costco’s model as one of the best defensive plays in retail, though its stock price already reflects much of that safety premium after a strong run this year.

Macro Watch:Inflation continues to pinch household budgets, and Costco’s “value at scale” pitch is well-suited for this climate. But even value leaders can’t escape the pressure of labor costs, tariffs, and cautious consumers. The takeaway: defense doesn’t mean immunity.

Investor Signal

Costco remains a core defensive anchor, but near-term upside looks limited. For tactical investors, this could be a moment to trim exposure and rotate into retailers with more leverage to easing costs. For long-term holders, treating Costco more like a bond proxy with equity upside… steady, safe, but not explosive… may be the best framing.

CLOSING LENS

Today’s PCE print set the tone: inflation is sticky but steady, and consumers are still spending. That mix gives the Fed cover to stay cautious without slamming the brakes.

Across today’s stories, the thread is clear.

Tariffs are being used less as trade weapons and more as tools to reshape industry.

From pharma to trucks to shale, Washington is forcing companies to choose between local costs and global access.

Corporate results, like Costco’s, show resilience but also limits, while cultural battles over pricing power keep politics in the mix.

The winners in this market aren’t just the firms with demand, they’re the ones that can align with domestic policy, defend margins under regulation, and hold consumer trust in an affordability squeeze. For investors, that means tilting toward companies with structural advantages, while keeping dry powder ready for tactical swings. Because policy, not just profits, is steering price action into year-end.