Markets edge higher as Fed week begins, TikTok deal takes shape, Tesla jumps on insider buy, Nvidia faces China probe.

MARKET PULSE

Records Push Higher, Fed Cut in Sight

Stocks opened the week on the front foot, with the S&P 500 and Nasdaq carving fresh records while the Dow inched higher. Momentum came from new headlines on U.S.-China talks and Tesla’s rally, even as Nvidia slipped under Beijing’s scrutiny.

Treasury yields held near 4% and the dollar softened. Gold surged past $3,700 to a record, a reminder that even in a risk-on tape, investors are hedging. Tesla jumped more than 3% after Musk disclosed a $1 billion share purchase. Nvidia eased after China’s antitrust regulator said it violated competition law. And a “framework” deal on TikTok gave traders hope the app will avoid a ban.

The backdrop hasn’t changed: markets are betting the Fed begins cutting rates this week. The question is no longer if Powell cuts, but how many more follow.

PREMIER FEATURE

The AI Stocks Every Pro Is Watching

AI isn’t a tech trend – it’s a full-blown, multi-trillion dollar race.

One dominates AI hardware with a full-stack platform and rising analyst targets.

Another ships accelerators to major hyperscalers with ~28% revenue growth ahead.

Get those tickers and 7 more in The 10 Best AI Stocks to Own in 2025 for free today!

TECH WATCH

China Targets Nvidia in Antitrust Probe

China said Nvidia broke its antitrust law when it bought Mellanox in 2020 and has widened its probe. Regulators argue Nvidia promised to keep chips flowing to China but later cut supply after U.S. export bans. That move opened the door to claims it broke its pledge. Nvidia said it has followed the law and will keep working with regulators. Shares slipped slightly after the news.

Upside: Nvidia is still the leader in AI chips. China has not been able to build anything close at scale, which keeps Nvidia in demand.

Downside: Beijing’s move shows it can make life harder for U.S. firms, especially when trade talks are tense. A probe now could also lead to new rules or punishments later.

Investor Takeaway: This isn’t about next quarter’s earnings. It’s about leverage in U.S.-China talks. Expect more headlines whenever tech or trade tensions heat up.

EV & MEGA-CAP MOVES

Tesla Rises After Musk Buys $1 Billion in Stock

Elon Musk bought about $1 billion worth of Tesla shares. The move lifted the stock and reminded investors how closely tied the company is to its CEO.

Upside: Insider buying is one of the strongest signs of confidence a leader can give. Musk putting his own money in may help support the stock near term.

Downside: Tesla still faces pressure from rivals, rising costs, and questions around margins. A big buy from Musk doesn’t fix those business issues.

Investor Angle:The trade gives Tesla a short-term boost, but over time investors need proof that delivery growth and profits match the confidence.

FROM OUR PARTNERS

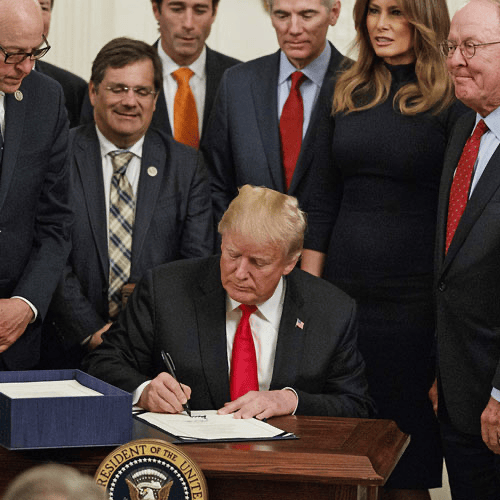

Breaking News: Trump Unlocks $21 Trillion for Everyday Americans?

President Trump just signed a new law…

That could unlock $21 trillion for everyday folks like you…

And potentially impact every checking and savings account in America.

Click here now because Chase, Bank of America, Citigroup, Wells Fargo, and U.S. Bancorp…

Are already preparing for what could be the biggest change to our financial system in 54 years.

POLICY & GEOPOLITICS

TikTok Deal Framework Reached

After talks in Madrid, U.S. and Chinese negotiators said they reached a framework to keep TikTok running in America. Trump and Xi are expected to finalize the deal later this week.

Upside: The deal avoids a shutdown and protects access for TikTok’s 170 million U.S. users. It also lowers near-term tension for tech stocks tied to social apps.

Downside: The hardest parts are still unresolved — who owns TikTok, who controls the algorithm, and who handles U.S. user data. Congress could reject a deal that doesn’t meet the 2024 law requiring Chinese divestment.

Investor Takeaway: The news is positive for now, but real risks remain. Until ownership and data control are nailed down, TikTok’s U.S. future is still cloudy.

IPO WATCH

StubHub IPO Oversubscribed, Eyes $9.3 Billion Value

StubHub’s IPO has drawn orders more than 20 times the shares available, setting up a hot debut expected Wednesday. The online ticketing company is leaning on its big brand and live-event demand, but questions remain about its heavy spending.

Upside: Strong name recognition and oversubscription point to high demand on day one. Based on pricing, StubHub could be worth $9.3 billion.

Downside: The company spends heavily to grow and faces strong rivals like Ticketmaster. Regulators are also watching fees closely.

Investor Takeaway: Expect a flashy debut, but watch whether the stock holds up after the early hype. Long-term value will depend on profits, not branding.

MARKET STRUCTURE

Trump Pushes to Scrap Quarterly Reporting

Trump called for ending quarterly earnings reports and moving to twice-a-year updates. He argues this would save companies money and help them focus on long-term goals.

Upside: Less focus on three-month targets could free up managers to plan bigger projects and reduce reporting costs.

Downside: Longer gaps between reports mean less transparency. Investors could face more volatility and fewer chances to question leaders. Analysts warn six months is a long time for leaks and uneven info.

Reality Check: The SEC would need to approve, and opposition from investors is strong. Other countries that tried scaling back reporting found it hurt pricing and confidence.

THE CLOSING LENS

Relief Meets Fragility

Today’s gains carried the same tone as last week, confidence that the Fed is ready to ease and the market is safe to press higher. Tech and AI remain the drivers, and Musk’s buy added fuel. The TikTok framework also gave the tape a lift, taking one geopolitical overhang off the table.

But Nvidia’s probe shows how quickly the same AI story that drove Oracle and Broadcom higher can turn into a headwind. Gold at record highs shows demand for safety hasn’t disappeared. This rally rests on the assumption Powell won’t surprise, and that fragility is the throughline. One hawkish note on Wednesday could turn these records into the high-water mark.