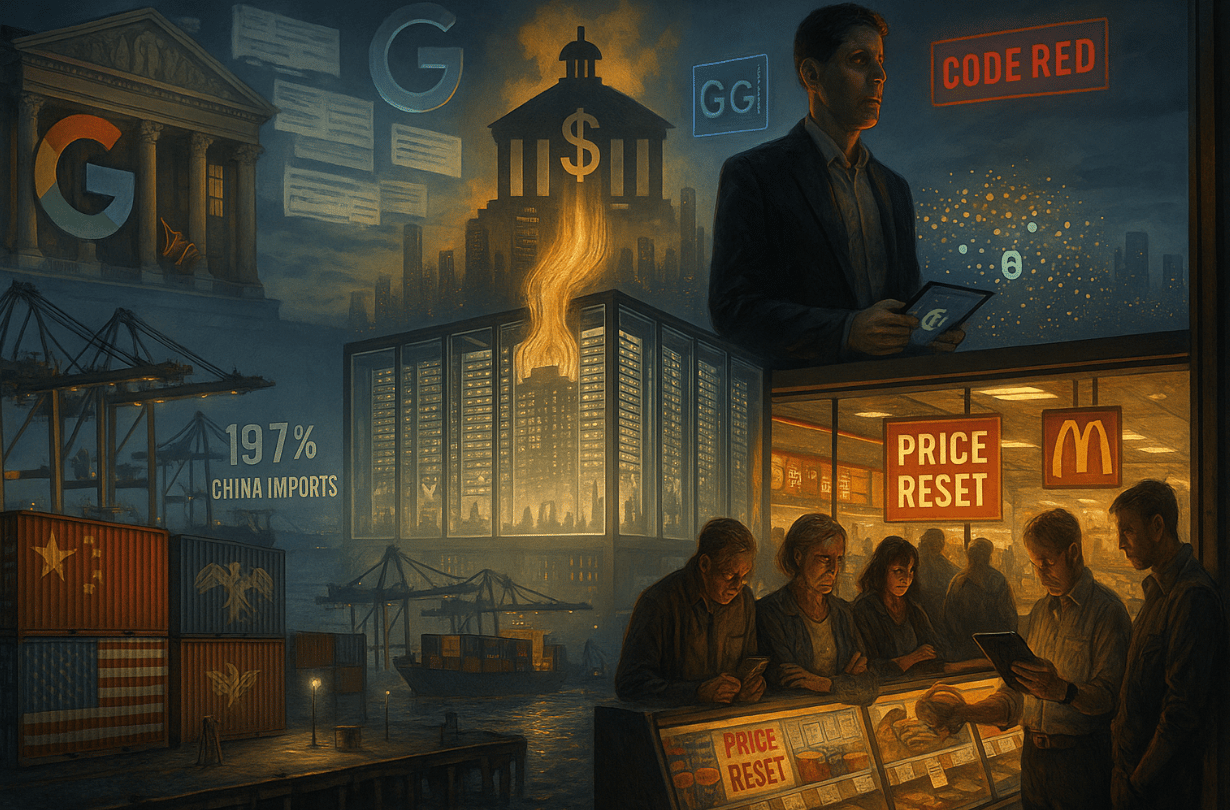

A market leaning on AI strength is being forced to confront state intervention, tariff-driven demand cracks, and consumer margin fatigue… all at once. Investors are testing how much pressure the cycle can actually carry.

MARKET PULSE

Calm Tape, Heavy Pressure: AI, Trade, and Consumers Strain

The tape moved like it understood the new hierarchy.

Governments extract, regulators restrain, and corporates carry the cost of both.

Yields eased off Monday’s highs as 10-year drifted near 4.16%.

Dollar held firmer, gold slipped after Friday’s rush, and oil steadied with Brent just under $69.

But the tape’s real signal came from where pressure concentrated:

Nvidia ticked higher after Trump approved H200 exports under a 25% government cut.

Google fell as the EU opened a probe into whether AI Overviews expropriate the open web.

PepsiCo moved after agreeing to activist-driven price cuts, confirmation that affordability, not premiumization, is now the path to volume survival.

Shipping data from Descartes showed nearly 20% YoY collapse in China–U.S. container traffic.

More evidence that tariffs are doing more than shifting routes… they’re suppressing actual orders.

What’s showing up across all of it is pressure redistribution: the state captures upside at the top (AI), policy kills volume in the middle (trade), and corporates absorb the cost at the bottom (consumer goods, logistics, media).

Investor Signal

Markets aren’t trading earnings, they’re trading shock absorption capacity.

Today’s trading hinted at the quiet realignment underway: policy now dictates the upside, companies absorb the downside, and markets price the gap in between.

PREMIER FEATURE

When the Fed Cuts, These Go First

The rate-cut rally is already taking shape — and our analysts just pinpointed 10 stocks most likely to lead it.

They’ve dug through every chart, sector, and earnings trend to find companies positioned for explosive upside once the Fed eases.

From AI innovators to dividend aristocrats, these are the names attracting billions in early institutional money.

Miss them now, and you’ll be chasing the rally later.

TECH WATCH

AI Chips Become Negotiated Sovereign Assets, Not Products

Nothing about yesterday’s move was subtle.

Washington just turned Nvidia’s China exports into a state-metered revenue stream, recasting the H200 not as a high-margin product but as a geopolitical tollbooth.

NVDA’s after-hours pop wasn’t about access, it was the market repricing who actually owns the upside of strategic compute.

The tape is absorbing a deeper inversion: export controls are no longer restricting flows; they’re monetizing them.

Nvidia, AMD, and now partially state-owned Intel are being drafted into a model where advanced hardware is allocated like a taxed commodity… priced and permitted at the government’s discretion.

For investors, that turns chip demand into a policy-mediated variable, one that can be negotiated, withheld, or repriced as leverage in real time.

The AI boom just gained a fiscal arm.

Investor Signal: Pricing Power Moves to the State

Markets are beginning to treat frontier chips as assets whose returns depend on policy rights, not production scale.

Government take-rates now sit inside earnings models whether companies acknowledge it or not.

The next phase of the AI trade belongs to whoever controls the gate, not the fab.

REGIME WATCH

EU Scrutiny Puts AI Overviews on Collision Course With the Web’s Economics

Google’s AI Overviews just triggered the moment everyone in the media feared.

Regulators treating generative search as an extraction engine that must finally pay for the content it consumes.

The EU’s probe isn’t about compliance friction, it’s the first formal challenge to the assumption that AI can absorb the open web without underwriting it.

Markets understand what’s really at stake.

If AI-native search keeps replacing link traffic with platform-authored summaries, the value chain inverts: publishers lose distribution, rival models lose training access, and Google carries both the margin expansion and the regulatory liability.

A potential 10% global-revenue fine is the headline, but the pricing signal is about something deeper, forced economics-sharing that compresses the profitability of AI Overviews just as they scale.

Investor Signal: AI Platforms Must Start Paying for What They Capture

Regulators are drawing a line between innovation and appropriation.

That shifts AI search from a self-contained profit pool to a negotiated system with external claimants.

The next phase of rerating hinges on whether Google can remain the arbiter of traffic once the web demands compensation.

FROM OUR PARTNERS

President Trump Just Privatized The U.S. Dollar

A controversial new law (S.1582) just gave a small group of private companies legal authority to create a new form of government-authorized money.

Today, I can reveal how to use this new money… why it's set to make early investors' fortunes, and what to do before the wealth transfer begins on December 18 if you want to profit.

AI WATCH

OpenAI Turns From AGI Ambition to Holding the Consumer Line

ChatGPT’s dominance is no longer slipping quietly, it’s slipping fast enough that OpenAI has halted its own moonshots to stop the slide.

Sam Altman’s “code red” is the surest signal yet that the AI race has left the lab and entered the arena where survival is decided by usage curves, not breakthroughs.

The company isn’t optimizing for intelligence anymore.

It’s fighting for attention before Google captures the center of gravity.

The context underneath the panic is brutal.

Gemini’s surge, Apple’s device-led pull, and Anthropic’s enterprise climb are compressing OpenAI’s advantage from all sides, and the economics of its trillion-dollar compute bets only work if ChatGPT remains the default gateway to AI.

That’s why OpenAI is turning back to the same engagement levers Big Tech once relied on: real-time user signals, personalization loops, and feedback-driven tuning.

Even though those systems carry the safety liabilities that scorched earlier platforms.

Markets are reading the shift clearly: distribution risk has become the company’s existential risk.

Investor Signal: The Moat Moves to Habit

The next leg of AI value accrues to whoever can anchor daily usage, not whoever ships the smartest model.

Engagement now decides which players can finance their ambition, and which ones get eclipsed.

IMPORT WATCH

Container Flows Flash a Deeper Slowdown Ahead

Tariffs are finally leaving fingerprints the market can’t ignore.

A near-20% plunge in China-to-U.S. container traffic lands like a warning shot: importers aren’t dodging duties anymore, they’re pulling back from the table entirely.

The demand loss is real, visible, and spreading.

Descartes’ numbers cut through the noise: inventories are full, orders are shrinking, and buyers are refusing to take 2026 risk without clarity on Trump’s tariff arsenal.

The uncertainty isn’t abstract, it now dictates how much product even enters the country.

Retailers may be stocked for the holidays, but forward volumes tell the real story.

Caution is replacing consumption, and supply chains are shifting into defensive mode because the policy backdrop won’t stabilize.

This is what the market is responding to, not seasonal softness, but a structural hit to goods appetite.

When trade policy becomes a variable companies can’t price, they stop betting on demand.

Investor Signal: The Shock Is Already in the System

Tariff risk is showing up first in freight, then in orders, and soon in margins.

Markets aren’t waiting for confirmation, they’re trading the contraction as if it’s underway.

FROM OUR PARTNERS

Apple’s Starlink Update Sparks Huge Earning Opportunity

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone hit 50M+ users even before global satellite coverage. With SpaceX eliminating "dead zones", Mode's earning technology can now reach billions more, putting them a step closer to potential IPO.

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors.

COMSUMER WATCH

Activism Forces a New Consumer-Goods Playbook

Pricing power just hit its breaking point.

PepsiCo’s deal with Elliott isn’t a routine cost trim, it’s a visible admission that volume is failing faster than margins can compensate, and that affordability has to be rebuilt, not assumed.

When a global staple brand agrees to lower prices under activist supervision, the market reads it for what it is: the premiumization era is over.

The context is brutal.

Consumers have been quietly defecting from big-brand snacks all year, elasticity has come roaring back, and the tolerance for stealth inflation is gone.

Elliott didn’t push for financial engineering, it pushed for price correction, SKU reduction, and structural resets that match what the tape has already been pricing into packaged food.

This is activism as macro diagnosis: demand fragility is now the primary risk factor.

The deeper tension is strategic.

If fiscal and trade shocks keep pressuring wallets into 2026, the companies that rebuild value fastest, even at the cost of margin compression, are the ones that keep share, while the rest leak volume they won’t recover.

Deeper Read

PepsiCo’s concession signals that investor activism is shifting from balance-sheet optimization to direct intervention in frontline consumer strategy.

The food sector is becoming an early-warning gauge for household stress, where even small pricing missteps cascade into share loss that takes years to recover.

What investors are really testing now is which brands can re-engineer demand without sacrificing the scale advantages their valuations rely on.

Investor Signal: Pricing Power Has Rolled Over

The market is rewarding companies that pre-empt the affordability reset, not resist it.

Margin defense no longer offsets demand risk.

Volume credibility is becoming the new moat.

CLOSING LENS

Pressure Rewrites the Map

Today’s moves were all variations of the same theme: upward consolidation of control, downward diffusion of cost.

AI chips became sovereign revenue engines.

Search models faced forced economic reciprocity.

Engagement platforms turned defensive.

Trade flows contracted under tariff uncertainty.

And consumer companies were pushed into affordability resets they can no longer avoid.

Power is being centralized at the policy level, risk is being socialized through supply chains, and financial strain is migrating into balance sheets that can least afford it.

The market isn’t trading direction, it’s trading where the compression shows up next.

In this setup, the next move comes from identifying who still has the capacity to absorb one more shock.