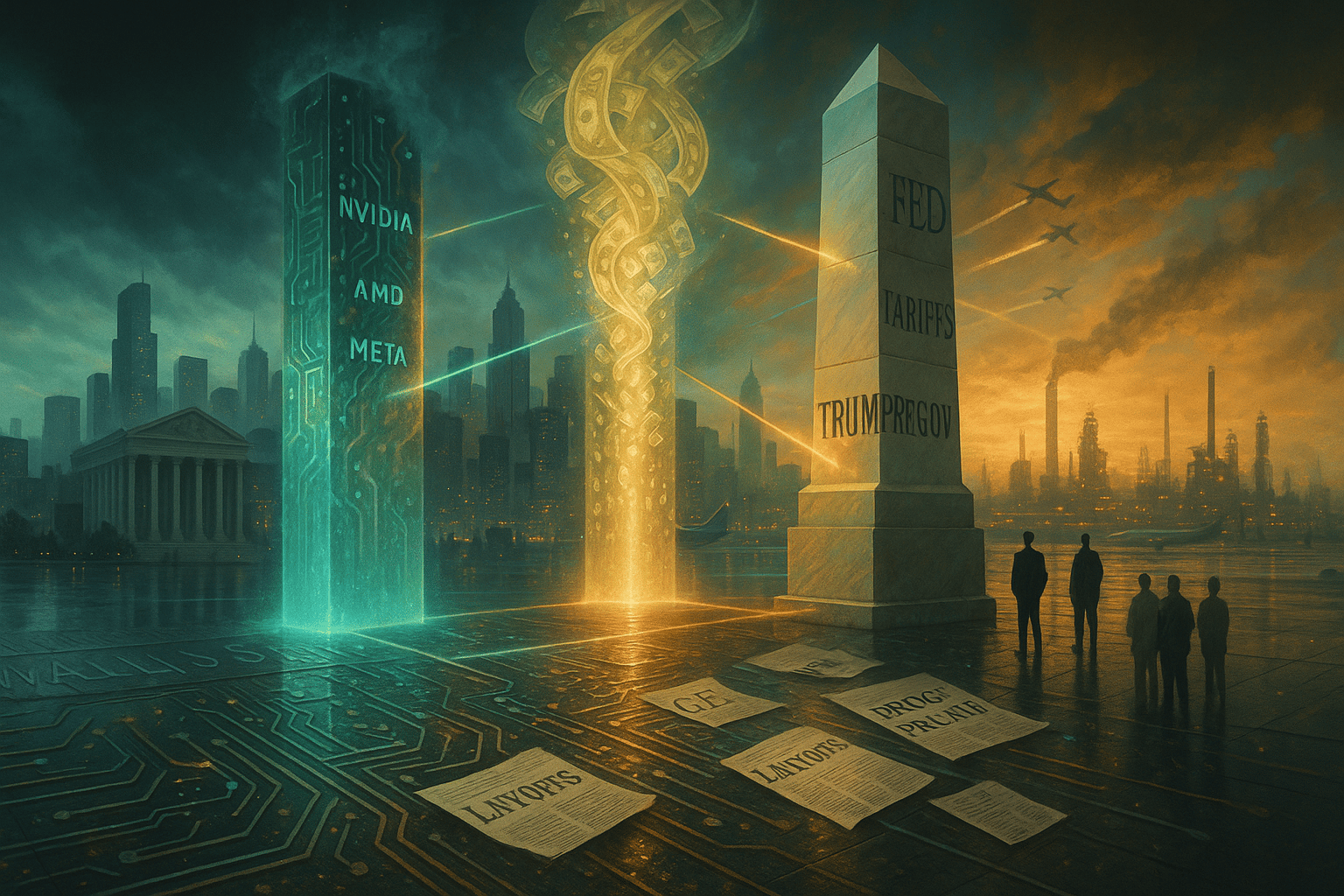

Markets stumble as AI valuations wobble, Dalio calls the Fed’s next move “dangerous,” and Trump’s Big Pharma bargain flips the health-care trade.

MARKET PULSE

Markets limped into Thursday with conviction cracking under its own weight.

Relief trades propped the tape, but the calm looked borrowed. With job cuts spiking and tech’s halo fading, traders are testing how much weakness they can buy before it bites back.

The Dow shed more than 300 points, the S&P 500 slipped nearly 1%, and the Nasdaq tumbled 1.5% as the week’s tech optimism turned brittle again.

AI favorites, Nvidia, Microsoft, Palantir, AMD, and Meta, led the slide, their valuations finally colliding with gravity.

The broader tape felt uneasy.

A surge in the October layoffs revived old recession ghosts, while the ongoing government shutdown kept investors flying blind with patchy data.

The Nasdaq 100 is on pace for its worst week since April, yet the bid for dip-buying still hums beneath the surface.

Energy names held up, gold firmed, and volatility whispered just enough to remind everyone complacency never really leaves.

Investor Signal

AI euphoria is cooling, but not exactly collapsing. But sentiment is shifting from how high to how fragile.

If job losses keep stacking and data stays dark, the next bounce may test who’s trading the story… and who’s still believing it.

PREMIER FEATURE

4 Stocks Poised to Lead the Year-End Market Rally

The S&P 500 just logged its best September in 15 years — and momentum carried through October, pushing stocks to multi-month highs.

Cooling inflation, strong earnings, and rising bets on more Fed rate cuts are fueling the move.

But this rebound isn’t broad-based — it’s being driven by energy, manufacturing, and defense sectors thriving under new U.S. policy and global supply shifts.

That’s why our analysts just released a brand-new FREE report featuring 4 stocks we believe are best positioned to benefit as these trends accelerate into year-end.

FINANCE WATCH

Schwab Crashes the Private Market Party

Charles Schwab just rewrote its own playbook.

The brokerage best known for discount trades is buying Forge Global, a marketplace where investors can grab slices of late-stage titans like OpenAI and SpaceX, in a $660 million bet that the next big boom won’t happen on the stock exchange, but off it.

If IPOs stay dead, Schwab’s about to sell you the next best thing.

It’s Schwab’s first major move under new CEO Rick Wurster, and it lands with a message: if the IPO window stays shut, Schwab will open its own.

The deal hands its ultrawealthy clients access to private shares that were once off-limits, minimum buy-ins starting around $5,000, and the firm plans to widen that invitation to million-dollar accounts next.

Wall Street is racing to sell exclusivity faster than startups can go public. Competitors smell the same opportunity.

Morgan Stanley just scooped up EquityZen, Forge’s rival, as part of a broader rush by brokerages to capture the hunger for private equity exposure.

With IPOs down nearly 50% since 1997, these platforms are pitching themselves as the new gateway to growth, even if the exits stay locked.

Deeper Read: Wall Street’s New Luxury Product? Access

Schwab’s entry signals that private investing is no longer niche, it’s the new frontier for capital chasing scarcity. But access doesn’t erase risk.

These companies disclose little, liquidity is thin, and prices are whatever the last handshake agreed to. Schwab is betting that fear of missing out now outweighs fear of being trapped.

Investor Signal

Private equity is bleeding into the public imagination.

For investors who qualify, Schwab’s Forge deal offers a rare backstage pass to pre-IPO giants.

But remember: when everyone wants in early, the exits get crowded fast.

HEALTH WATCH

Trump Cuts a Deal on Weight-Loss Drugs

President Trump just scored a win where politics, health, and money collide: drug pricing.

The White House struck landmark deals with Eli Lilly and Novo Nordisk to slash prices of their blockbuster obesity treatments, including upcoming pills, and to make some versions available through Medicare and Medicaid for the first time.

Starting mid-2026, eligible patients could pay as little as $50 per month for injectables like Wegovy and Zepbound, while new pills from both companies are expected to launch at $145 monthly.

The discounts will also reach everyday consumers through a new federal site, TrumpRx.gov, which goes live in January.

It’s a bold play to tame soaring drug costs, and a political flashpoint as the administration claims it’s tying U.S. drug prices to the lowest abroad.

Health Secretary Robert F. Kennedy Jr. called the move “the biggest impact on the American people yet.”

Trump’s push to undercut Big Pharma just put both drugmakers, and Washington, on notice.

Deeper Read: The Price War Diet

This isn’t just about affordability; it’s a power shift.

Obesity drugs have become the hottest commodity in medicine, minting trillion-dollar valuations and reshaping health care portfolios.

Now, the same government once accused of letting prices spiral is brokering bulk discounts.

For investors, that means margin pressure on drugmakers, but also a market expansion that could double patient access overnight.

Investor Signal

Health care’s new battleground is pricing leverage.

Expect volatility in Lilly and Novo Nordisk as profits meet policy, and watch for a fresh wave of M&A bets chasing cheaper drug access.

The weight-loss boom just got political, and potentially, a lot more crowded.

FROM OUR PARTNERS

Your Bank Could Change Forever on November 18th

If you have money in a checking or savings account… this could affect you directly.

Treasury warns it could drain $6.6 trillion from traditional banks.

Meanwhile, investors who make the right moves before the wealth transfer begins could make up to 40X by 2032…

MACRO WATCH

Ray Dalio Says the Fed Is Playing with Fire

Ray Dalio is back, and this time, he’s taking aim at the Fed’s playbook.

The Bridgewater founder says the Federal Reserve’s latest pivot could turn a controlled landing into an overheated boom.

The Fed plans to end quantitative tightening next month and may start buying assets again in early 2026… a move that smells a lot like QE by another name.

Dalio’s warning is blunt: combine expanding balance sheets with rate cuts and record fiscal deficits, and you get “a dangerous mix of monetary and fiscal stimulation into a bubble.”

He argues that if the Fed floods liquidity while AI stocks are already frothy, inflation could roar back, and markets could melt up before they melt down.

Investors are already betting on a liquidity binge, and Dalio says that’s exactly how bubbles start.

He’s not alone.

Analysts at Evercore estimate the Fed might need to buy up to $50 billion a month in assets next quarter to keep repo markets stable, indirectly pushing yields lower and valuations higher.

Deeper Read: Liquidity Without Limits

Dalio calls this “a bold and dangerous bet on growth.”

It’s stimulus without restraint, and it rarely ends cleanly.

He predicts tangible assets like gold, infrastructure, and inflation-linked bonds could soon outperform pure tech plays once the inflation risk reawakens.

Investor Signal

Follow the liquidity trail, not the headlines.

If real yields dip while stocks surge, it’s fuel for one last run, but remember Dalio’s rule: when policy feels too generous, the clock is already ticking.

TECH WATCH

Microsoft Launches ‘Superintelligence’ Team to Serve Humanity

Microsoft just made its boldest AI move yet: forming a Superintelligence Team under AI chief Mustafa Suleyman, the DeepMind co-founder who once helped shape Google’s AI empire.

The new division, called MAI Superintelligence, will pursue research aimed at “serving humanity,” tackling projects from disease diagnostics to renewable energy and next-gen digital companions.

Suleyman insists this isn’t another moonshot for artificial gods. “We’re not building an ill-defined and ethereal superintelligence,” he said. “We’re building practical technology explicitly designed to help people.”

The mission lands as rivals like Meta pour billions into their own superintelligence labs, setting the stage for an arms race where control, not capability, may prove the toughest challenge.

Microsoft’s push to build “controllable” superintelligence could define whether AI remains a tool… or becomes the test.

The move also signals how far Microsoft has come since its OpenAI partnership.

With a $135 billion stake in Sam Altman’s firm, Redmond is now diversifying by drawing models from Anthropic and Google to reduce dependence while keeping the innovation edge.

Suleyman’s arrival from Inflection AI makes this play as much about people as technology: Microsoft is building its own internal “AI brain trust.”

Deeper Read: The Race for Responsible Power

Every tech titan claims to build AI “for good.”

But Microsoft’s MAI lab is staking its brand on accountability. The company’s bet: that the next frontier of AI dominance won’t be who builds faster, but who builds safely enough to scale first.

Investor Signal

Expect Microsoft to frame AI spending as “mission-driven” while quietly tightening ROI targets.

Watch for R&D pivots into healthcare and energy AI, sectors where ethics meet economics, and where Suleyman’s restraint could prove Microsoft’s biggest advantage.

FROM OUR PARTNERS

One Stock Poised to Soar.

Now, as Editor in Chief at WallStreetZen, I’m applying a proven 4-step system to pinpoint stocks with the potential for triple-digit gains — and one just rose to the top of my list.

This week’s “Stock of the Week” has the setup I’ve seen before every major winner I’ve ever owned: strong fundamentals, powerful catalysts, and technical confirmation.

My new pick just went live — and early positioning is key.

CHIPS WATCH

SoftBank Eyes Marvell in AI Power Play

The chip world just got a fresh jolt of takeover buzz. SoftBank reportedly explored buying Marvell Technology to merge it with Arm Holdings, in what could’ve been one of the largest semiconductor tie-ups in years.

Talks fizzled, but the market heard the message: Masayoshi Son is still shopping for AI dominance.

Marvell’s stock jumped 3% on the report, trimming gains later but holding steady around $96 a share.

The $80 billion chipmaker has lagged other AI names this year, down 16%, even as its custom chip design work with Amazon and Microsoft heats up.

SoftBank’s pitch was simple: fold Marvell’s networking and SerDes tech into Arm’s silicon roadmap and create an end-to-end AI infrastructure giant.

Investors are betting Son won’t stay quiet for long, another bid could test just how hungry Wall Street is for an AI hardware empire.

For now, the logic is compelling but risky.

Merging U.S. chip IP with a Japan-based parent would face heavy regulatory scrutiny.

Still, analysts call the potential combination “a natural fit” as Marvell’s high-speed connectivity IP could supercharge Arm’s push into custom AI silicon, where Broadcom and Qualcomm are already advancing.

Deeper Read: The Silicon Land Grab

This isn’t a rumor mill; it’s a strategy preview.

Every chip firm with AI exposure is being sized up for synergy, Arm wants vertical control, SoftBank wants a legacy-defining platform, and Marvell wants validation.

Whether a deal happens or not, the industry’s next consolidation wave is already forming.

Investor Signal

Expect renewed M&A chatter across semis as liquidity and ambition collide.

Marvell’s “floor is higher” now, but regulatory risk could keep buyers cautious. For investors, this is a momentum play: watch Arm, Broadcom, and Qualcomm for who moves first when Son does.

CLOSING LENS

The Edge Gets Thinner

This market doesn’t break, it bends until everyone swears it won’t.

AI’s still the story, but the tone has changed: less prophecy, more proof. Traders are learning that liquidity is faith, not fact, and that belief is starting to cost more every day.

If the rally has one more act left, it’ll need something stronger than hope: maybe data, maybe earnings, maybe time.

Until then, every uptick is a test: who’s buying conviction, and who’s just buying the dip?