Markets reward those who control inputs, not those waiting on outcomes. Access shaped how risk is being allocated today.

MARKET PULSE

Fed Holds, Dollar Firms, Markets Test How Much Calm Is Left

The Fed delivered the expected pause, and markets responded by testing conviction rather than chasing relief.

By the close, equities were little changed, signaling acceptance without enthusiasm.

Powell’s press conference reinforced that balance.

He described an economy entering 2026 on “firm footing,” with risks to inflation and employment both easing, while declining to engage on legal or political pressure.

That steadiness carried weight, but it also clarified the constraint: policy is no longer driving momentum.

With two meetings left in Powell’s term, uncertainty has shifted from rates to governance.

Currency and commodities reflected the tension.

The dollar rebounded after Treasury officials reiterated a strong-dollar stance, easing immediate credibility concerns.

At the same time, gold surged to fresh highs, less a panic signal than a hedge against longer-run institutional risk.

Yields stayed contained near 4.25%, suggesting markets see stability, but not cheap capital.

Equity leadership narrowed.

Semiconductors found support on real demand signals from ASML, even as gains faded, while idiosyncratic risk reappeared elsewhere as Carvana slid sharply on a short report.

Calm held… but it wasn’t uniform.

Investor Signal

The Fed removed uncertainty without adding fuel.

Markets are sorting between stability and stress, not pricing a shock.

Leadership now depends on balance sheets, credibility, and execution, not policy momentum.

PREMIER FEATURE

Former Illinois Farmboy Built a Weird A.I. System to Expose His Wife's Killer…

After his wife's untimely death, he used Artificial Intelligence to get sweet revenge...

But what happened next could change everything... while making a select few early investors very rich.

TECH WATCH

AI Scale Meets Capacity Reality Inside Enterprise Cloud

Microsoft’s earnings land with a single pressure point:

How much funded capacity still exists.

Azure growth near 38% would keep the narrative intact, but the real signal sits beneath the revenue line.

Management already pushed capex higher last quarter, and guidance this time will clarify whether spending remains an accelerator or becomes a governor.

Memory costs, custom silicon rollout, and data-center timing now shape returns as much as demand itself.

Enterprise software offers insulation.

M365 remains embedded, switching costs stay high, and workload stickiness buys time.

That buffer matters as AI infrastructure absorbs capital faster than monetization converts it.

A strong Azure print paired with firm capex language reinforces scale as a moat.

A solid quarter paired with softer spending tone reframes the complex toward throughput efficiency rather than expansion.

Either outcome resolves a question markets have carried since last summer: how long funded scale can outrun depreciation drag without reshaping forward returns.

Investor Signal

Durability is still clearing, but only when balance sheets can carry the weight.

Execution cadence matters more than topline acceleration.

The next leg belongs to platforms that can extend time without narrowing future optionality.

ENERGY WATCH

Washington Puts Nuclear Power Back Into Infrastructure Math

Washington moved the timeline today.

The Department of Energy’s push to rebuild the nuclear fuel supply chain turns power availability into a bankable constraint rather than a regulatory abstraction.

Nuclear Lifecycle Innovation Campuses signal intent to compress enrichment, recycling, generation, and load under one permitting and financing umbrella.

That matters as hyperscalers hunt for baseload that survives political cycles and grid stress.

Capital follows certainty.

A framework that stabilizes fuel access and siting reopens underwriting assumptions that stalled after Yucca Mountain and post-Fukushima paralysis.

Co-located data centers convert electricity from a utility problem into a contracted asset, pulling nuclear closer to infrastructure multiples than speculative energy tech.

The scale discussed, tens of billions per site, anchors the shift.

This is not a reactor story yet.

It is a sequencing story about permits, supply chains, and credit durability.

The edge moves toward players positioned at the intersection of financing, siting, and fuel logistics.

Investor Signal

Power is becoming an input markets model, not a variable they ignore.

Visibility favors platforms that shorten approval and funding paths.

Infrastructure math reasserts itself where timelines finally look credible.

FROM OUR PARTNERS

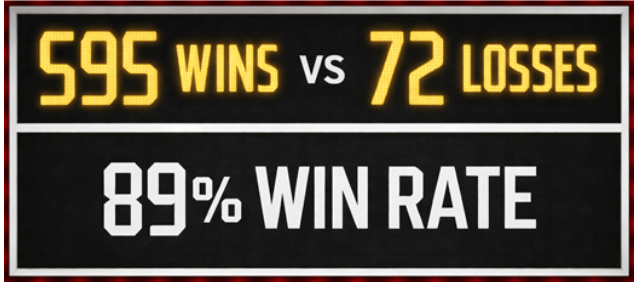

Here's The Scoreboard: 595 Wins vs 72 Losses

Most options traders swing for triple-digit gains... and strike out repeatedly.

I did the opposite. Small, boring, consistent wins. Over and over.

Since 2023, this system has won 89% of the time. One ticker. Same setup daily.

INFRASTRUCTURE WATCH

Ports Become Policy Assets as Capital Locks In Throughput

Stonepeak and CMA CGM just put a price on control.

A $10 billion ports venture spanning Los Angeles, New York, and strategic overseas terminals shifts logistics from a cost center into owned capacity.

Terminals move cargo, but they also dictate timing, pricing leverage, and resilience when trade routes tighten or politics intervene.

That distinction is doing real work in portfolios.

Owning terminals secures throughput at a moment when shipping lanes, tariffs, and national priorities increasingly collide.

Contracted volumes turn volatility into cash flow, while policy alignment lowers regulatory drag that once capped returns.

The scale matters: this is capital stepping into assets that sit below headlines but above disruption.

China exposure is part of the backdrop, not the headline.

The more durable signal is that infrastructure capital is rotating toward assets that compound quietly while everything else debates cycles.

Ports stop behaving like trade proxies and start clearing like strategic utilities.

Investor Signal

Throughput control is emerging as a balance-sheet advantage.

Policy alignment strengthens cash-flow visibility in hard assets.

Infrastructure quietly absorbs capital that once chased abstraction.

MACRO WATCH

Dollar Slips, Term Premium Starts Doing the Talking

The dollar’s slide landed without drama, which is exactly why desks noticed.

On the surface, that looks benign.

Exporters get relief, multinationals breathe easier, and nothing appears broken.

Underneath, the signal runs through funding.

A softer dollar changes how global capital prices U.S. credibility at the margin.

If foreign buyers start demanding more compensation to hold Treasurys, yields rise without a policy decision, and financial conditions tighten quietly.

That shift doesn’t need panic to matter.

It reallocates leadership toward firms that can defend margins, self-fund growth, and absorb higher carrying costs.

The counterweight is still there.

Relative growth, productivity gains, and weakness elsewhere can keep the dollar serviceable.

But the balance has shifted from confidence by default to confidence by proof.

Currency calm now tests fiscal durability, not sentiment.

Investor Signal

Rates can tighten without a Fed headline.

Balance sheets regain primacy as funding costs reprice quietly.

Dollar stability becomes a gatekeeper for risk appetite rather than a backdrop.

MACRO WATCH

Tariffs Grind On: Execution Decides Who Actually Walks Through

A trade deal can clear customs faster than it can change buying behavior.

U.S. exporters arrived in Malaysia with tariff relief on paper, only to find shelves still ruled by price, freight costs, and currency math.

Lower duties help at the margin, but they don’t rewrite consumer habits or logistics economics overnight.

In categories where China and regional suppliers already control distribution, winning share requires more than access.

The market implication sits below the headlines.

Trade policy is shifting from announcement-driven optimism to a slow throughput test.

FX swings, shipping routes, certification rules, and local sourcing all compress the advantage tariffs promise.

That pushes competitiveness into operational detail rather than diplomatic wins.

The counterweight matters.

Where U.S. suppliers already have relationships, premium positioning, or local partners, incremental share is achievable.

But capital markets will reward patience and infrastructure over rhetoric.

Export growth becomes a grind measured in contracts, not communiqués.

Investor Signal

Trade headlines lose influence as execution timelines stretch.

Supply chain flexibility becomes the scarce asset.

Throughput replaces policy as the arbiter of competitive advantage.

FROM OUR PARTNERS

The AI Stock 6 Tech Giants Are Buying

Twenty years ago, $7,000 spread across the original Magnificent Seven could be worth $1.18 million today.

Now, the famous investor who called 4 of the best performing stocks of the last 20 years says:

And one of them recently pulled off something insane...

Apple, Nvidia, Google, Intel, Samsung and AMD have ALL bought shares of this company.

The same analyst who found Nvidia at $1.10 (split-adjusted) is now revealing the details — including all seven stocks he believes could lead the next AI wave.

CLOSING LENS

One idea expressed across different systems.

Capital is not retreating; it is becoming selective about friction.

Compute depends on funded capacity, power moves from procurement into policy, logistics turns strategic through ownership, and currency behavior reflects confidence costs rather than panic.

Even trade policy points the same way… headlines open doors, execution determines who walks through.

What held today were balance sheets, contracted cash flows, and structures built to operate through constraints.

The market is not chasing speed.

It is paying for control, patience, and the ability to compound inside bottlenecks without eroding returns.